Crypto futures are spinoff contracts that allow you to invest on the long run worth actions of cryptocurrencies. They assist you achieve publicity to the crypto market with out truly buying, proudly owning, or transacting the underlying belongings.

On this article, we’ll supply precious insights into cryptocurrency futures contracts, their working, varieties, options, advantages, and dangers. We’ll additionally present a step-by-step information to buying and selling futures, masking key methods and prime cryptocurrencies for contract buying and selling.

What Are Cryptocurrency Futures?

Crypto futures are agreements between two merchants to purchase or promote the underlying cryptocurrencies at particular costs by sure dates. They’re settled in fiat, stablecoins, or the underlying digital forex.

In essence, cryptocurrency futures are just like conventional futures contracts. They require each patrons and sellers to fulfil their obligations at predetermined costs by or earlier than a contract’s expiration date.

How Does Crypto Futures Work?

When merchants purchase a futures contract, they open a protracted place. Conversely, after they promote, they open a brief place.

Nevertheless, earlier than participating in futures buying and selling, merchants must fulfil margin necessities. Exchanges accumulate two varieties of margins: preliminary and upkeep margins. Preliminary margin is the minimal collateral required to open a futures place. Upkeep margin is the minimal fund steadiness merchants ought to preserve of their margin accounts to maintain their positions open.

If a cryptocurrency’s worth drops drastically because of opposed worth actions, the collateral could also be unable to cowl the place. In such situations, a margin name is triggered, informing merchants to replenish their margin accounts. In case you fail to answer a margin name, your place will likely be liquidated.

3 Methods to Shut a Futures Contract

Offsetting: Offsetting a futures place is one of the simplest ways to liquidate a contract. It additionally helps merchants keep away from bodily supply of the underlying belongings. You should execute equal and reverse transactions to offset a place. For instance, think about you purchased two Bitcoin futures contracts expiring in September. To neutralize this commerce, you need to promote two Bitcoin futures that additionally expire in September. Rolling over: You’ll be able to roll over a cryptocurrency futures contract if you wish to preserve your publicity to the dynamic market. For example, assume you’ve gone lengthy on two Ether futures contracts that expire in October. You’ll be able to roll over this place by promoting two October contracts and shopping for two December contracts. Settling the contract: A futures contract is settled solely when each events fulfil their obligations by the expiry date. Merchants holding lengthy and quick positions should purchase or promote the underlying cryptocurrency as per the contract phrases.

Kinds of Crypto Futures Contracts

Perpetual futures: They’re linear contracts with no expiry date. Therefore, merchants can maintain them indefinitely.Expiry futures: They’re linear contracts with a set expiry date, after which they stop to exist. Inverse futures: They’re non-linear contracts which are quoted in fiat however settled within the underlying cryptocurrency.

Key Options of Crypto Futures Contracts

Zero-sum recreation

Since one dealer should incur losses for the opposite dealer to make positive factors, crypto futures buying and selling is a zero-sum recreation.

Expiration date

It’s the date on which a futures contract ceases to exist. It’s also referred to as the strike or train date. Each events agree upon the expiration date on the time of getting into into the contract.

Train worth

It’s the worth at which the futures contract will likely be executed. It’s also referred to as the strike worth, and is fastened on the time of formation of the contract.

Contract measurement

It signifies the amount of the underlying asset a derivatives contract represents. A contract will be priced by way of the underlying digital forex or asset. For instance, 1 contract = $2,50,000 price of Ether or 1 contract = 50 Ether.

You may also do fractional buying and selling of crypto futures. Thus, you should purchase or promote contracts with sizes as little as 0.0001 BTC.

Leverage

Most exchanges allow merchants to make use of leverage to regulate giant positions with smaller quantities of capital upfront. For example, a 10x leverage means you need to deposit only one/10th of the long run contract’s notional worth as margin. Thus, if the notional worth is $550,000, you need to fulfil a margin requirement of $55,000.

The settlement methodology additionally varies throughout futures exchanges and merchandise. For instance, Binance gives USD-margined contracts which are settled in United States Greenback Coin (USDC) and Tether (USDT). It additionally gives coin-margined contracts which are settled within the underlying cryptocurrencies. For each merchandise, merchants should deposit their precise cryptocurrency holdings as collateral.

