Ethereum is barely holding above the crucial $3,000 degree because the broader crypto market battles intense promoting strain. Concern stays elevated, liquidity is thinning, and buyers are bracing for extra volatility. But regardless of the drawdown, some analysts argue that this atmosphere is starting to appear like a traditional oversold setup, one which has traditionally provided sturdy accumulation alternatives for long-term gamers.

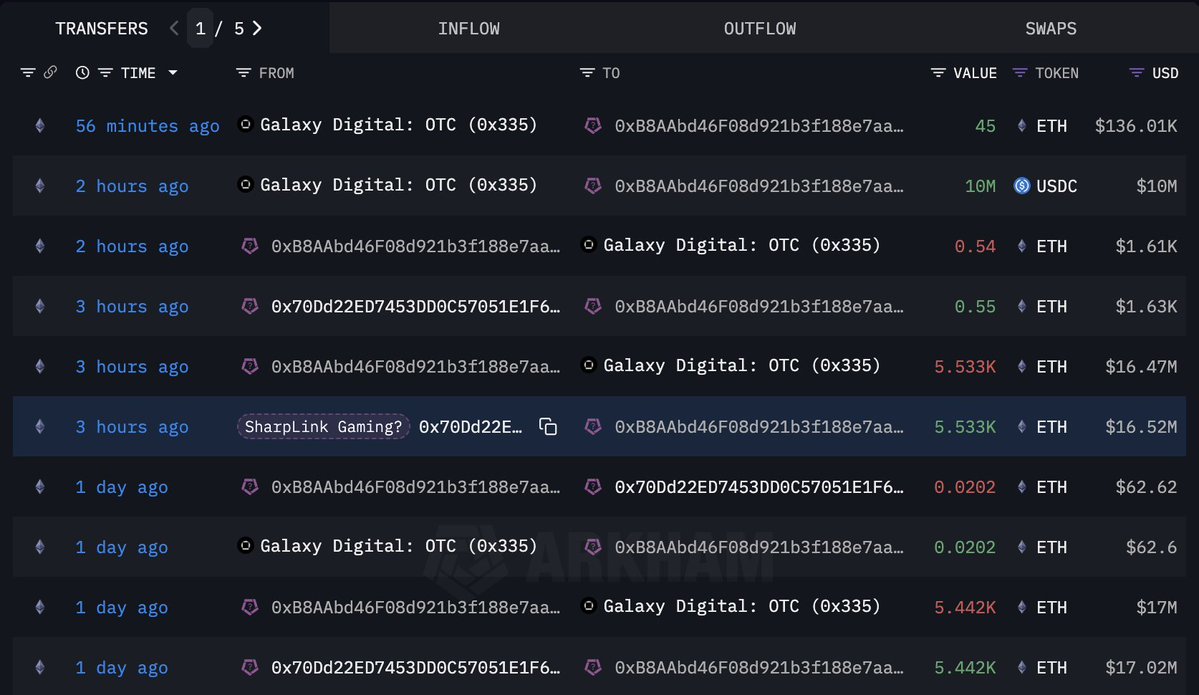

Including to the intrigue, new knowledge from Lookonchain reveals uncommon on-chain exercise involving a pockets doubtlessly linked to SharpLink Gaming. The transfer has sparked intense hypothesis throughout the market, as massive OTC transactions usually sign strategic repositioning by institutional gamers moderately than panic promoting.

This exercise stands out at a second when Ethereum is testing main help ranges and sentiment is overwhelmingly bearish. The truth that important OTC flows are nonetheless occurring means that good cash is energetic beneath the floor—at the same time as retail panic dominates public markets.

SharpLink-Linked Pockets Sparks Promote-Off Hypothesis

In keeping with new knowledge from Lookonchain, a pockets doubtlessly linked to SharpLink Gaming (deal with 0x70Dd) has executed a collection of enormous transactions which can be drawing consideration throughout the Ethereum market. Over the previous two days, the pockets transferred 10,975 ETH, value roughly $33.5 million, to a Galaxy Digital OTC pockets. Shortly after, it obtained 10 million USDC again from the identical OTC deal with, elevating questions in regards to the nature of the transfer.

Lookonchain brazenly asks the query circulating amongst analysts: Is SharpLink Gaming promoting ETH? Whereas the transactions resemble a structured OTC sale—the place massive holders offload property with out impacting public order books—there’s nonetheless no affirmation that the funds belong on to the corporate. Nonetheless, the timing of the switch is notable. Ethereum is buying and selling close to an important help zone round $3,000, and liquidity throughout the market is tightening as panic-driven promoting accelerates.

Giant OTC flows like this usually sign strategic repositioning moderately than emotional promoting, but they will nonetheless form market sentiment. If this was certainly a sale, it provides to the narrative of establishments lowering publicity throughout the correction. If it was merely a treasury reshuffle, the impression could also be far much less bearish than it seems. For now, the market is watching intently.

Testing the $3,000 Help as Momentum Weakens

Ethereum is hovering simply above the crucial $3,000 help zone, a degree that has grow to be the battleground between consumers attempting to defend the pattern and sellers urgent for deeper draw back. The day by day chart exhibits a transparent and protracted downtrend that started after ETH did not reclaim the $4,000 area in late October. Since then, decrease highs and decrease lows have outlined value motion, with ETH unable to interrupt above the 50-day transferring common — an indication of weakening momentum.

The 100-day and 200-day transferring averages are additionally trending downward, reinforcing bearish market construction. Worth is presently sitting beneath all main transferring averages, usually a precursor to prolonged corrective phases in previous cycles. Nonetheless, the $3,000–$2,950 vary has acted as a powerful demand zone a number of occasions all year long, and consumers are as soon as once more trying to defend it.

The candles present lengthy decrease wicks forming round this degree, suggesting that some dip consumers are stepping in, although conviction stays restricted. If ETH loses $3,000 decisively, the following notable help sits round $2,750–$2,800. On the flip facet, reclaiming the 50-day MA close to $3,400 can be the primary signal of a possible momentum shift after weeks of promoting.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.