Within the wake of the GENIUS Act, which was signed into regulation by President Donald Trump in July, consideration is now turning to the CLARITY Act, generally referred to as the crypto market construction invoice. This laws has encountered substantial delays, exacerbated by the current authorities shutdown and an absence of consensus in Congress.

Financial institution Leaders To Have interaction With Congress On Key Crypto Subjects

This week, the CEOs of Citigroup, Wells Fargo, and Financial institution of America are scheduled to fulfill with each Republican and Democratic senators to debate the evolving laws surrounding crypto market construction.

The conferences are set for Thursday, and congressional workers have indicated that the CEOs would welcome the possibility to share insights on US World Systemically Necessary Financial institution (GSIB) market construction priorities.

The financial institution leaders are anticipated to carry separate discussions with lawmakers from each events, emphasizing collaboration to form efficient insurance policies that place the USA as a frontrunner in crypto belongings. Among the many matters on the agenda are financial institution permissibility, curiosity funds, and issues surrounding illicit finance.

Senate Faces Hurdles

Current updates on social media platform X (beforehand Twitter) from Eleanor Terret of Crypto In America, additionally point out that getting a markup for the crypto market construction invoice earlier than the Christmas break poses challenges.

Senator Mark Warner has expressed issues about pending language from the White Home concerning two essential elements of the invoice—ethics and quorum.

Warner famous the significance of addressing these points thoughtfully, stating that bipartisan discussions are ongoing, but productive progress is important.

The Senate’s method to the laws is additional difficult by its division into two committees: the Banking Committee, which oversees securities legal guidelines, and the Agriculture Committee, which focuses on commodities regulation.

Each committees have launched drafts of their work through the fall, with markup periods—the method for voting on amendments earlier than a full Senate vote—upcoming. Nonetheless, each committees are continuing cautiously as a consequence of unresolved points.

Senators Demand Battle Of Curiosity Provisions

Probably the most urgent issues embrace the remedy of stablecoin yields, potential conflicts of curiosity, and the regulatory method to decentralized finance (DeFi).

Some Democratic senators have indicated that they won’t help the laws until it contains provisions addressing any attainable conflicts regarding the President’s household and their enterprise involvements within the crypto realm.

Furthermore, whereas market construction laws primarily targets centralized platforms managing person funds, there’s a push from the conventional finance sector to categorise just about all crypto-related entities, together with builders and validators, as intermediaries.

Market analyst MartyParty supplied an encouraging replace on December 4, noting that the bipartisan crypto market construction invoice is gaining momentum in Congress.

A markup session with the Senate Banking Committee has been tentatively scheduled for December 17-18, simply previous to the vacation recess.

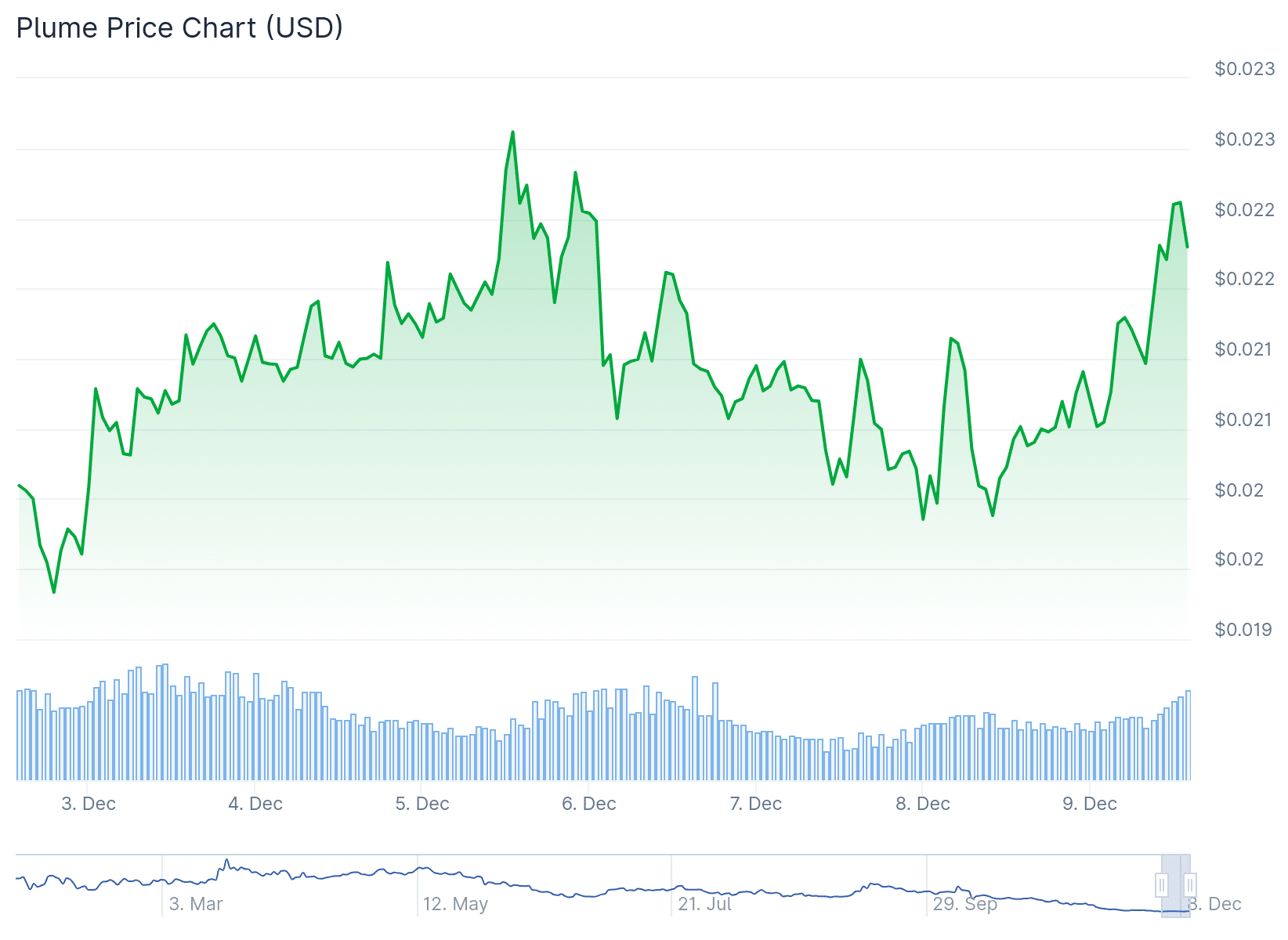

Featured picture from DALL-E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.