BlackRock, the biggest asset administration agency on the earth, has described tokenization as probably the most crucial market improve because the early web.

Alternatively, the Worldwide Financial Fund (IMF) describes it as a unstable, untested structure that may amplify monetary shocks at machine velocity.

Each establishments are wanting on the similar innovation. But, the gap between their conclusions captures probably the most consequential debate in fashionable finance: whether or not tokenized markets will reinvent world infrastructure or reproduce its worst fragilities with new velocity.

The institutional divide on tokenization

In a Dec. 1 op-ed for The Economist, BlackRock CEO Larry Fink and COO Rob Goldstein argued that recording asset possession on digital ledgers represents the following structural step in a decades-long modernization arc.

They framed tokenization as a monetary leap similar to the arrival of SWIFT in 1977 or the shift from paper certificates to digital buying and selling.

In distinction, the IMF warned in a current explainer video that tokenized markets could possibly be liable to flash crashes, liquidity fractures, and smart-contract domino cascades that flip native failures into systemic shocks.

The cut up over tokenization arises from the truth that the 2 establishments function beneath very completely different mandates.

BlackRock, which has already rolled out tokenized funds and dominates the spot ETF marketplace for digital belongings, approaches tokenization as an infrastructure play. Its incentive is to broaden world market entry, compress settlement cycles to “T+0,” and broaden the investable universe.

In that context, blockchain-based ledgers appear like the following logical step within the evolution of monetary plumbing. This implies the expertise presents a approach to strip out prices and latency within the conventional monetary world.

Nevertheless, the IMF operates from the other way.

Because the stabilizer of the worldwide financial system, it focuses on the hard-to-predict suggestions loops that come up when markets function at extraordinarily excessive velocity. Conventional finance depends on settlement delays to internet transactions and preserve liquidity.

Tokenization introduces instantaneous settlement and composability throughout good contracts. That construction is environment friendly in calm durations however can propagate shocks far quicker than human intermediaries can reply.

These views don’t contradict one another a lot as they mirror completely different layers of accountability.

BlackRock is tasked with constructing the following era of funding merchandise. The IMF is tasked with figuring out the fault strains earlier than they unfold. Tokenization sits on the intersection of that pressure.

A expertise with two futures

Fink and Goldstein describe tokenization as a bridge “constructed from either side of a river,” connecting conventional establishments with digital-first innovators.

They argue that shared digital ledgers can get rid of gradual, handbook processes and change disparate settlement pipelines with standardized rails that members throughout jurisdictions can confirm immediately.

This view will not be theoretical, although the information requires cautious parsing.

In response to Token Terminal, the broader tokenized ecosystem is approaching $300 billion, a determine closely anchored by dollar-pegged stablecoins like USDT and USDC.

Nevertheless, the precise take a look at lies within the roughly $30 billion wedge of regulated real-world belongings (RWAs), similar to tokenized Treasuries, personal credit score, and bonds.

Certainly, these regulated belongings are not restricted to pilot packages.

Tokenized authorities bond funds similar to BlackRock’s BUIDL and Ondo’s merchandise at the moment are stay. On the similar time, valuable metals have moved on-chain as nicely, with vital volumes in digital gold.

The market has additionally seen fractionalized actual property shares and tokenized personal credit score devices broaden the investable universe past listed bonds and equities.

In gentle of this, forecasts for this sector vary from the optimistic to the astronomical. Studies from corporations similar to RedStone Finance challenge a “blue sky” situation through which on-chain RWAs might attain $30 trillion by 2034.

In the meantime, extra conservative estimates from McKinsey & Co. counsel the market might double as funds and treasuries migrate to blockchain rails.

For BlackRock, even the conservative case represents a multi-trillion-dollar restructuring of monetary infrastructure.

But the IMF sees a parallel, much less steady future. Its concern facilities on the mechanics of atomic settlement.

In immediately’s markets, trades are sometimes “netted” on the finish of the day, that means banks solely want to maneuver the distinction between what they purchased and offered. Atomic settlement requires each commerce to be totally funded immediately.

In pressured circumstances, this demand for pre-funded liquidity can spike, doubtlessly inflicting liquidity to evaporate precisely when it’s wanted most.

If automated contracts then set off liquidations “like falling dominoes,” a localized drawback might change into a systemic cascade earlier than regulators even obtain the alert.

The liquidity paradox

A part of the passion round tokenization stems from the query of the place the following cycle of market development could originate.

