Bitcoin worth motion has shifted right into a high-volatility zone, and a widely known crypto dealer is reinforcing a bearish outlook that’s unfolding nearly precisely as he projected. Physician Revenue—who beforehand pinpointed the $68,000 peak in 2021 and this cycle’s $125,000 high—is now mapping out additional draw back, framing the present correction as solely the primary stage of a a lot deeper decline.

Crypto Dealer Reveals Bitcoin Value Targets After $125,000 Peak

Bitcoin worth has entered a pronounced downward cycle, registering losses of 8.4% previously 24 hours and greater than 17% during the last two weeks. Physician Revenue famous on X (previously Twitter) that Bitcoin’s drop from $125,000 marks the primary stage of a bigger bear-market development. He frames the present atmosphere as a transitional zone marked by temporary consolidation slightly than true stabilization. Below his mannequin, the following main transfer factors towards a deeper retracement, with the Bitcoin worth in the end gravitating towards the $60,000 area because the cycle’s subsequent important goal.

This name aligns together with his historic cycle predictions. In earlier cycles, he anticipated the 2021 high close to $68,000, projected a collapse towards $18,000, after which switched bullish at that backside to forecast the rally towards $120,000. With the newest reversal forming straight on the ranges he flagged months upfront, his bearish thesis has gained renewed credibility.

He additionally pointed again to a September warning that the crypto market was set for a 30% contraction. With about 25% already worn out, he views the downturn as a broad repricing slightly than a easy correction.

Grayscale And BlackRock Speed up Large Bitcoin Value Dump

In a separate put up, Physician Revenue highlights unusually massive outflows from high asset managers, framing the exercise as aggressive bearish positioning slightly than panic. On-chain information helps this, as switch logs present deep, steady outflows from Grayscale-linked wallets into Coinbase Prime. These transactions embody batches starting from roughly 14 BTC to almost 500 BTC per switch, with a number of consecutive sends above $47 million every. The sequencing signifies coordinated offloading slightly than remoted reallocations.

Equally, BlackRock’s IBIT autos executed a string of 300 BTC transfers repeatedly into the identical change infrastructure, alongside different batches such because the 135.351 BTC motion captured within the logs. Every 300-BTC tranche displays roughly $27–28 million in stream at latest costs.

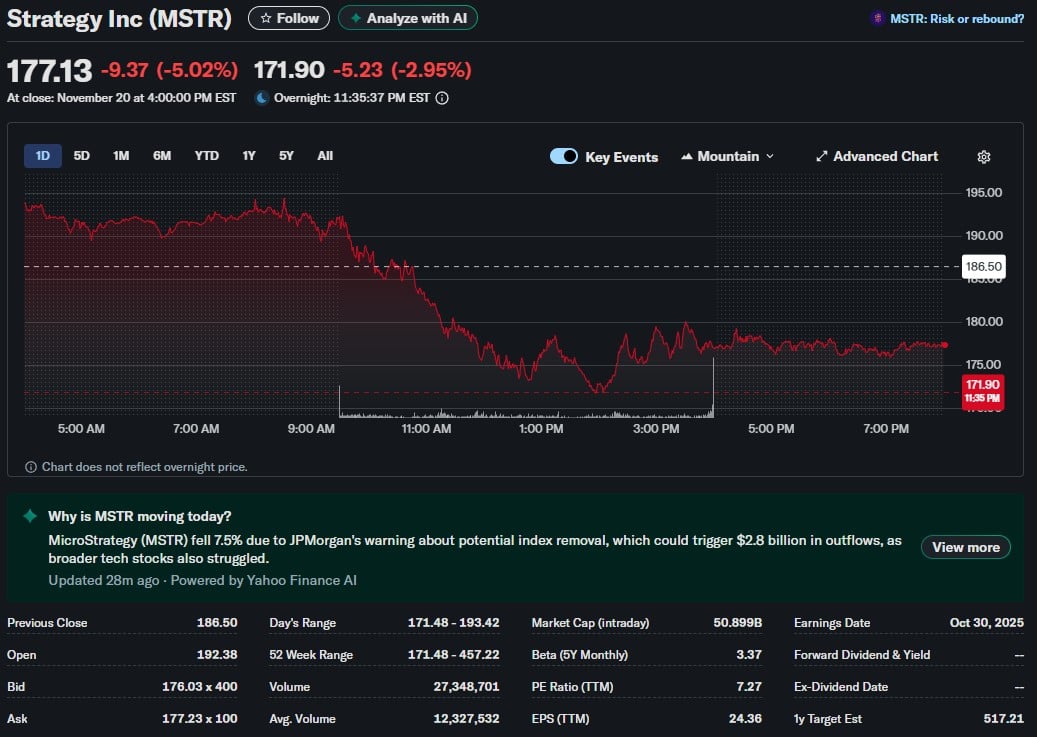

Analysts observing these flows reported that greater than $3 billion in Bitcoin hit exchanges inside simply 45 minutes on November 20, one of the aggressive sell-offs of the cycle. As institutional promoting grows and his cycle mannequin tracks costs intently, the market is adjusting expectations. Bitcoin may keep effectively above the following predicted ranges, preserving consideration on the trail from $125,000 right down to his $60,000 goal.

Featured picture created with Dall.E, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.