Once you correctly perceive what’s staking crypto, you possibly can confidently make smarter choices about the way you develop your digital belongings. Staking has develop into a core a part of the crypto area as a result of it provides you a solution to earn rewards whereas staying concerned in how blockchain networks run. As extra folks look past buying and selling, curiosity has expanded into areas like bitcoin staking, even amongst inexperienced persons who need long run participation relatively than short-term strikes. In your journey with crypto, staking represents a shift towards incomes by contribution, not hypothesis.

On this article, we focus on how staking works at a excessive stage, the alternative ways you possibly can stake crypto, the advantages and dangers concerned, and how one can get began step-by-step. We additionally spotlight widespread errors that may price you rewards or restrict your flexibility. If you would like a transparent basis that can assist you determine whether or not staking aligns together with your objectives, proceed studying.

What Is Staking Crypto?

Staking crypto provides you a solution to take part in blockchain networks whereas incomes rewards in your involvement. As a substitute of counting on fixed shopping for and promoting, you lock up your belongings to assist how sure networks keep safe and course of exercise. Once you stake crypto, you commit your cash to the system, which permits the community to operate easily and stay reliable. In return, you get rewards that replicate your contribution and dedication.

Out of your perspective, staking feels just like placing cash into an curiosity incomes account, however with extra accountability and management. You determine which community to assist, how lengthy to commit your belongings, and the way actively you wish to handle the method. Some networks require you to stake coin straight, whereas others allow you to take part by swimming pools or platforms that simplify the expertise. This flexibility explains why staking continues to develop amongst inexperienced persons and skilled crypto customers alike.

Proof of Stake (PoS)

Proof of Stake, generally known as PoS, is the system that makes staking doable. Networks utilizing this mannequin select members to validate exercise based mostly on how a lot crypto they commit and the way lengthy they maintain it staked. The extra you stake, the extra affect you possibly can have, though many networks stability this to maintain issues honest.

PoS focuses on effectivity and accessibility. It makes use of far much less vitality than older programs and opens the door for on a regular basis customers to participate with out specialised {hardware}. Ethereum staking follows this mannequin, which marked a serious shift towards a extra vitality aware and group pushed method to securing a blockchain.

Proof of Work (PoW)

Proof of Work, or PoW, makes use of a really totally different method. As a substitute of staking belongings, members compete to resolve complicated issues utilizing computing energy. This course of secures the community, nevertheless it calls for vital vitality and tools, which limits participation for many individuals.

PoW performed a serious position in shaping early crypto networks, nevertheless it doesn’t assist staking in the way in which PoS does. You can’t earn staking rewards by PoW programs as a result of they depend on computational effort relatively than dedicated belongings. Understanding this distinction helps you see why staking solely applies to particular cryptocurrencies and why newer networks proceed to maneuver towards PoS fashions.

How Does Staking Crypto Work?

Staking crypto is a course of the place you lock up your cryptocurrency to actively assist a blockchain community. This includes validating transactions, sustaining the community’s safety, and making certain its easy operation. In return in your contribution, you earn staking rewards, that are sometimes distributed in the identical cryptocurrency you’ve staked. This makes staking a sexy possibility for rising your holdings whereas enjoying an important position within the blockchain ecosystem.

In contrast to Proof of Work, which depends on miners fixing complicated mathematical issues utilizing vital computational energy, staking operates on the Proof of Stake mechanism. This method selects validators based mostly on the quantity of cryptocurrency they stake, relatively than their means to resolve issues. This method isn’t solely extra energy-efficient but in addition permits for sooner transaction processing. For example, Solana – a well-liked blockchain platform, makes use of Proof of Stake to realize high-speed and low-cost transactions.

Once you stake your crypto, you are able to do so by varied strategies. Some desire staking straight by a devoted pockets, whereas others be a part of staking swimming pools to mix sources and improve their probabilities of incomes rewards. Moreover, many exchanges provide staking providers, simplifying the method for inexperienced persons. Whatever the methodology, staking gives a sensible solution to develop your belongings whereas contributing to the community’s general well being and effectivity.

Advantages and Dangers of Staking on Crypto Platforms

Staking that means on crypto platforms affords a singular alternative to develop your digital belongings whereas supporting blockchain networks. Nevertheless, like several funding, it comes with its personal set of benefits and challenges. Listed here are the advantages and dangers it’s best to think about earlier than you stake your cash.

