Bitcoin’s bounce final week was rapidly lower off by rising volatility within the broader crypto market, inflicting the worth to fall beneath the pivotal $90,000 mark as soon as once more. Given the latest value fluctuations, buyers’ sentiment, particularly these on crypto exchanges, has shifted as inflows from BTC wholecoiners plummet.

Binance Sees Sharp Drop In BTC Wholecoiner Inflows

Whereas the worth of Bitcoin pulls again this new week, there may be one key metric that’s presently standing out. This metric is the BTC Wholecoiners Inflows on Binance, which is beginning to inform a special story about buyers on the biggest cryptocurrency alternate on this planet.

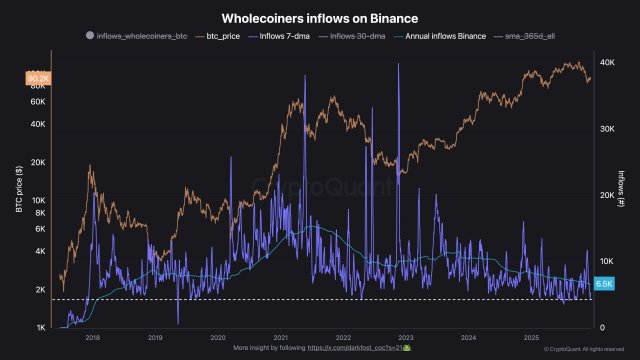

After inspecting this metric, Darkfost, a market analyst and writer at CryptoQuant, revealed that on the Binance platform, wholecoiner deposits are drying up. Particularly, wholecoiner inflows suggest transactions bigger than 1 BTC, which supplies very important perception into each present promoting stress and the broader evolution of the market.

Information exhibits that the inflows from this cohort are declining when in comparison with previous years. Presently, BTC’s yearly common now sits round 6,500 BTC, representing a stage not seen since 2018. In the meantime, on the shorter time-frame, the weekly common is located close to 5,200 BTC, marking one in every of its lowest readings of this cycle.

Whereas the wholecoiner inflows dry up, the sample that inflows have adopted this cycle compared to earlier ones may be very intriguing. At the same time as Bitcoin continued to rise, wholecoiner inflows to Binance have steadily decreased reasonably than rising as they as soon as did.

Past indicating that buyers with sizable Bitcoin holdings are much less inclined to promote, this development might additionally level to a deeper structural shift out there. With Bitcoin’s valuation experiencing a gentle enhance, proudly owning a full BTC has grow to be extraordinarily tough, which naturally decreases the whole variety of transactions bigger than 1 BTC.

On the similar time, Darkfost highlighted that there at the moment are extra choices out there within the ecosystem for proudly owning or buying and selling Bitcoin. Even crypto exchanges have multiplied, and the regular progress of Decentralized Finance (DeFi) supplies extra venues, a development that’s prone to redirect flows that beforehand went almost completely to main exchanges equivalent to Binance.

BTC Nonetheless Buying and selling Beneath Quick-Time period Price Foundation

Bitcoin remains to be buying and selling beneath the Quick-Time period Holder Price Foundation positioned at $105,400. What this implies is that the crypto king has been buying and selling beneath the extent for almost 2 months now. Nonetheless, Darkfost acknowledged that staying beneath the extent for such an prolonged interval is just not unusual.

Throughout earlier corrections, the length of those phases has ranged from two months to over 4 months, making the current correction fall properly inside a typical vary. Nonetheless, since this indication tends to remain detrimental for for much longer after the market really enters a bear section, it will be essential to forestall Bitcoin from declining any additional.

Within the meantime, this doesn’t invalidate the notion that these durations stay a sign for accumulation alternatives. Nonetheless, warning remains to be essential, and entry factors ought to be rigorously optimized. Darkfost believes that an accumulation of this sort is simply acceptable for long-term buyers.

Featured picture from Pixabay, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.