Contrarily, CME Group facilitates the money settlement of crypto futures. It means merchants should settle the contracts in a fiat forex like USD.

Tick

Each futures contract comes with a minimal worth fluctuation, often called a tick. For example, the minimal tick measurement of CME Bitcoin futures is $5, whereas its contract measurement is 5 BTC. Due to this fact, the worth of a tick transfer equals $25 ($5 X 5).

Crypto Futures vs Crypto Choices: What’s the distinction?

Cryptocurrency futuresCryptocurrency ChoicesA crypto futures contract is an obligation to purchase or promote the underlying cryptocurrency at a predetermined worth on a future date.A crypto choices contract provides patrons the fitting, not the duty, to buy or promote the underlying digital forex.Futures contracts are settled in money (fiat forex), stablecoins, or cryptocurrencies.Most exchanges supply crypto choices settled in stablecoins, particularly USDT and USDC.Crypto futures can be found on a number of cryptocurrencies. Crypto choices are provided solely on a restricted variety of cryptocurrencies, significantly Bitcoin and Ether. Losses will be limitless, particularly when traded utilizing leverage. For patrons, losses are restricted to the choice premium paid. For sellers, losses will be limitless relying on market volatility.

Finest Cryptocurrencies for Futures Buying and selling

Bitcoin futures

Bitcoin (BTC) is the most important cryptocurrency by market capitalization (cap) and has the very best greenback worth per coin. With Bitcoin futures, you will get publicity to the Bitcoin market with out truly proudly owning BTC. Furthermore, Bitcoin futures are essentially the most liquid and actively traded.

Ether futures

Ether (ETH) is the second-largest cryptocurrency by market cap. It’s the prime governance token of Ethereum, the pioneer blockchain that helps sensible contracts and decentralized purposes. By Ether futures, you may garner earnings from ETH’s worth actions in both course.

Solana futures

SOL is the native token of the Solana blockchain. It’s an ultra-fast, extremely scalable, and energy-efficient community, making it a sizzling alternative for upcoming Web3 initiatives. Thus, SOL carries a robust progress potential, and Solana futures give you a strong option to faucet into it.

XRP futures

XRP is the utility token of the XRP ledger, an open-source community that fosters cost-efficient cross-border funds. It’s also the third-largest crypto as per market cap. With XRP futures, you may achieve publicity to this promising market.

Commerce Crypto Futures

Step 1: Register on an change

To commerce futures, you need to create your account on a crypto change utilizing your e-mail or telephone quantity. If you have already got an account, go surfing to the change.

