A brand new projection from an XRP analyst is drawing contemporary consideration to how rapidly spot ETFs might gobble up obtainable tokens if heavy inflows persist.

Associated Studying

The numbers within the mannequin are easy and enormous, they usually pressure a simple query: what occurs if regular ETF shopping for meets a restricted public provide?

ETF Flows May Outrun Provide

In accordance with analyst Chad Steingraber, one XRP ETF may common $90 million in day by day inflows. Multiplying that by 12 ETFs and the result’s $1.08 billion every day.

Based mostly on his assumptions, if half of these flows create contemporary demand for XRP, issuers would want to purchase about $504 million value — roughly 229 million XRP — in a single day.

One Day Billion ETF Movement Situation (assume present worth)

Single Fund Day Avg – $90Millionx12 Funds Avg – $1.08Billion Day50% Avg Web Share Creation – $504MillionRequired Acquisition – 229,090,909 XRP —> 1 Day

For enjoyable — what if one week:x5 Days – 1,145,454,545 XRP

What if… https://t.co/wpdDD1q7bn

— Chad Steingraber (@ChadSteingraber) November 19, 2025

Stretch that tempo for per week and the full climbs to 1.14 billion XRP. A month pushes it to 4.58 billion XRP. After six months, the mannequin reaches 27.49 billion XRP, which is sort of half of the roughly 60 billion XRP at present in circulation.

In accordance with the projection, a full 12 months at these ranges might theoretically take in the complete public provide except costs transfer increased and gradual purchases.

Early Fund Flows Present Demand However Not A Shock

Experiences present Canary Capital’s XRPC ETF opened with $245 million in day-one inflows, adopted by $25.41 million and $8.32 million on the following two days, bringing the fund to $277 million in belongings.

Franklin Templeton’s EZRP is scheduled to launch on November 24 and market estimates put first-day demand between $150–$250 million. 5 different issuers — Bitwise, Grayscale, 21Shares, Valkyrie, and CoinShares — are ready in line.

Neighborhood math that assumes seven ETFs has produced a $7.2 billion annual influx determine. That’s some huge cash. However, up to now, the market response has been muted quite than explosive.

Associated Studying

In accordance with analysts, fund purchases don’t hit public exchanges immediately. Trades choose a sure cycle, and plenty of issuers purchase XRP over-the-counter.

Consequently, giant quantities may very well be collected quietly earlier than they present up in trade order books or strain the spot worth.

$XRP

Misplaced the earlier breakout degree.

Seems headed again to $1.50 space. pic.twitter.com/8VskyzrPXk

— Nebraskangooner (@Nebraskangooner) November 17, 2025

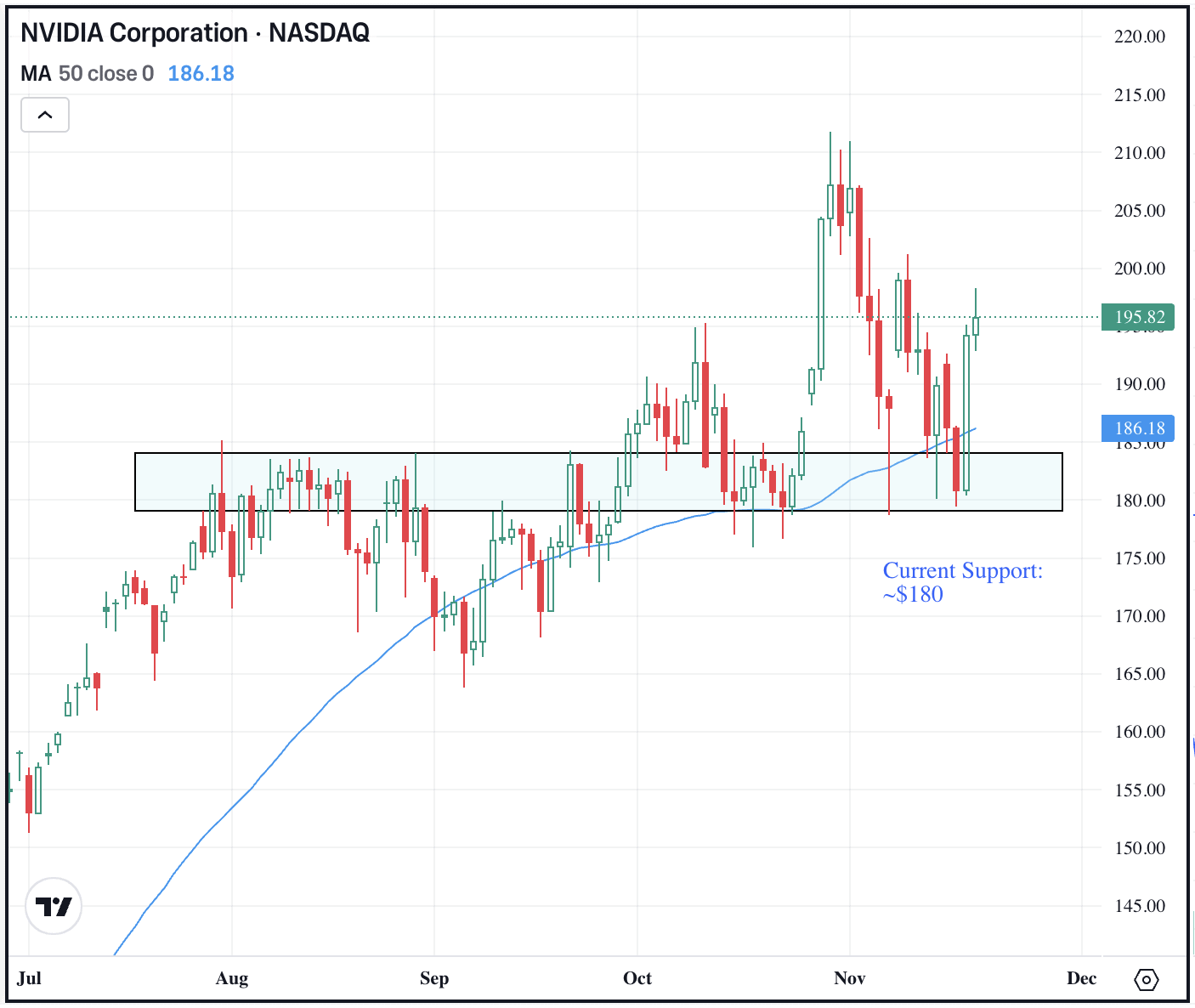

Worth Dynamics And Technical Dangers

XRP’s worth has not marched upward in lockstep with ETF headlines. The token has hovered close to $2.14 and slipped greater than 14% since final week.

Technical voices out there are warning about draw back. Analyst Nebraskangooner factors to a failed breakout from a descending triangle and units a goal close to $1.50 — roughly a 30% drop from a current $2.15 buying and selling degree.

The chart argument traces a rally to a yearly excessive of $3.66 in July, a late-October try to interrupt increased, and a subsequent break beneath help round $2.2.

Featured picture from Gemini, chart from TradingView