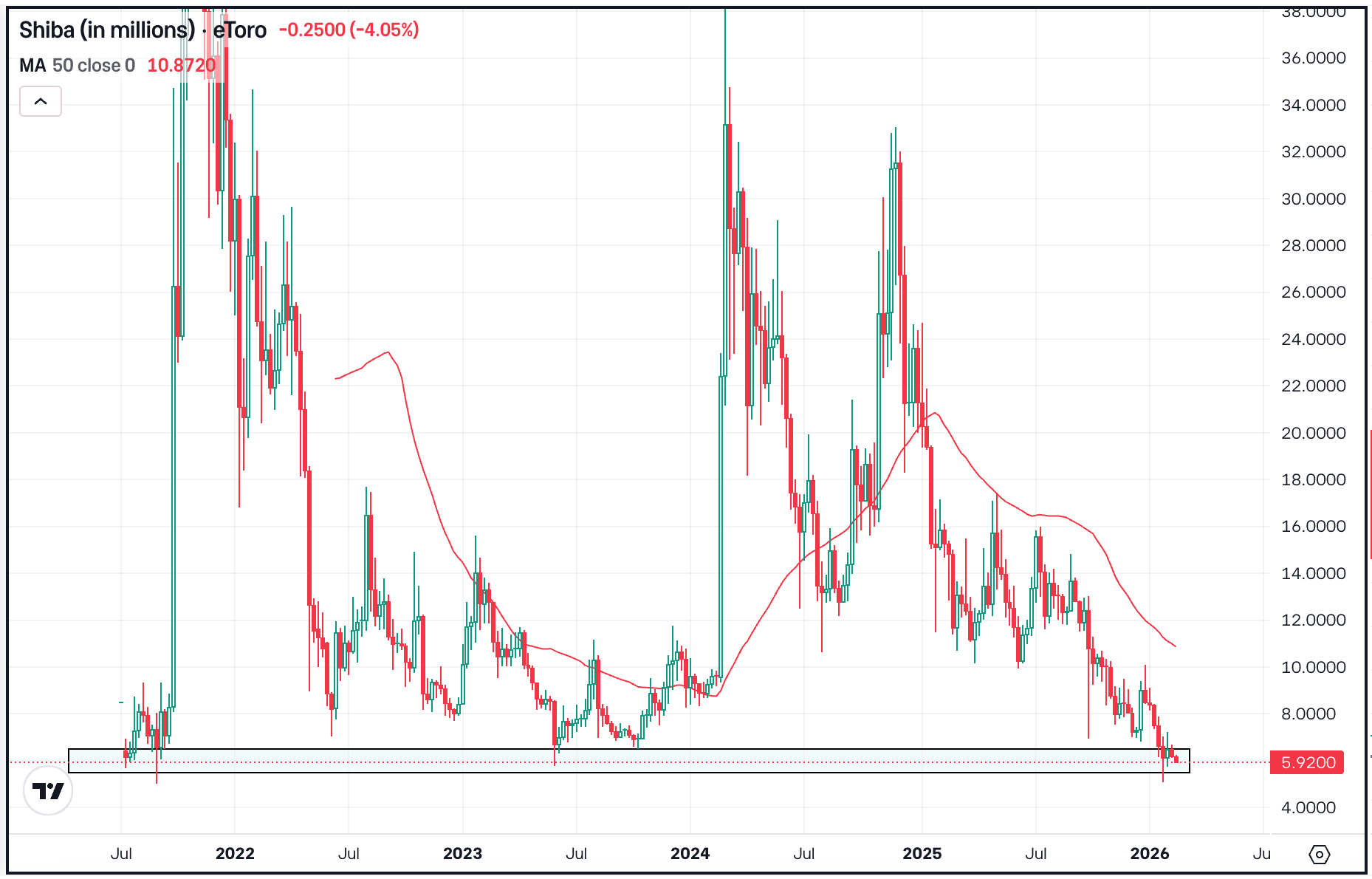

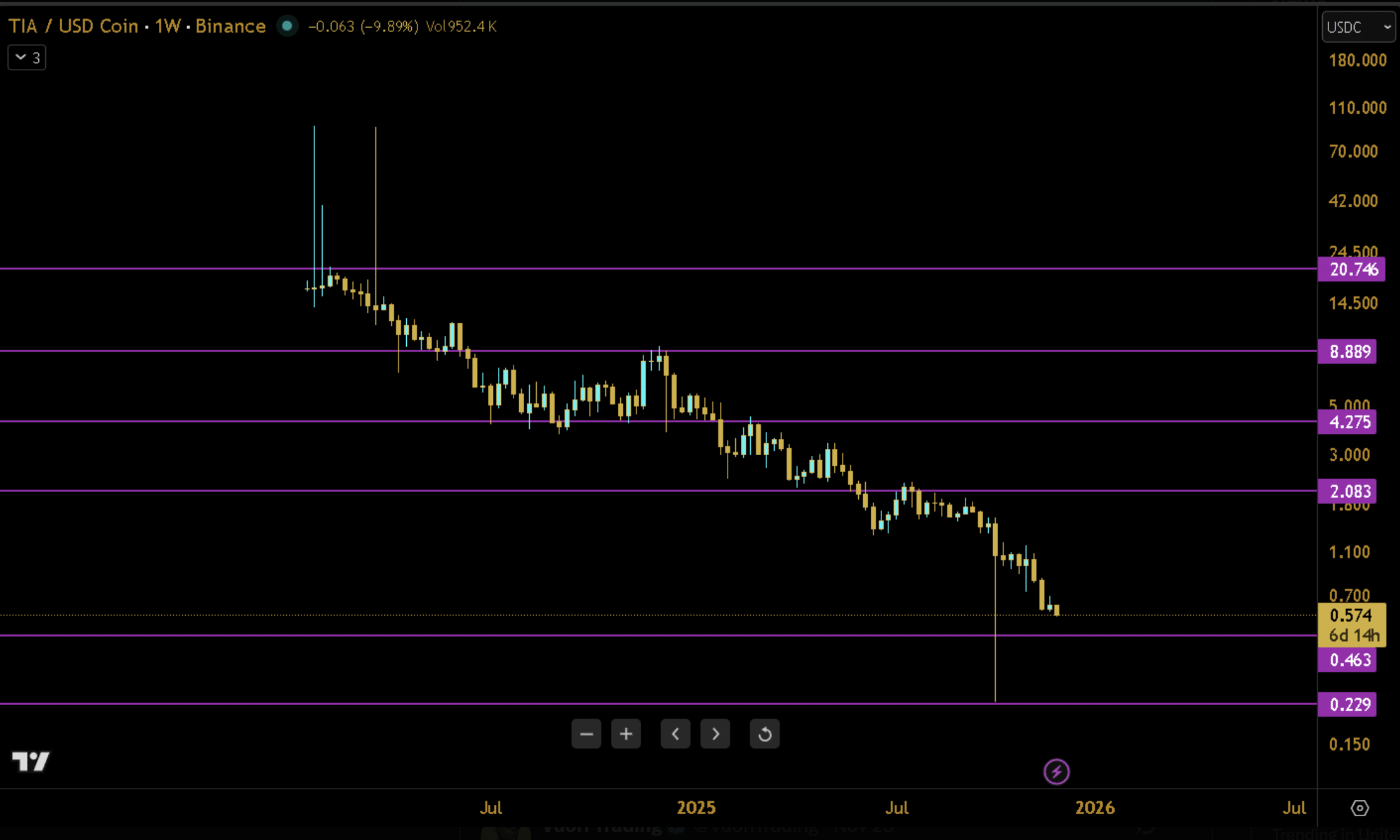

The final crypto cycle was characterised by memecoin-driven hypothesis, which generated excessive exercise however drained liquidity with out increasing long-term adoption.

Advocates of tokenization argue that the following enlargement might be pushed not by retail hypothesis however by institutional yield methods, together with tokenized personal credit score, real-world debt devices, and enterprise-grade vaults delivering predictable returns.

Tokenization, on this framing, will not be merely a technical improve however a brand new liquidity channel. Institutional allocators dealing with a constrained conventional yield surroundings could migrate to tokenized credit score markets, the place automated methods and programmable settlement can yield increased, extra environment friendly returns.

Nevertheless, this future stays unrealized as a result of massive banks, insurers, and pension funds face regulatory constraints.

The Basel III Endgame guidelines, for instance, assign punitive capital therapy to sure digital belongings categorized as “Group 2,” discouraging publicity to tokenized devices until regulators make clear the distinctions between unstable cryptocurrencies and controlled tokenized securities.

Till that boundary is outlined, the “wall of cash” stays extra potential than actuality.

Moreover, the IMF argues that even when the funds arrive, they carry hidden leverage.

A posh stack of automated contracts, collateralized debt positions, and tokenized credit score devices could create recursive dependencies.

In periods of volatility, these chains can unwind quicker than threat engines are designed to deal with. The very options that make tokenization engaging, similar to the moment settlement, composability, and world entry, create suggestions mechanisms that might amplify stress.

The tokenization query

The controversy between BlackRock and the IMF will not be about whether or not tokenization will combine into world markets; it already has.

It’s concerning the trajectory of that integration. One path envisions a extra environment friendly, accessible, globally synchronized market construction. The opposite anticipates a panorama the place velocity and connectivity create new types of systemic vulnerability.

Nevertheless, in that future, the result will rely on whether or not world establishments can converge on coherent requirements for interoperability, disclosure, and automatic threat controls.