Advantages

Earn Passive Revenue. Staking permits you to earn rewards with out promoting your belongings. Whether or not you’re utilizing cryptocurrency exchanges or devoted wallets, staking gives a gentle solution to develop your holdings over time.Strengthen Blockchain Networks. Once you stake, you actively contribute to the safety and effectivity of the community. That is very true for staking swimming pools, the place members mix sources to validate transactions and keep the blockchain.Power Effectivity. In contrast to mining, staking is much much less resource-intensive. Crypto staking platforms that use Proof of Stake are designed to be environmentally pleasant, making them a sustainable selection for blockchain buyers.Accessibility. Staking is easy and doesn’t require costly tools. Many platforms, together with exchanges, provide user-friendly choices to get began, making it accessible to each inexperienced persons and skilled customers.

Dangers

Market Volatility. The worth of belongings you stake could change significantly over time. Whilst rewards are earned, a sudden drop within the cryptocurrency’s worth may offset your good points.Lock-Up Durations. Some platforms require you to lock your belongings for a particular interval. Throughout this time, you received’t be capable of entry or commerce your staked cash, which may very well be a downside in risky markets.Validator Dangers. In the event you’re staking by a validator or pool, their efficiency straight impacts your rewards. Poorly managed validators may result in penalties or diminished earnings. Understanding these advantages and dangers will enable you make knowledgeable choices about staking and maximize your potential rewards.

Which Cryptocurrencies Can Be Staked?

Staking has develop into a well-liked solution to develop your crypto holdings whereas supporting blockchain networks. Many cryptocurrencies now mean you can stake cash, providing rewards in return in your participation. Under is a listing of a number of the mostly staked cryptocurrencies:

Ethereum (ETH)Solana (SOL)Cardano (ADA)Polkadot (DOT)Avalanche (AVAX)Tezos (XTZ)Cosmos (ATOM)Algorand (ALGO)Tron (TRX)Binance Coin (BNB)

Crypto Staking Choices

When you perceive how staking works, the subsequent step includes selecting the choice that matches your objectives, expertise stage, and obtainable sources. Every possibility comes with commerce offs round effort, flexibility, and potential staking rewards, so it helps to know what to anticipate earlier than you commit your belongings. Listed here are the staking choices:

1. Solo Staking

Solo staking provides you full management over your crypto and the way you take part within the community. You run your personal setup and stake straight with out counting on a 3rd occasion. This selection appeals to customers who need independence and are comfy managing technical necessities. Whereas solo staking can improve your sense of possession, it additionally calls for time, dependable programs, and sufficient funds to satisfy community minimums.

2. Staking Pool

A staking pool permits you to mix your crypto with different customers to extend the probabilities of incomes rewards. Quite than staking alone, you contribute to a shared pool that handles validation on behalf of the group. Rewards are then cut up based mostly on every participant’s contribution. This selection lowers entry limitations and works nicely if you need constant returns with out managing every thing your self.

3. Delegated Staking

Delegated staking permits you to maintain possession of your crypto whereas assigning validation duties to a trusted participant. You select a validator and delegate your stake to them, which helps safe the community and generate returns. This selection fits customers who need involvement with out working their very own setup. Cautious validator choice issues since efficiency and reliability have an effect on outcomes.

