The massive story within the crypto information at present is how surprisingly calm the market takes care of what may’ve been a a lot larger shake-up. BTC USD remains to be parked round $90,000, and ETH USD retains inching upward. These all occurred even after that sudden Chicago knowledge middle outage that briefly froze world buying and selling screens.

As soon as the Chicago knowledge middle difficulty was sorted out, markets snapped again, and shares even pushed greater on hopes the Fed may lastly ease charges. In some way, BTC and ETH barely flinched towards USD by way of all of it.

7d

30d

1y

All Time

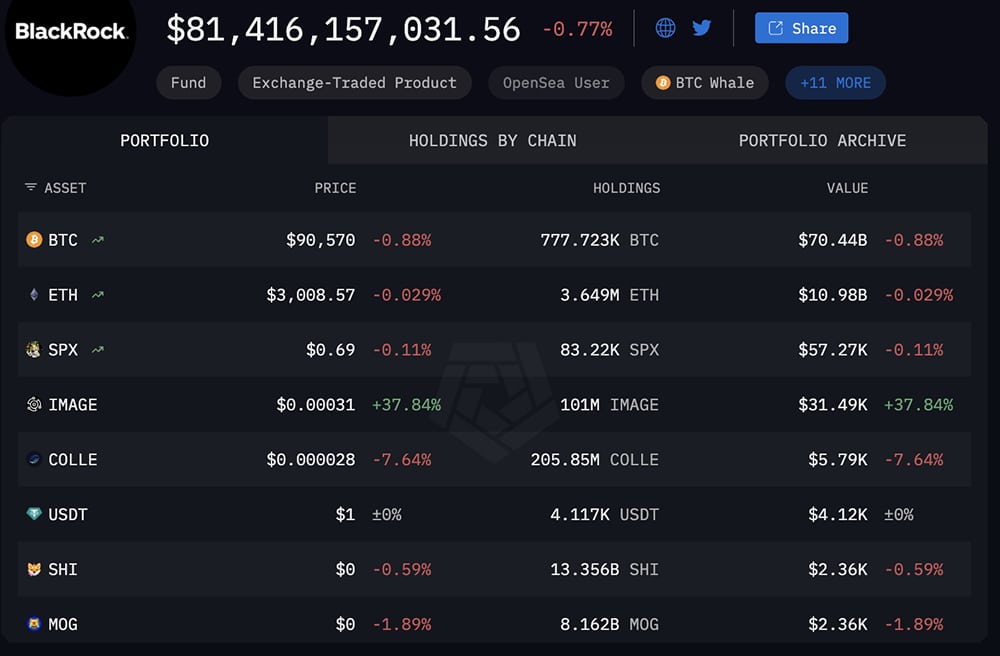

If something stands out this week, it’s how aggressively establishments are shopping for the dip. Ark Make investments scooped up $88 million price of Bitcoin, and BlackRock grabbed one other $68.8 million price of Ethereum. The establishments are displaying conviction whereas retails are in deep concern.

7d

30d

1y

All Time

Establishments Preserve Shopping for Whereas Liquidity Pours In: Can ETH USD Catch Up?

Following the conviction of the large boys, roughly $190 billion flowed again into the crypto market in only a week. signal that the larger gamers don’t assume the celebration’s over simply but.

USD Steady issuer Circle additionally minted one other 500 million USDC, bringing the overall to $1.25 billion over the past 2-3 days. This added liquidity is usually recycled again into BTC and main altcoins like ETH as soon as confidence returns to redeploy.

BREAKING:

Circle mints one other 500,000,000 $USDC. pic.twitter.com/JlkXsZXhQ6

— Crypto Rover (@cryptorover) November 29, 2025

Outdoors crypto, metals are on a tear. Gold is tightening into one other bullish consolidation, and Silver simply printed a contemporary all-time excessive at $56, up by nearly 90% since January.

When shares, metals, and danger belongings all begin heating up collectively, the spillover into BTC and ETH towards USD tends to comply with, and lots of people watching crypto information at present anticipate precisely that.

However scroll by way of X and most crypto communities, and we are going to see the alternative sentiment: doomsday predictions, October cycle prime theories, and warnings of an 84% crash.

Crypto Worry and Greed Chart

1y

1m

1w

24h

The humorous half? Each indicator that really nailed the 2013, 2017, and 2021 tops is silent. Pi Cycle High isn’t triggered. MVRV Z-Rating can be at an absurdly low 1.07, which is traditionally oversold. Puell A number of is below 1, which means miners are squeezed in the mean time.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

BTC USD Primed for the Subsequent Transfer

ETF flows inform the actual story within the larger image. Even with November’s document $3.79 billion in outflows, BlackRock nonetheless holds 777,000 BTC, and greater than 10 billion USD in ETH. We all know the establishments didn’t blink after the Chicago knowledge middle mess. The market remains to be bullish regardless of the present dip.