Step 2: Open a futures buying and selling account

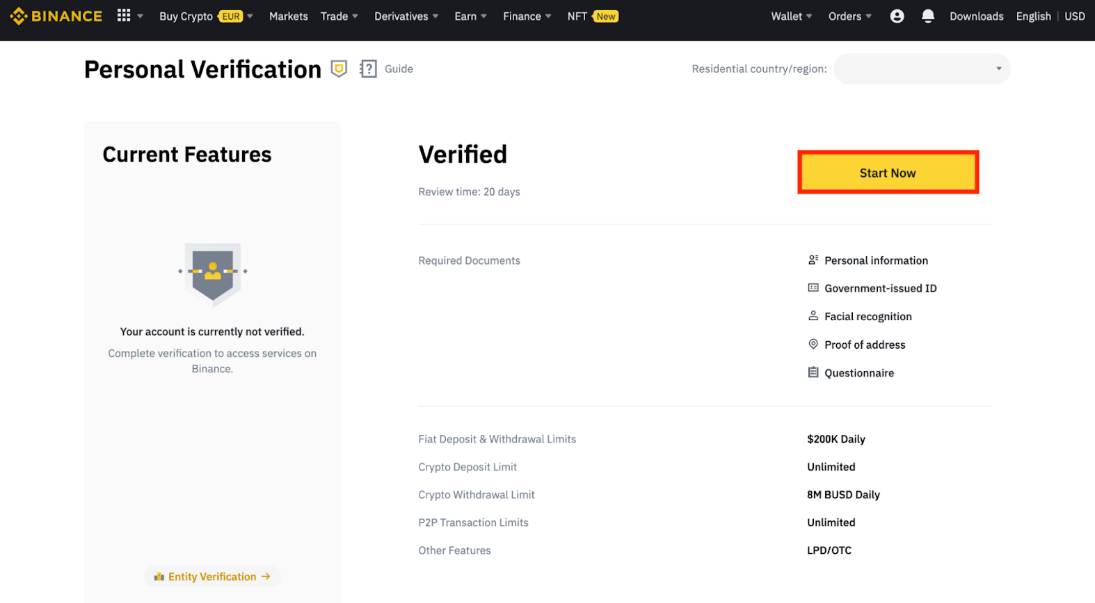

Exchanges like Binance require merchants to open a separate futures account. To activate this account, you need to full a couple of duties on the platform.

Step 3: Full id verification

Earlier than you start contract buying and selling, you need to full the know-your-customer (KYC) course of. Enter primary particulars akin to identify, location, and many others., and move a facial recognition check. Moreover, submit a government-authorized id proof and a sound deal with proof.

Step 4: Make the primary deposit

As soon as your account is verified, deposit fiat or cryptocurrencies into your change pockets. Often, exchanges assist varied cost strategies like financial institution switch, credit score/debit card, PayPal,… to assist merchants make deposits. As soon as performed, you’re able to open a futures place.

Buying and selling on Regulated vs. Unregulated Exchanges

Regulated exchanges function beneath the oversight of presidency authorities. For instance, the CME Group is regulated by the Commodities Futures Buying and selling Fee (CFTC).

These authorities businesses additionally decide the quantity of leverage a dealer can use. Furthermore, margin necessities are greater on exchanges working in a regulated setting. Thus, they assist curtail the magnitude of losses suffered by merchants because of opposed worth actions. Moreover, exchanges just like the CME Group use reference charges to make sure honest pricing.

Conversely, unregulated exchanges enable merchants to imagine extreme dangers. Some platforms supply leverage of as much as 500x on sure futures pairs. The upper the leverage, the upper the danger of incurring important losses. Moreover, no authorized recourse is on the market in the event you lose your belongings on unregulated exchanges.

What’s Chicago Mercantile Alternate (CME)?

CME is the most effective regulated change for buying and selling cryptocurrency futures on XRP, Solana, Bitcoin, and Ether. It kinds a part of the CME group, the world’s hottest derivatives market.

Aside from crypto market insights, CME Group publishes benchmark reference charges and stay spot worth indices for varied cryptocurrencies. Moreover, CME is the go-to platform for merchants looking for micro Bitcoin futures and progressive merchandise like Bitcoin Friday Futures.

Futures ProductsContract SizeMinimum worth fluctuation per contractMargin requirementBitcoin futures5 Bitcoin$2550%Micro Bitcoin futures0.1 Bitcoin $0.550%Bitcoin Friday Futures0.02 Bitcoin$0.150%Spot-quoted Bitcoin futures0.01 Bitcoin$0.150%Ether futures50 Ether$2560%Micro Ether futures0.1 Ether$0.0560%Spot-quoted Ether futures0.2 Ether$0.150%Solana futures500 SOL$2550%Micro Solana futures25 SOL$1.2550%XRP futures50,000 XRP$2550%Micro XRP futures2,500 XRP$1.2550%

Advantages and Dangers of Crypto Futures Buying and selling

Advantages

Hedging: It’s a threat administration technique that serves as a security internet for crypto portfolios, particularly throughout excessive market volatility. As crypto futures are highly effective hedging instruments, they assist you handle the danger of losses attributable to sudden worth swings. Merchants can safeguard lengthy positions within the spot market by going quick within the futures market, and vice versa.Hypothesis: Cryptocurrency futures assist merchants speculate on future costs of underlying digital currencies. Often, merchants go lengthy on futures contracts when the cryptocurrency market rallies and go quick when the market slumps.No cryptoasset possession: If managing crypto wallets or buying cryptocurrencies baffles you, futures buying and selling will be your greatest wager. It allows you to achieve publicity to cryptoasset costs with out proudly owning the belongings. Decrease charges: The futures buying and selling payment is normally decrease than spot buying and selling costs on most exchanges.Arbitrage: Crypto futures are perfect for merchants who want to benefit from worth discrepancies throughout a number of buying and selling platforms. Nevertheless, the futures contracts on each platforms ought to have the identical settlement date, underlying cryptocurrency, leverage, and worth monitoring methodology. Cryptocurrency futures additionally assist you garner earnings from the worth variations between the underlying asset’s spot and futures markets. Sometimes, you may make positive factors from arbitrage alternatives by assuming reverse positions within the two markets or platforms.Excessive liquidity: Many crypto futures contracts are extremely liquid, which means merchants can enter and exit positions shortly.

