Coinbase Ventures has outlined a roadmap for the place it expects the following wave of crypto worth creation in 2026, centering on real-world asset perpetuals, specialised exchanges, “next-gen DeFi,” and the convergence of crypto with AI and robotics. The agency presents the doc as a solution to the recurring founder query: “What ought to I construct subsequent?” and says it’s “actively searching for the appropriate groups to take a position behind in these classes.”

The staff argues that 2025 quietly reset crypto’s foundations. They spotlight “stablecoin infrastructure reshaping funds,” cross-chain proofs collapsing settlement instances “that when took days,” and new DEX fashions that enabled “markets for the whole lot onchain.” No matter present value motion, Coinbase Ventures writes: “We’re as bullish as ever about what’s subsequent.”

Main Crypto Developments For 2026

The primary main theme is real-world asset derivatives. Kinji Steimetz argues that “RWA perpetuals” are rising because the quickest approach to deliver offchain belongings onchain, describing perpetuals as “crypto’s most confirmed buying and selling product” and “a structurally quicker and extra versatile path than tokenization.”

As a result of perpetuals don’t require custody of an underlying, Coinbase Ventures expects “the perpification of the whole lot,” with “markets [forming] round nearly something,” from non-public firms to financial knowledge prints. Steimetz additionally hyperlinks this to macro integration, noting that as crypto merchants grow to be extra subtle, they are going to search onchain publicity to “oil, inflation breakevens, credit score spreads, and volatility.”

A second cluster focuses on market construction and buying and selling interfaces. On Solana, Steimetz factors to “Prop-AMMs” the place resting liquidity is just executed through aggregators, insulating LPs from “predatory movement.” This “prop-driven strategy,” the weblog argues, may “meaningfully advance market construction innovation forward of base-layer enhancements” and isn’t restricted to Solana spot markets.

In parallel, Coinbase Ventures sees prediction markets as “one of many main client crypto functions,” however nonetheless hampered by fragmentation paying homage to early DeFi. Jonathan King expects “prediction market aggregators” to grow to be the “dominant interface layer,” consolidating greater than $600 million in liquidity and offering an Axiom-like terminal for occasion contracts. He imagines buying and selling terminals with “superior order sorts, filters / charts, multi-venue routing and place monitoring, cross-venue arbitrage insights, and extra.”

Underneath “Subsequent-gen DeFi,” the agency highlights three fronts: composable perp markets, unsecured credit score, and privateness. Perpetual futures, it argues, are evolving from remoted venues into constructing blocks for capital-efficient methods the place customers can “concurrently hedge, earn, and leverage with out sacrificing liquidity.” Coinbase Ventures notes that perp DEX volumes have reached roughly $1.4 trillion monthly and grown about 300% year-on-year, and expects 2026 to see deeper integrations with lending protocols so collateral can earn yield whereas backing leveraged positions.

On credit score, King calls unsecured, credit-based cash markets “DeFi’s subsequent frontier,” pointing to $1.3 trillion in revolving, unsecured US credit score strains because the addressable alternative. The weblog envisions fashions that mix onchain repute with offchain knowledge to unlock “unsecured lending at scale,” whereas warning that the core problem is “designing sustainable danger fashions that scale.” If that may be achieved, Coinbase Ventures argues that DeFi turns into “real monetary infrastructure that may outcompete conventional banking rails.”

Privateness is framed as a prerequisite for institutional and mainstream adoption. Ethan Oak notes that establishments {and professional} merchants “can’t commerce in the event that they continuously leak their methods,” and that strange customers don’t need “their complete monetary historical past” uncovered onchain. The staff sees rising developer power round privacy-preserving belongings equivalent to Zcash, non-public orderbooks and borrow-lend protocols, and “devoted blockchains for funds touting privateness as a raison d’etre.” They spotlight superior cryptography – “ZKPs, FHE, MPC, TEEs” – as instruments to let blockchains “keep their verifiability whereas lowering consumer’s public publicity to dangerous actors.”

The ultimate class connects crypto with AI and robotics. On robotics, Steimetz factors to a scarcity of “fine-grained bodily interplay knowledge equivalent to grip, strain, or multi-object manipulation,” and means that incentivized data-collection schemes impressed by DePIN “may supply a viable framework” for scaling these datasets.

On identification, Hoolie Tejwani warns that we’re “approaching the tipping level the place the whole lot you see on an web linked digital display screen might be disassociated and indistinguishable from human provenance vs. AI generated.” Coinbase Ventures argues that “a mixture of biometrics, cryptographic signing, and open supply developer requirements” might be essential to any “proof of humanity” answer, noting that Worldcoin has been “forward of the curve” however stressing they “would like to assist a number of approaches.”

Lastly, King describes AI for smart-contract improvement as nearing its “GitHub Copilot second,” predicting that AI brokers will let “non-technical founders [launch] onchain companies in hours, not months,” by dealing with “good contract code technology, safety evaluations, and steady monitoring.”

Waiting for 2026, Coinbase Ventures says it’s “energized by the builders taking huge swings and pushing the onchain financial system ahead,” however concedes that “probably the most thrilling tasks usually come from locations nobody expects,” leaving the door open for theses which have but to be written.

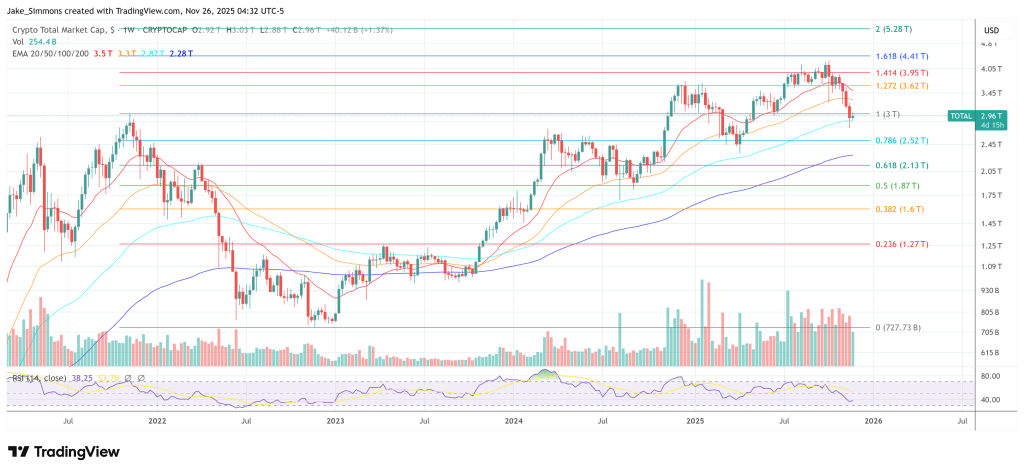

At press time, the full crypto market cap stood at $2.96 trillion.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.