Caroline Bishop

Nov 20, 2025 07:04

Bitcoin Money trades at $497.60 with minimal 24-hour motion as technical indicators recommend consolidation close to crucial assist ranges amid sideways crypto market motion.

Fast Take

• BCH buying and selling at $497.60 (up 0.02% in 24h)

• No vital catalysts driving value motion in previous 48 hours

• Testing assist close to $493.83 pivot level with impartial RSI

• Following broader crypto market’s sideways development

Market Occasions Driving Bitcoin Money Worth Motion

Buying and selling on technical components in absence of main catalysts, Bitcoin Money has maintained a comparatively slender vary over the previous 24 hours. No vital information occasions have emerged up to now 48 hours to drive directional strikes within the BCH value, leaving technical evaluation as the first driver for near-term value motion.

The shortage of main developments has resulted in Bitcoin Money consolidating inside a well-known buying and selling vary, with the 24-hour vary spanning from $470.90 to $513.00. This sideways motion displays the broader cryptocurrency market’s present state, the place many property are awaiting contemporary catalysts to interrupt out of established patterns.

Quantity on Binance spot market reached $30.18 million over the previous 24 hours, indicating average however not distinctive buying and selling curiosity. This quantity stage suggests merchants are sustaining positions reasonably than initiating vital new strikes, according to the minimal value motion noticed.

