Solana stayed locked in a decent vary between $117.3 and $128.8 on December 19. The worth motion pointed to warning. Merchants confirmed little urgency to take sturdy positions.

The market is coming off months of sharp strikes. These swings left many members ready for clearer indicators.

A key query is now taking form. Has SOL began to construct an actual base, or is that this simply one other pause?

DISCOVER: Prime Solana Meme Cash to Purchase in 2025

Is Solana’s Worth Being Pushed Extra by Spot Consumers or Derivatives Merchants?

With the ultimate weeks of 2025 forward, technical ranges are drawing extra consideration. These zones are prone to information short-term route and form how merchants place going ahead.

The following main transfer might hinge on a stability subject. Spot patrons are stepping in, however the derivatives market stays energetic and aggressive.

That pressure continues to outline worth habits. The latest bounce got here alongside stable participation. Buying and selling quantity reached about $6.0Bn over 24 hours. Solana’s market capitalization sits close to $70.9Bn, maintaining it among the many largest tokens out there.

Derivatives positioning provides one other layer to the image. Knowledge from DefiLlama reveals round $1.497Bn in 24-hour perpetual quantity on Solana-linked venues, with open curiosity close to $365M.

Over the previous 30 days, complete perp quantity sits near $39.8Bn.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Solana Worth Prediction: What Does SOL’s Bullish RSI Divergence Sign Close to Lengthy-Time period Assist?

That exercise suggests merchants are nonetheless utilizing leverage to play short-term strikes, even because the spot worth tries to carry above the session low.

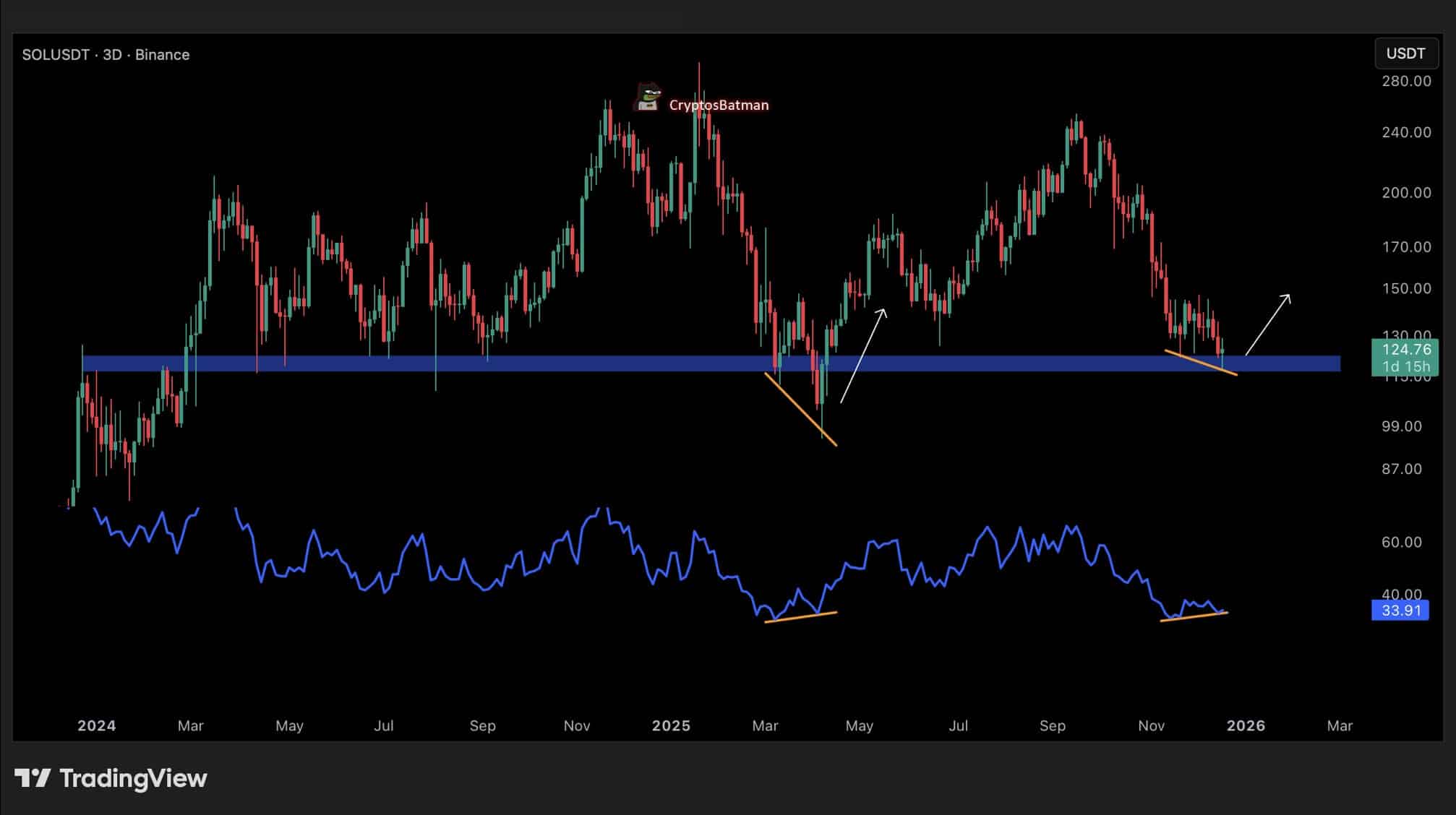

On the chart, Solana is testing a degree that merchants have tracked for practically two years. Worth is compressing close to a transparent assist zone on greater timeframes.

On the three-day chart, SOL has pulled again in an orderly means from its late-2025 highs and is now transferring sideways across the identical space that acted as a base throughout earlier corrections.

The construction reveals decrease highs urgent into assist. However promoting stress appears to be like lighter. Every dip has drawn fast responses, which factors to energetic patrons on this vary.

For now, the market stays inside a broader vary, not a confirmed breakdown, with this assist performing as a key stability level.

Momentum indicators level to a shift beneath the floor. On the 3-day chart, the RSI is exhibiting a bullish divergence.

The indicator is forming greater lows whereas the value continues to check the identical assist zone. That often indicators that promoting stress is dropping power.

An analogous sample appeared earlier within the cycle, simply earlier than the March backside.

The analyst highlighted the parallel in his commentary. “$SOL isn’t solely at its main assist degree, the identical one which has held worth for the previous two years, however there’s additionally a bullish divergence forming on the 3D timeframe,” he stated.

He added that the present setup carefully matches what performed out forward of the earlier main low in March.

Collectively, the repeated assist exams and bettering momentum counsel draw back stress could also be weakening, regardless that the value has but to interrupt greater.

DISCOVER: 10+ Subsequent Crypto to 100X In 2025

The submit SOL Holds Tight Vary as Assist Will get Examined: Base Formation or False Calm? appeared first on 99Bitcoins.