Ethereum has misplaced the $3,000 mark and hasn’t been capable of reclaim it for days, reinforcing rising considerations that the market could also be coming into a deeper corrective part. Promoting strain continues to mount as merchants unwind positions and sentiment shifts towards warning.

The broader crypto market can also be weakening, including to hypothesis {that a} bear market may very well be forming sooner than many anticipated. Concern and uncertainty now dominate social metrics, derivatives information, and spot flows, with traders questioning whether or not ETH has already set its cycle prime. But, regardless of the pessimism and deteriorating value construction, not all gamers are retreating. In reality, a few of the largest market individuals are aggressively accumulating.

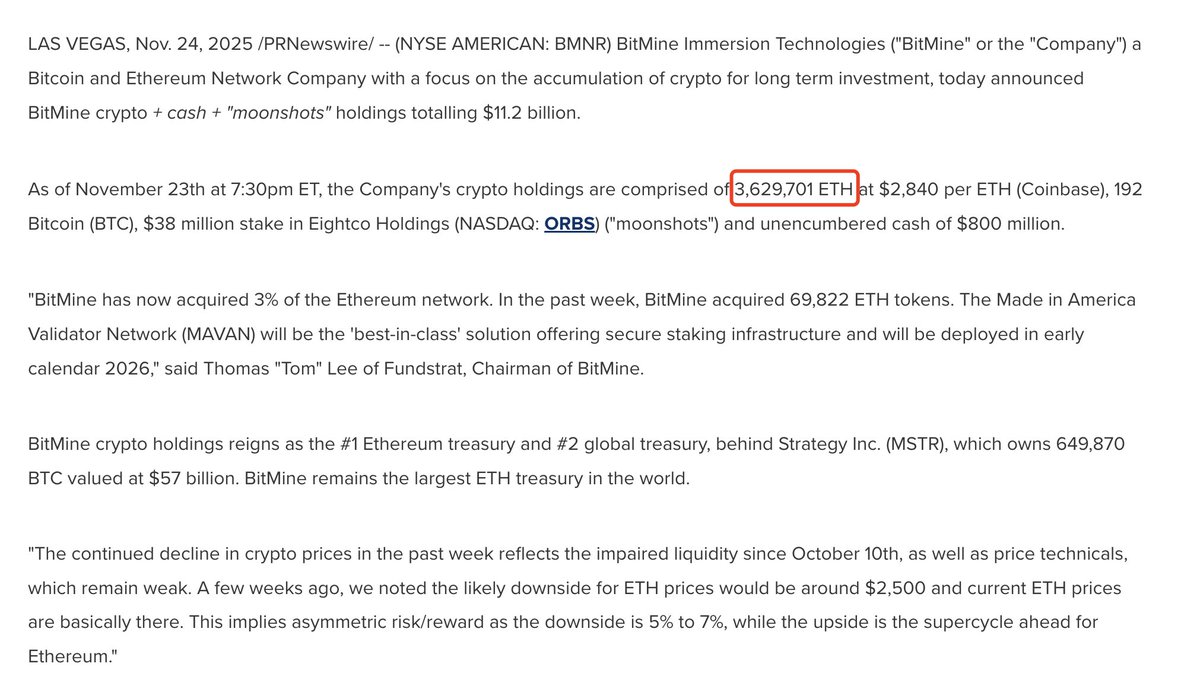

New information from Lookonchain reveals that Tom Lee’s Bitmine purchased 69,822 ETH valued at $197.25 million final week alone. This brings their whole holdings to a staggering 3,629,701 ETH value roughly $10.25 billion.

Bitmine Faces Huge Unrealized Loss as Market Awaits Route

Based on a press launch from Bitmine, the agency’s common shopping for value sits close to $3,997, leaving its place at an unrealized lack of roughly $4.25 billion at present market ranges. This disclosure highlights the dimensions of conviction behind Bitmine’s accumulation technique, nevertheless it additionally underscores how deeply Ethereum has retraced since its current highs. The continued drawdown displays the broader uncertainty gripping the market, the place concern and hesitation are overpowering momentum and liquidity stays skinny.

The market is now coming into a essential part that would outline value habits for the approaching months, as merchants assess whether or not ETH can stabilize and start reclaiming misplaced floor. Many analysts argue that regardless of the sharp retracement, Ethereum stays positioned for a restoration, particularly if macro circumstances enhance and promoting strain eases. They level out that traditionally, comparable intervals of aggressive whale accumulation throughout market weak point have preceded robust rebounds and renewed investor confidence.

Nevertheless, others warn that if ETH fails to regain momentum above key psychological ranges, draw back continuation may deepen. This second has subsequently turn out to be a dividing line between bullish expectation and bearish warning.

Ethereum Worth Motion Reveals Weak Restoration Makes an attempt Amid Bearish Construction

Ethereum’s value motion on the day by day chart continues to replicate a market struggling to regain upward momentum after dropping the $3,000 degree. The current bounce towards $2,900 reveals a short lived response, but the broader construction stays bearish as ETH trades under the 50-day, 100-day, and 200-day shifting averages.

This alignment of shifting averages — with the sooner averages positioned beneath the slower ones — confirms a sustained downward pattern that has been growing since early October.

The chart additionally reveals declining highs and decrease lows, reinforcing that consumers haven’t but regained management. Quantity spikes throughout selloffs point out that bearish exercise is driving market motion greater than accumulation. Regardless of temporary recoveries, every try to push increased has been rejected close to resistance across the $3,150–$3,250 vary, suggesting that sentiment stays fragile.

Moreover, the crimson 200-day shifting common close to the $3,500 zone is now a essential long-term threshold. If ETH can not reclaim this area within the coming weeks, the likelihood of continued consolidation and even deeper correction will increase.

For now, Ethereum stays in a weak place, requiring stronger demand to shift the pattern again in favor of bulls.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.