(supply – BlackRock, Arkham)

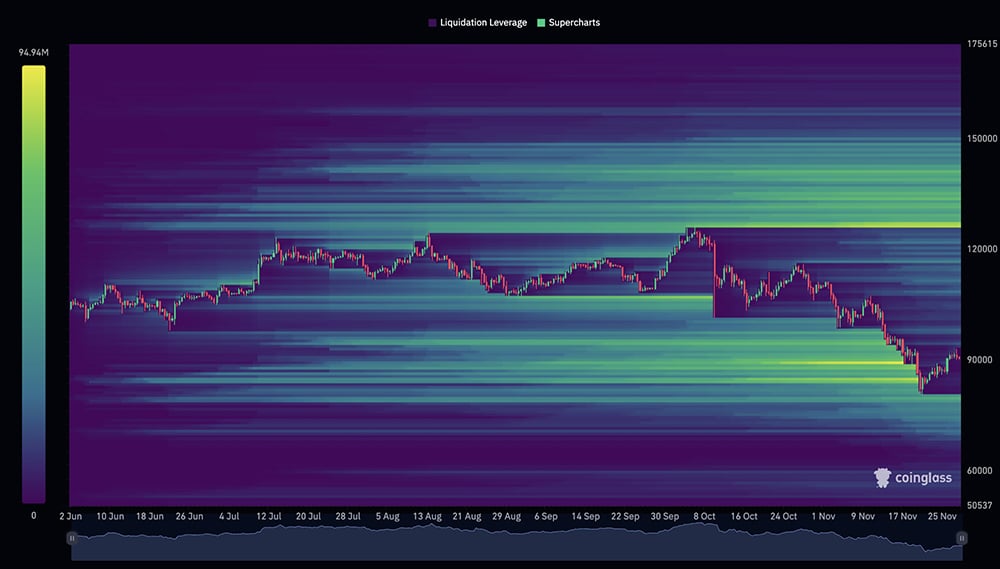

This latest 36% pullback over six weeks was the harshest of the cycle, and it caught nearly everybody off guard after months of sluggish bleeds. However structurally, there may be nothing damaged. The identical weekly divergences that launched earlier rallies are forming once more. If BTC USD pushes towards $112,000, greater than $15 billion briefly positions may get worn out in a single large squeeze.

(supply – Liquidation Warmth Map, Coinglass)

So, regardless of the noise, the crypto bull run doesn’t look accomplished. At this time, with crypto liquidity rising, large cash nonetheless shopping for as seen all over the place within the information, and indicators refusing to point out a prime, the setup favors continuation.

It’s Saturday, and I’m bullish, as all the time.

DISCOVER: 10+ Subsequent Crypto to 100X In 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

XRP Value Prediction: $1B ETF Inflows however No Pump: What’s Holding It Again?

The brand new XRP ETFs are off to a loopy sturdy begin. Their mixed belongings below administration are already on tempo to interrupt 1 billion {dollars} inside the first month, primarily based on contemporary knowledge from Finbold and XRP Insights.

As of November 28, the 5 energetic funds collectively maintain roughly $ 801.7 million, locking up 339.16 million XRP. That’s roughly 0.339 % of the circulating provide, displaying that establishments are slowly however clearly shifting into XRP.

JUST IN: $1.7 trillion asset supervisor, Franklin Templeton, says $XRP “performs a foundational position in world settlement infrastructure.” pic.twitter.com/4iw8KpKum1

— Whale Insider (@WhaleInsider) November 25, 2025

Canary Capital stays the most important holder with 155.8 million XRP, whereas Bitwise holds second place with 80.5 million. Every day buying and selling quantity throughout all ETFs is roughly $ 42.79 million, and Bitwise leads the pack with $ 15.3 million. Mainly, there may be actual exercise right here, not simply empty hype.

Nonetheless, regardless of this important curiosity, XRP’s value nonetheless doesn’t react the way in which individuals anticipated. The inflows are sturdy, Wall Avenue demand is actual, but the chart barely strikes. A giant issue may very well be the shortage of retail participation. A lot of the shopping for proper now seems to be institutional, and with out retail participation, the worth impression stays muted.

Barcelona Crypto Nightmare: How a Huge Cash Sponsorship Grew to become a Huge Cash Legal responsibility

A brand new crypto partnership meant to regular FC Barcelona’s funds has as a substitute turn into a public headache inside days.

FC Barcelona is going through rising criticism after confirming in mid-November {that a} Samoa-based firm, Zero-Information Proof (ZKP), would act because the membership’s “Official Cryptographic Protocol Associate.”

However by November 26, the membership moved to distance itself from a digital token launched by the sponsor, insisting it had “no connection in anyway” to the asset.

The controversy broke in Barcelona over the previous 24 to 48 hours as followers and observers questioned who controls ZKP and why the membership permitted the association.

World partnership with @ZKPofficial, new Official Blockchain Expertise Associate of FC Barcelona. #BarçaxZKP

— FC Barcelona (@FCBarcelona) November 14, 2025

Learn the total story right here.

QNT Crypto Trade Provide at Report Lows: The London-Primarily based Quant Community Is Slowly Climbing in a Pink Market

Quant community, or QNT, has been quietly pushing greater at the same time as a lot of the crypto market stays crimson. Whereas main cash wrestle to carry help, Quant has managed to nudge its means towards the mid $90s after an 11% bounce, giving it an uncommon little bit of energy in a dismal week.

A number of this comes all the way down to Quant Community’s slow-burn progress with Overledger, the London-based firm’s interoperability system that goals to attach blockchains with the standard monetary rails that establishments nonetheless depend on.

Between shrinking alternate provide and rising consideration from the crypto group, there are a number of causes QNT crypto retains climbing whereas the whole lot else appears to be like heavy.

7d

30d

1y

All Time

Learn the total story right here.

The put up Crypto Market Information At this time, November 29: BTC USD Steady at $90,000, ETH USD Grinding Up as Chicago Knowledge Heart Chaos Ends appeared first on 99Bitcoins.