Dangers

Leverage: Many exchanges facilitate leveraged buying and selling of crypto futures contracts. They permit merchants to regulate giant positions with out investing important quantities of capital. Nevertheless, leverage is a double-edged sword. Whereas it magnifies potential positive factors, it additionally amplifies potential losses. Excessive margins: Some exchanges impose greater upkeep margins that represent a major proportion of a contract’s notional worth. Thus, merchants could also be compelled to regulate their place sizing or liquidate their trades.Excessive volatility: Each cryptocurrencies and futures contracts are extremely risky. They’re usually topic to opposed worth actions, inflicting important losses for merchants.

Fashionable Crypto Futures Exchanges

Coinbase: is a prime US-based change for cryptocurrency futures buying and selling. It gives CFTC-compliant perpetual contracts and nano futures on varied cryptocurrencies, together with Bitcoin and Ether. The change additionally supplies leverage of as much as 10x for futures buying and selling.Binance Futures: is the largest change by buying and selling volumes. In July 2025, its futures quantity touched $2.55 trillion, and its open curiosity reached a whopping $88 billion.Dydx: is the most effective decentralized change for buying and selling crypto perpetuals. It has recorded $220 million in open curiosity and gives as much as 50x leverage for futures buying and selling.

Crypto Futures Buying and selling Methods

Going lengthy: You must go lengthy when the underlying asset’s worth is rising. This technique helps you procure the asset at a cheaper price.Going quick: You must go quick when the underlying cryptocurrency’s worth is falling. This technique helps you promote the asset at the next worth and purchase it again later at a cheaper price.Scalping: It’s a quick-fire technique, the place merchants execute a number of small trades all through the day to revenue from minor worth fluctuations. It yields excessive returns throughout intense worth volatility in extremely liquid cryptocurrency markets.Day buying and selling: It’s a appropriate technique for each skilled and new merchants who wish to keep away from in a single day worth fluctuations. It includes opening and shutting positions on the identical day. Breakout buying and selling: In periods of excessive volatility and speedy adjustments in market sentiment, breakout buying and selling is useful. It helps you clock earnings when costs break pivotal assist and resistance ranges.

Conclusion

Cryptocurrency futures assist merchants doubtlessly revenue from hypothesis and arbitrage alternatives. Furthermore, the worth volatilities of cryptocurrencies rely upon a number of elements, together with market sentiment, macroeconomic tendencies, and regulatory developments. Understanding these dynamics and utilizing threat administration methods like hedging is crucial to revenue from futures buying and selling.

FAQs

Are you able to make $100 a day with crypto?

You can also make $100 a day via spot buying and selling of crypto. Nevertheless, it relies on varied elements like your out there capital, threat tolerance, and buying and selling technique. Making $100 a day is less complicated with cryptocurrency futures, as many exchanges facilitate leveraged buying and selling of derivatives.

Is crypto futures buying and selling worthwhile?

Crypto futures allow you to make earnings by speculating on a cryptocurrency’s future costs or via arbitrage alternatives. Moreover, you need to use leverage to commerce futures contracts and increase your positive factors.

Can I commerce futures with $100?

With $100, you may commerce futures on low-priced cash. You may also commerce micro futures on in style cryptocurrencies. Furthermore, many platforms supply over 100x leverage on choose pairs. Due to this fact, you may open a $10,000 place with a margin of simply $100.

What’s the distinction between customary and micro futures?

Standardized futures are full-size contracts that enable merchants to take giant positions within the futures market.

Conversely, micro futures are byte-sized contracts that are perfect for merchants with low threat tolerance and who wish to take small positions.

For instance, the dimensions of CME Group’s standardized Bitcoin futures contract is 5 BTC. Their micro Bitcoin futures contracts are sized at 0.1 BTC.