Crypto market evaluation at the moment reveals a important divergence in on-chain information, indicating sturdy potential for a big upside transfer. Latest findings affirm that influential Ethereum Whales are aggressively accumulating ETH, which pushed their whole holdings to a historic excessive. Concurrently, Binance has seen ETH reserves plummeting, whereas stablecoin reserves surged to a brand new document.

Historic Accumulation by Ethereum Whales

Ethereum’s most influential market contributors have shifted their technique towards aggressive long-term accumulation. Knowledge identifies holders with balances between 10,000 and 100,000 ETH as the first drivers of this development. The influential group lately pushed their whole stability previous 21 million ETH, setting a brand new document and a powerful accumulation wave.

Mid-cap whales used current months to extend their holdings. Such a demographic usually acts as a number one indicator for broader market tendencies. Their refusal to promote, mixed with energetic shopping for, establishes a high-conviction flooring for the asset.

Confidence extends past the mid-cap tier to the biggest entities within the ecosystem. The “mega-whale” cohort, outlined as addresses holding greater than 100,000 ETH, has expanded its stability to roughly 4.3 million ETH. This rise displays a decisive shift in sentiment amongst institutional and extremely liquid buyers.

Up to now, when these large teams purchase, it comes earlier than a powerful worth assist stage. These bases usually act as beginning factors for giant market rallies because the buyers see present costs as an excellent deal. By locking away thousands and thousands of ETH, they minimize the availability accessible for buying and selling.

Each mid-cap whales and mega-whales elevated their ETH holdings. – Supply: CryptoQuant

Study extra: NFTPlazas Information: Ethereum Blockchain Elementary

Falling Binance Reserves, File Stablecoin Inflows

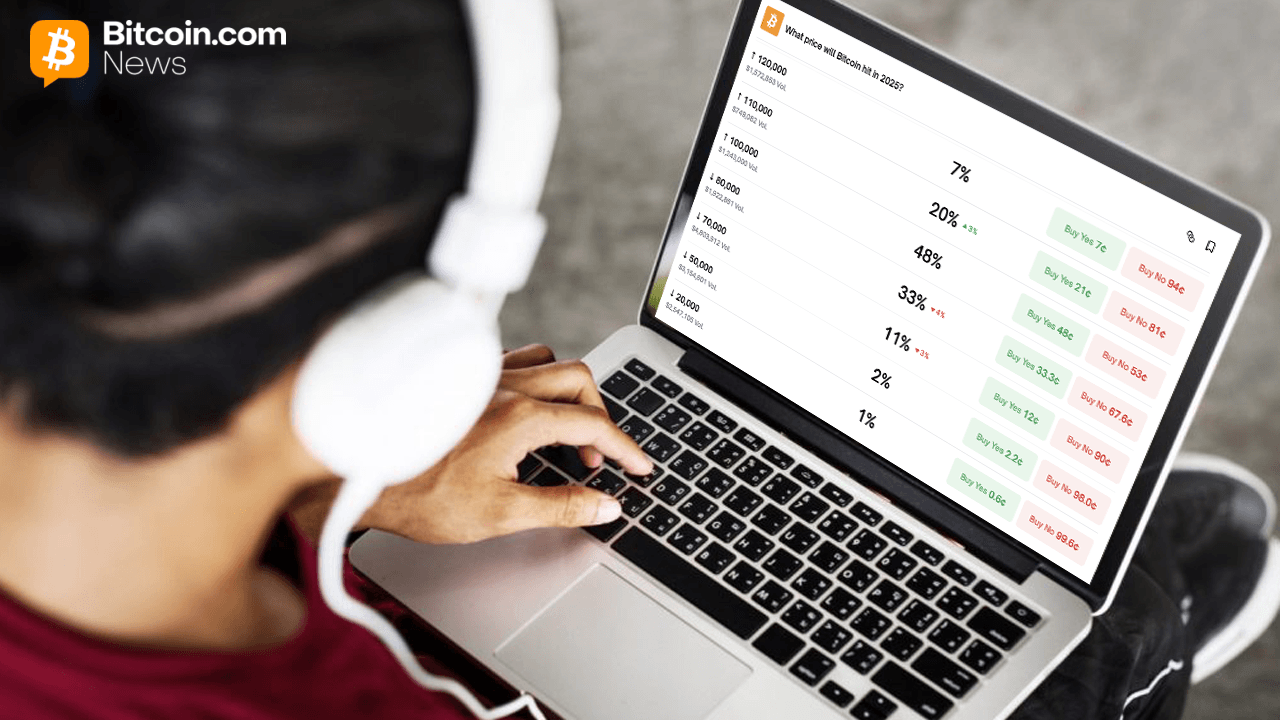

Knowledge from Binance, the world’s largest alternate, backs up the bullish thought. Since August fifteenth, the alternate has seen a giant distinction in cash flows. In just some months, Ethereum reserves on Binance almost dropped by half. The entire worth fell from over 20 billion to beneath 11 billion. The precise variety of Ethereum tokens dropped to three.764 million ETH in November. Traders clearly want chilly storage or staking as an alternative of holding belongings on exchanges.

Whereas unstable belongings depart exchanges, stablecoins are flooding in. The influx creates a powerful reverse development. Tether (USDT) reserves throughout TRC20 and ERC20 networks on Binance surged from 26 billion to a record-breaking 42 billion.

This metric serves as the important thing to understanding the present market sentiment. Merchants have taken earnings throughout earlier peaks however haven’t exited the crypto ecosystem. As a substitute of leaving, they put money into stablecoins proper on the alternate. The USDT setup reveals that merchants are usually not bearish; they’re ready for the precise second.

Binance reserves present reducing ETH provide whereas stablecoins surged. – Supply: CryptoQuant

What Comes Subsequent?

The information combine creates a “coiled spring” impact available in the market. Two sturdy forces now meet: a dropping provide of belongings on the market (BTC and ETH) and an all-time excessive in shopping for energy (USDT reserves). Market gamers at the moment present “armed persistence.” Traders await a selected signal, reminiscent of a worth dip or higher financial information, to make use of this cash. When this money floods the market, it chases a small provide of cash.

Thus, the on-chain indicators give a transparent outlook: The market appears quiet however holds lots of money. Whales act with conviction by eradicating provide, whereas merchants stand prepared with document ranges of stablecoin capital. This construction sometimes precedes important market volatility favoring the upside. As the availability of Ethereum and Bitcoin disappears into chilly storage, the $42 billion in stablecoin reserves will possible gasoline the following massive market progress.