Bitcoin Money Technical Evaluation: Impartial Consolidation Section

Worth Motion Context

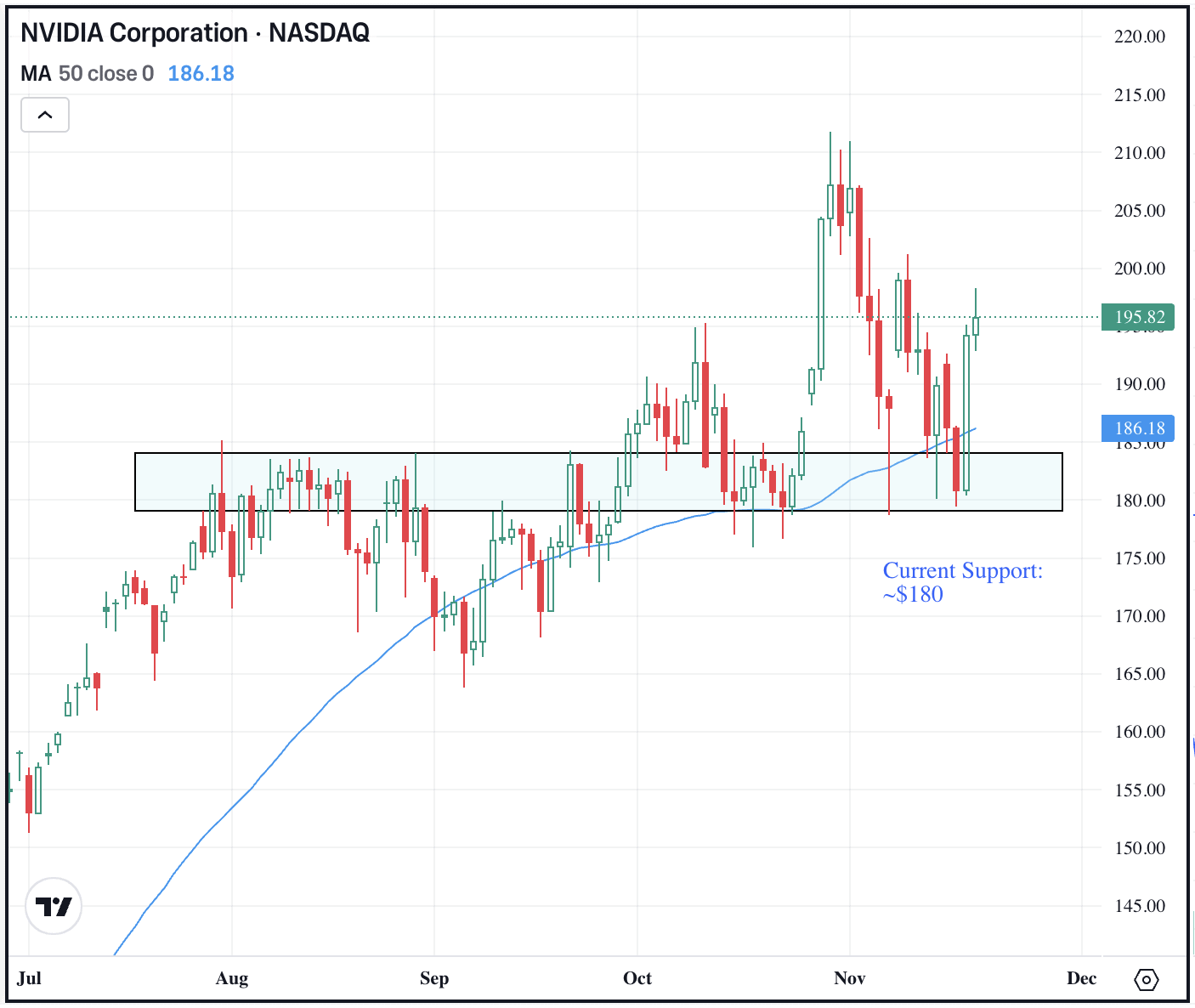

BCH value at the moment sits beneath its key shifting averages, with the 20-day SMA at $502.69 appearing as rapid resistance. The present value of $497.60 locations Bitcoin Money barely above the 7-day SMA of $494.79 however beneath longer-term averages together with the 50-day SMA at $521.70.

The positioning relative to shifting averages suggests a short-term consolidation section, with Bitcoin Money neither strongly bullish nor bearish. The proximity to the pivot level at $493.83 signifies the market is testing crucial choice ranges that would decide the following directional transfer.

Key Technical Indicators

The RSI at 47.79 sits firmly in impartial territory, indicating neither oversold nor overbought situations. This studying suggests balanced shopping for and promoting strain, supporting the consolidation narrative evident in current value motion.

The MACD histogram exhibits a optimistic studying at 0.6143, indicating potential bullish momentum regardless of the general MACD remaining unfavourable at -7.0854. This divergence suggests underlying momentum could also be constructing, although affirmation by means of value motion stays obligatory.

Bitcoin Money’s place throughout the Bollinger Bands at 0.4346 locations it within the decrease half of the band vary, indicating the present value sits beneath the center band however properly above the decrease boundary at $463.72.

Essential Worth Ranges for Bitcoin Money Merchants

Rapid Ranges (24-48 hours)

• Resistance: $502.69 (20-day SMA confluence)

• Help: $493.83 (established pivot level)

Breakout/Breakdown Eventualities

A break beneath the $493.83 pivot may goal the rapid assist zone at $460.30, representing roughly 7% draw back danger. Such a transfer would seemingly coincide with broader crypto market weak point and will speed up if quantity will increase.

Conversely, a sustained break above the $502.69 resistance stage may open the trail towards $563.00, the place stronger resistance awaits. This situation would require elevated shopping for quantity and certain optimistic momentum from Bitcoin or broader market catalysts.

BCH Correlation Evaluation

Bitcoin Money continues following Bitcoin’s common course, although with diminished volatility in comparison with the flagship cryptocurrency. With Bitcoin displaying optimistic momentum as we speak, BCH’s minimal motion suggests it is lagging reasonably than main the present market cycle.

Conventional market correlations stay muted within the absence of great macro occasions. The sideways motion in main indices has translated to equally subdued exercise throughout cryptocurrency markets, together with Bitcoin Money.

Buying and selling Outlook: Bitcoin Money Close to-Time period Prospects

Bullish Case

A sustained transfer above $502.69 resistance with growing quantity may sign the beginning of a broader restoration towards the $563.00 stage. This situation would require Bitcoin Money technical evaluation to indicate bettering momentum indicators and broader crypto market energy.

The optimistic MACD histogram studying suggests underlying momentum may assist such a transfer if exterior catalysts emerge to drive elevated shopping for curiosity.

Bearish Case

Failure to carry the $493.83 pivot level may result in a check of stronger assist at $460.30. Given the present weak bullish development classification, any unfavourable momentum may speed up promoting strain towards the $443.20 sturdy assist stage.

Danger Administration

Merchants ought to contemplate stop-losses beneath $485 for lengthy positions, representing roughly 2.5% draw back from present ranges. The every day ATR of $36.92 suggests place sizing ought to account for potential volatility growth because the market resolves its present consolidation section.

Picture supply: Shutterstock