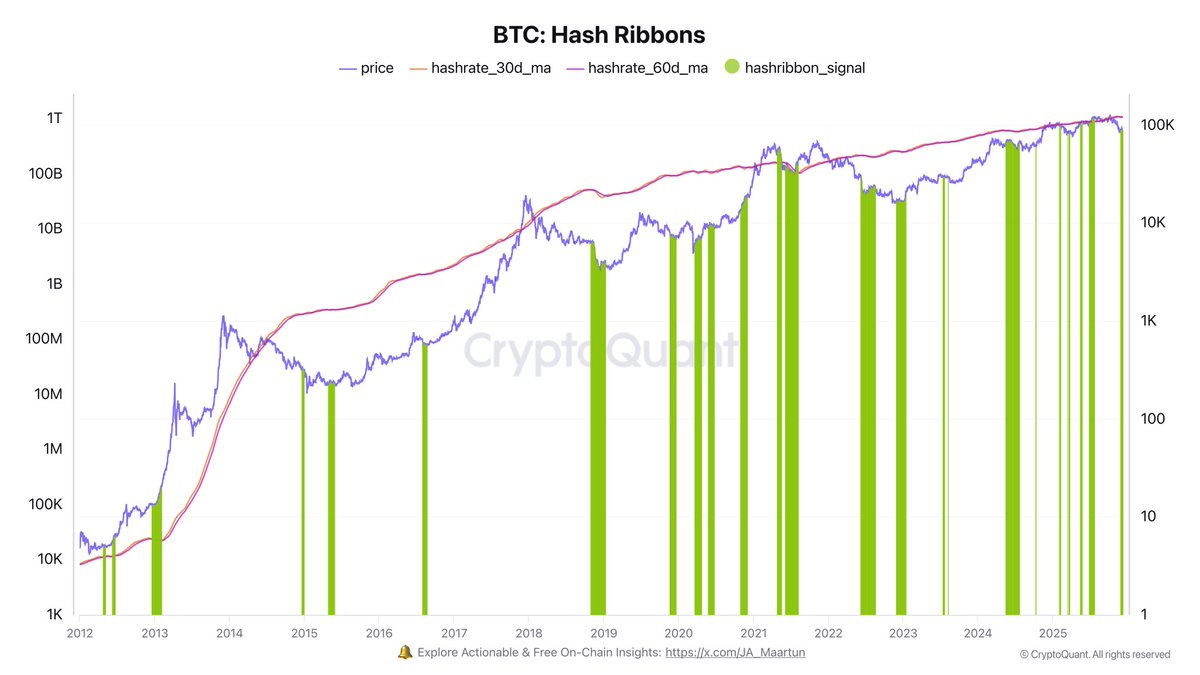

Bitcoin is buying and selling at a decisive second, holding simply above the $90,000 mark after a number of days of tight consolidation. Regardless of reclaiming this key degree, the market continues to wrestle with upward momentum, leaving merchants unsure in regards to the subsequent main transfer. But beneath the floor, a key on-chain indicator has triggered recent curiosity amongst analysts. In keeping with prime analyst Darkfost, the Hash Ribbons have simply flashed a brand new purchase sign — a growth that traditionally aligns with sturdy medium-term efficiency for Bitcoin.

Darkfost emphasizes that this sign will not be a cue to hurry blindly into the market, however slightly a significant piece of knowledge value highlighting. Hash Ribbon alerts sometimes seem during times of miner stress, when mining issue forces weaker miners to close down.

These moments usually precede important accumulation phases, as promoting strain from distressed miners fades. Aside from the unprecedented 2021 mining ban in China, each earlier Hash Ribbon purchase sign has produced worthwhile outcomes for affected person buyers.

Understanding The Bitcoin Hash Ribbons Sign

Darkfost explains that the Hash Ribbons indicator is constructed across the evolution of Bitcoin’s hashrate, evaluating the 30-day and 60-day shifting averages to detect intervals of miner stress. When the 30-day MA of the hashrate falls beneath the 60-day MA, it alerts that mining issue is rising relative to miner profitability.

In these phases, much less environment friendly miners are sometimes pressured to cut back operations or shut down completely, decreasing the general community hashrate.

Whereas mining issue itself is influenced by a number of elements — together with electrical energy prices, {hardware} effectivity, block rewards, and, in fact, Bitcoin’s value — the important thing level is that miner capitulation tends to create short-term promoting strain. Miners could liquidate a part of their reserves to remain afloat, usually contributing to non permanent weak point available in the market.

Nonetheless, Darkfost emphasizes that these intervals of stress traditionally current sturdy mid-cycle accumulation alternatives. As weaker miners exit and issue adjusts downward, the market usually enters a more healthy part the place promoting strain subsides, and long-term contributors start to build up BTC at discounted costs.

Over time, Hash Ribbon purchase alerts have continuously marked early phases of main recoveries, providing buyers a structural, data-driven benefit even when sentiment seems unsure.

Testing Assist as Momentum Weakens

Bitcoin continues to commerce simply above the $90,000 degree, displaying indicators of stabilization after a number of weeks of heavy draw back momentum. The chart reveals that BTC has bounced off the 100-day shifting common (inexperienced), which is now appearing as a key dynamic help zone. This degree has traditionally served as an vital midpoint throughout main pullbacks, and the market’s capability to carry above it means that promoting strain could also be easing.

Nonetheless, the worth stays nicely beneath the 50-day shifting common (blue), which has begun to curve downward — a sign that short-term momentum nonetheless leans bearish. For a stronger restoration, Bitcoin should reclaim this shifting common and convert it into help. Till then, rallies could wrestle to increase meaningfully.

Quantity has additionally compressed considerably in comparison with the sooner phases of the uptrend. This decline signifies hesitation from each patrons and sellers, usually typical throughout consolidation phases following sharp corrections. The dearth of aggressive promoting is a constructive signal, however the absence of sturdy buy-side curiosity retains BTC weak to additional swings.

If Bitcoin holds above the $90K–$88K space, it might construct a base for a broader rebound. A breakdown beneath this area, nevertheless, would open the door to deeper retracements towards the mid-$80K vary.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.