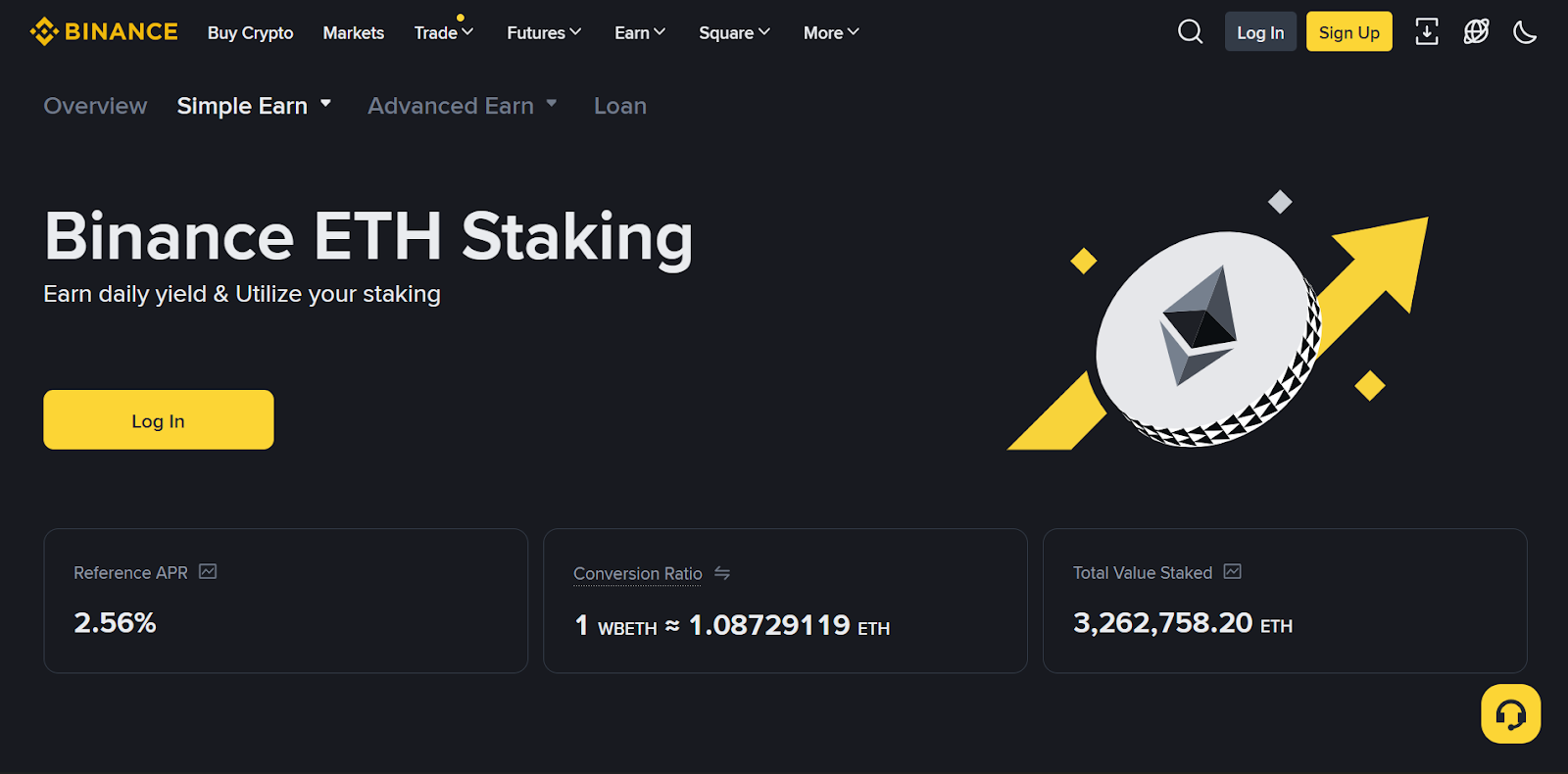

4. Trade Staking

Trade staking affords a easy solution to get began by platforms that already handle the technical facet. You stake your crypto straight inside an alternate account and earn rewards with out further setup. Many inexperienced persons discover this route and select the greatest crypto staking platform to keep away from complexities. The commerce off comes with diminished management and reliance on the alternate’s insurance policies.

5. Staking-as-a-Service

Staking as a service gives skilled administration for customers who need a palms off method. These suppliers deal with setup, upkeep, and monitoring whilst you retain possession of your crypto. This selection works nicely for individuals who worth comfort and stability over direct involvement. Service charges apply, so that you’ll wish to weigh price towards saved effort and time.

6. Liquid Staking

Liquid staking provides you flexibility by permitting you to stake your crypto whereas nonetheless conserving entry to its worth. Once you stake, you obtain a token that represents your staked belongings, which you should utilize in different elements of the crypto ecosystem. This selection appeals to customers who wish to earn rewards with out locking up their funds. Curiosity in liquid staking has grown alongside conversations about bitcoin staking, despite the fact that availability depends upon the community and platform.

