Be a part of Our Telegram channel to remain updated on breaking information protection

Solana worth is dealing with resistance after breaking out of an prolonged consolidation zone inside the $127 space. SOL worth is down a fraction of a proportion within the final 24 hours, regardless of a ten% surge within the final week, buying and selling at $138.78 as of 01:18 a.m. EST.

This slight drop occurred simply hours after Morgan Stanley filed a Kind S-1 with the US Securities and Trade Fee (SEC) for a Solana Belief.

Solana’s weekly surge comes amid a begin of the 12 months rally that noticed Bitcoin worth climb again above the $93,500 area.

Nevertheless, a key historic sample on the SOL 3-day chart suggests a possible restoration. At any time when Solana touches assist round $120, it’s adopted by a sustained surge to get better any losses. Can the Solana token ship on this sentiment?

Morgan Stanley Information For Solana ETF: Why This May Be A Main Value Catalyst

Morgan Stanley, a Wall Avenue heavyweight, has filed a Kind S-1 with the US SEC, searching for approval for a spot BTC exchange-traded fund (ETF) and a Solana belief, additional advancing its ambitions in digital property.

SHOCKER: Morgan Stanley simply filed for a spot Bitcoin and Solana ETF. H/t @TheBlock__ pic.twitter.com/AmYLeDTJBy

— Eric Balchunas (@EricBalchunas) January 6, 2026

The Morgan Stanley Solana Belief is supposed to trace the worth of Solana and permit buyers achieve publicity to SOL by way of conventional funding autos. This removes the necessity for direct custody of the token.

In accordance with SoSoValue knowledge, Solana funds have grown to greater than $1 billion in complete web property, following cumulative web inflows of almost $800 million and day by day complete inflows of $9.22 million.

Traditionally, ETF filings and approvals have performed a important position in boosting institutional participation, as seen with BTC sport ETFs.

Solana Value Evaluation: Bullish Breakout In Focus

The SOL worth chart evaluation on the 3-day timeframe reveals that Solana has damaged out of the $135 assist stage, which coincides with a decrease assist space throughout a consolidation section that has capped the asset under the $168 resistance.

With the tried surge, key Fibonacci Retracement ranges to look at are $155.84 (0.618 Fib stage) and $174.57 (0.5 Fib stage), with the 50-day and 200-day Easy Transferring Averages (SMAs) at $174.25 and $168.70, respectively.

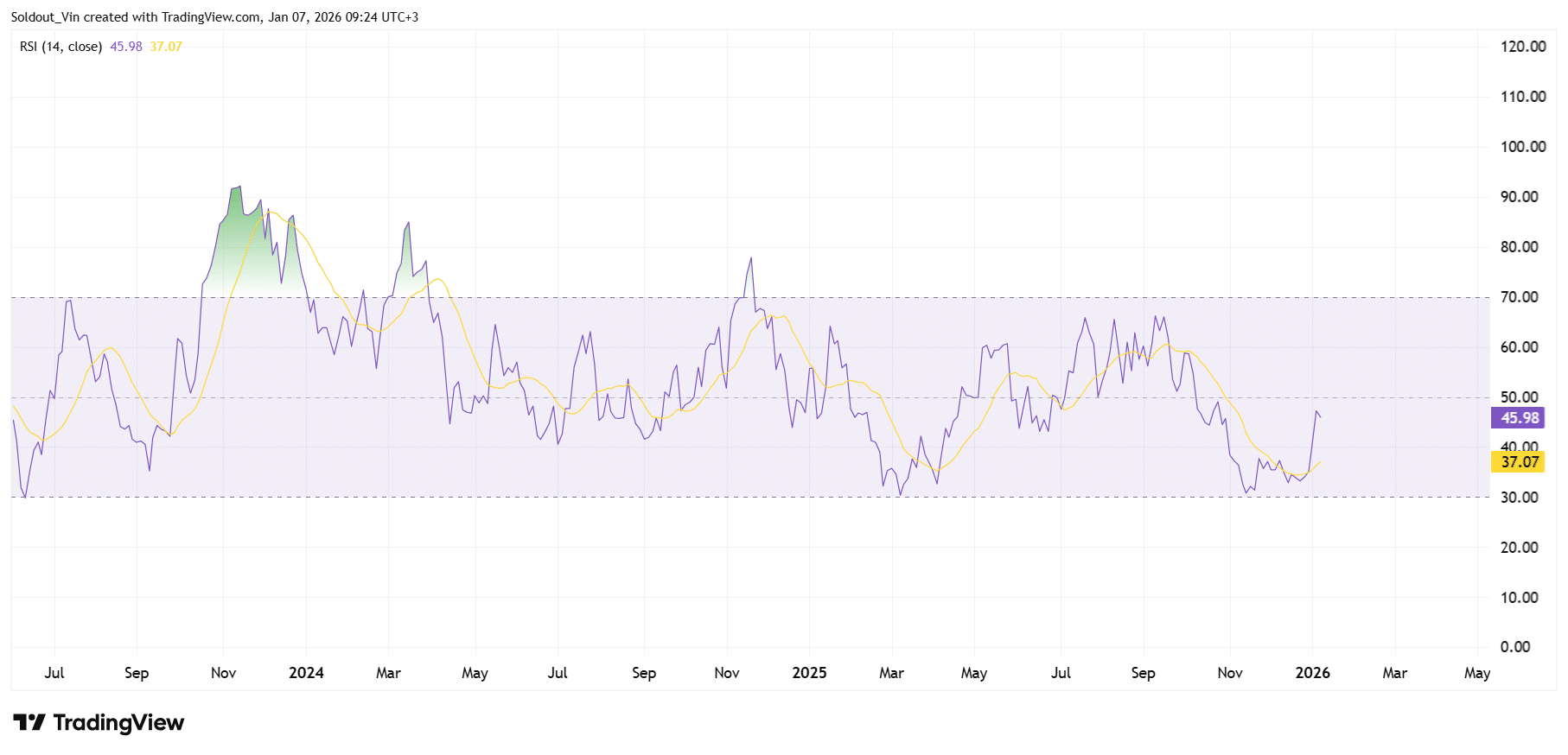

The Solana Relative Energy Index (RSI) is at 45.98 and rising, indicating that purchasing strain is rising however nonetheless inside the equilibrium zone. There’s some resistance on the 47.7 space, but when it rises larger than this, patrons might take full management to push Solana worth previous the $155.84 speedy resistance.

The buying and selling quantity surged by over 14% within the final 24 hours to $6.26 billion, indicating market exercise has picked up. Regardless of this, Solana is down from the $143.09 stage, as proven by the latest candle on the 3-day chart.

Can The SOL Value Soar To $200?

In accordance with the SOL/USD chart evaluation, the SOL worth is presently poised for a bullish breakout continuation. Due to this fact, the $200 stage is feasible, so long as the Solana worth continues to commerce above the $129.17 space (0.786 Fib stage).

This might occur, as each time the worth of Solana has dropped again to the $120 zone from February 2024, it has recovered massively.

With the latest correction from the $143 stage, buyers are nonetheless cautious, because the asset nonetheless has the danger to drop again to the $121.41 long-term assist space.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection