The TRU token collapsed from $0.1659 to close zero, wiping out market worth.

Liquidity on decentralised exchanges dried up following the exploit.

The attacker pockets was linked to a Sparkle protocol assault 12 days earlier.

A critical safety breach at Truebit Protocol has triggered one of many sharpest collapses seen in decentralised finance this yr.

The blockchain mission, which focuses on verified computing, misplaced round $26.5 million after an attacker exploited a weak point in its sensible contract system.

The incident despatched the protocol’s native TRU token crashing to close zero and left liquidity throughout decentralised exchanges severely strained.

On-chain actions following the exploit present how rapidly funds have been siphoned away, highlighting ongoing dangers round sensible contract design and monitoring throughout the DeFi sector.

How the exploit unfolded

The breach was first flagged by blockchain safety agency PeckShield, which detected a sequence of suspicious transactions on the Ethereum community.

Evaluation confirmed that the attacker drained almost 8,500 ETH from Truebit Protocol.

On the time of the exploit, the stolen cryptocurrency was valued at about $26.5 million.

On-chain information signifies that the funds have been rapidly break up and transferred to 2 separate pockets addresses, recognized as 0x2735…cE850a and 0xD12f…031a60.

Dividing funds on this manner is a generally used approach to complicate monitoring and cut back the probabilities of restoration.

PeckShield’s preliminary findings recommend the exploit focused a flaw inside the protocol’s contract construction, though an in depth technical breakdown has not but been revealed.

Token collapse and liquidity shock

The market influence was instant. Truebit’s native TRU token suffered a near-total collapse, falling from a each day excessive of $0.1659 to a low of $0.000000018.

The transfer successfully erased the token’s market capitalisation inside hours.

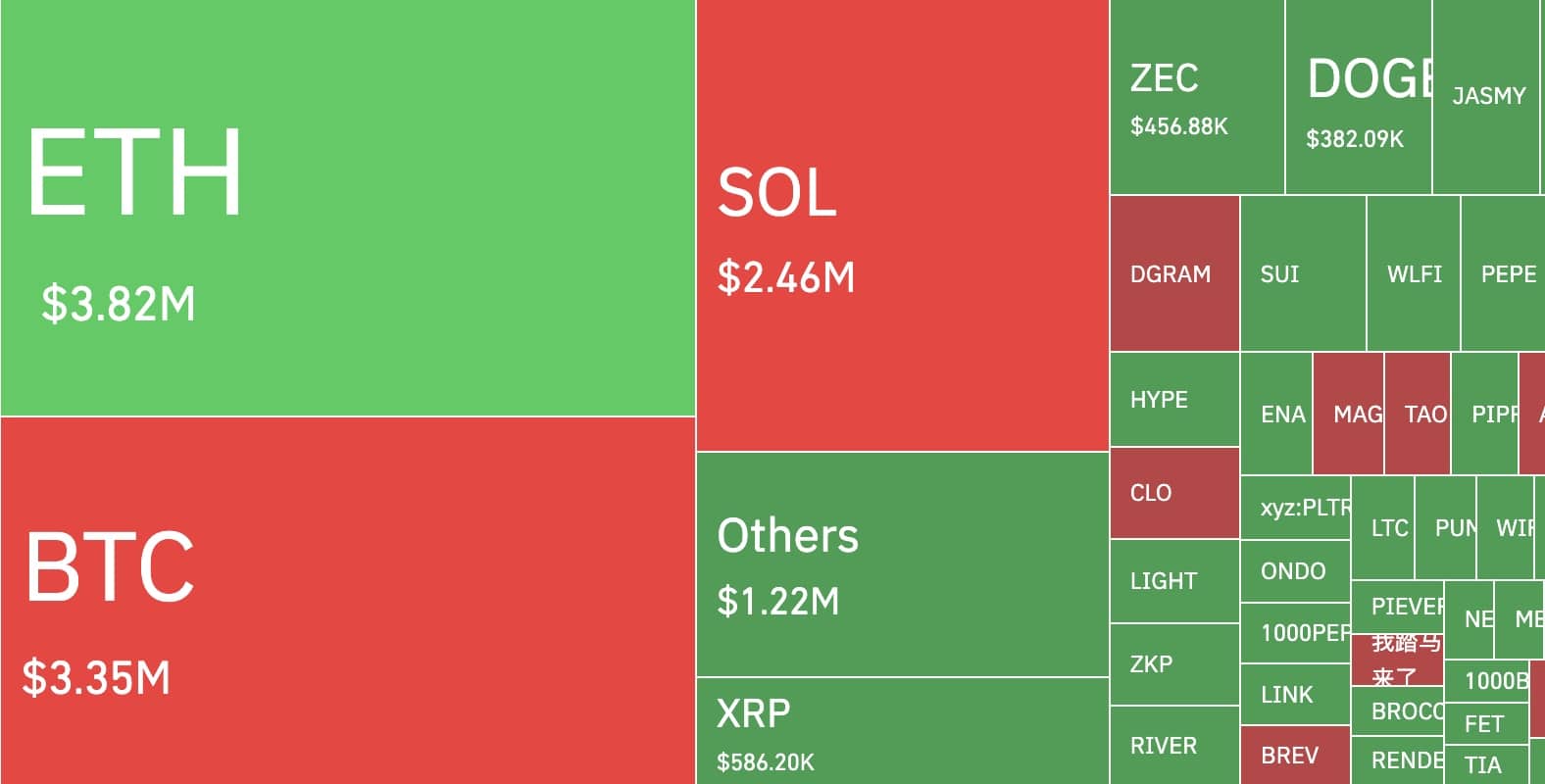

Liquidity throughout decentralised exchanges additionally dried up quickly.

With swimming pools depleted and confidence shaken, many token holders have been unable to exit positions.

The episode underlined how tightly token valuations are linked to protocol safety, significantly for smaller DeFi tasks the place confidence can evaporate rapidly as soon as an exploit is confirmed.

Protocol response and containment steps

After the breach, Truebit Protocol issued an official replace acknowledging the incident.

The group confirmed {that a} particular sensible contract had been compromised and warned customers to not work together with it till additional discover.

The protocol acknowledged that it’s working alongside regulation enforcement authorities and taking steps to restrict additional harm.

Customers have been additionally suggested to rely solely on official communication channels for updates as investigations proceed.

No timeline has but been shared for remediation or potential restoration efforts.

Hyperlink to earlier DeFi assault

PeckShield additional reported that the pockets concerned within the Truebit exploit had been related to a separate assault on the Sparkle protocol roughly 12 days earlier.

In that case, the attacker acquired tokens and later routed funds by way of Tornado Money, a privateness service typically used to obscure transaction trails.

The repeated use of comparable strategies factors to an skilled exploiter actively scanning for vulnerabilities.

The connection has raised broader issues throughout the DeFi ecosystem, the place a sequence of linked assaults can amplify threat notion past the affected tasks.