How one can Begin Staking Crypto

Getting began with staking is a simple course of that permits you to develop your belongings whereas supporting blockchain networks. Whether or not you’re new to staking or trying to refine your method, comply with these steps to begin staking:

Step 1: Choose a Cryptocurrency

Begin by deciding on a crypto that provides staking, akin to Ethereum, Solana, or Cardano. Analysis the staking necessities and potential rewards for every to search out the most effective match in your objectives.

Step 2: Select Your Staking Methodology

Resolve the way you wish to stake your cash. Choices embody staking straight by a devoted pockets, utilizing an alternate or becoming a member of a staking pool. Every methodology has its personal advantages, so choose one which aligns together with your preferences and sources.

Step 3: Set Up Your Staking

Arrange your crypto pockets to securely retailer your belongings. In the event you’re utilizing a staking pool or alternate, comply with their particular directions to delegate your cash. Make sure you perceive any lock-up durations or charges related to the platform.

Step 4: Earn Rewards

As soon as your staking is energetic, you’ll begin incomes rewards based mostly in your contribution to the community. Monitor your staking progress recurrently and keep knowledgeable about any updates or adjustments to the platform.

Widespread Crypto Staking Errors to Keep away from

Staking generally is a rewarding solution to develop your cryptocurrency holdings, nevertheless it’s essential to keep away from widespread pitfalls. Listed here are some errors to be careful for:

Not Researching the Platform. Utilizing unreliable platforms or validators can result in poor rewards and even lack of funds.Ignoring Lock-Up Durations. Overlooking lock-up phrases can depart you unable to entry your belongings whenever you want them.Staking With out Diversification. Placing all of your belongings into one cryptocurrency or validator will increase your danger.Selecting Unreliable Validators. Validators with poor efficiency or excessive slashing charges can scale back your rewards.Overlooking Charges. Excessive charges from staking swimming pools or exchanges can eat into your earnings.Failing to Monitor Your Staking. Neglecting to verify your staking progress may end up in missed alternatives or points.

Conclusion

Staking crypto affords a sensible solution to develop your belongings whereas supporting blockchain networks. It gives rewards and promotes community safety, nevertheless it additionally comes with dangers like market volatility and lock-up durations. Consider your objectives, analysis platforms, and perceive the staking course of earlier than committing. Diversify your investments and monitor your staking progress to reduce dangers. With cautious planning, staking generally is a priceless addition to your cryptocurrency technique.

FAQs

Is staking crypto a good suggestion?

Staking crypto might be a good suggestion when you’re trying to earn passive earnings whereas contributing to the safety of blockchain networks. It’s important to guage your monetary objectives, analysis dependable platforms, and perceive the dangers concerned, akin to market volatility and lock-up durations.

How a lot can I make staking crypto?

How a lot you can also make staking crypto depends upon the cryptocurrency you stake, the platform you employ, and the staking methodology you select. Rewards are sometimes calculated as a share of your staked belongings and may fluctuate broadly. Researching reward charges and charges will enable you estimate potential earnings.

Can I lose my crypto if I stake it?

You’ll be able to lose your crypto when you stake it with unreliable platforms or validators. Dangers embody slashing penalties for validator misconduct, platform failures, or a major drop within the worth of the belongings you staked. Selecting dependable platforms and diversifying your staking may help mitigate these dangers.

Can I stake Bitcoin (BTC)?

You can’t stake Bitcoin (BTC) as a result of it operates on a Proof of Work mechanism, which depends on mining relatively than staking. In the event you’re desirous about staking, think about cryptocurrencies like Ethereum, Solana, or Cardano that use Proof of Stake.

What occurs if I cease staking?

In the event you cease staking, your belongings are now not locked, and you’ll cease incomes rewards. Relying on the platform or staking methodology, there could also be a ready or unbonding interval earlier than you possibly can entry your cash. This era can vary from just a few days to a number of weeks, so it’s essential to plan accordingly.

Is staking secure for inexperienced persons?

Staking might be secure for inexperienced persons when you use trusted platforms and begin with a small quantity to reduce danger. Novices ought to analysis the staking course of, perceive the phrases and circumstances of the platform, and concentrate on potential dangers like slashing penalties or market volatility. Beginning with user-friendly platforms or cryptocurrency exchanges that provide staking providers could make the method simpler and safer.