The impermanent loss in crypto is the non permanent discount within the worth of your belongings while you deposit them right into a liquidity pool, in comparison with when you simply held those self same belongings in your personal pockets. Therefore, it straight impacts liquidity suppliers (LPs) by lowering their potential returns, and even research have proven that for over half of LPs in some main swimming pools, the loss is definitely larger than the buying and selling charges they earn. To compensate liquidity suppliers, many DeFi protocols even distribute extra token rewards or buying and selling charges.

To attenuate impermanent losses in DeFi, it is advisable to use methods like selecting stablecoin swimming pools (ETH/WBTC), utilizing correlated asset pairs, or choosing uneven liquidity swimming pools. This information will cowl what impermanent loss is, how liquidity swimming pools work with value divergence and token ratios, and the precise formulation and calculators you should use to calculate it.

What’s Crypto Impermanent Loss?

Impermanent loss is principally a danger you tackle while you determine to supply liquidity to a decentralized trade’s liquidity pool. You see, while you deposit your crypto tokens right into a pool, you’re primarily changing into a liquidity supplier (LP) there. Now, you understand, that is how DeFi works, permitting individuals to commerce tokens without having any of the standard middlemen, like a financial institution or a centralized trade.

So, what’s impermanent loss? Nicely, the core of impermanent loss is solely the distinction in worth between the 2 eventualities: offering liquidity versus holding the belongings your self. It’s known as “impermanent” as a result of, theoretically, if the token costs finally return to the place they have been while you first deposited, the loss goes away. However, you understand, crypto costs could be fairly unstable, in order that’s not all the time a assure.

Usually, this loss solely turns into everlasting when you determine to withdraw your tokens out of the pool earlier than the costs right themselves. Additionally, most of the research have proven that for some swimming pools, particularly on these in style platforms like Uniswap V3, over 50% of LPs have truly been unprofitable as a result of their impermanent losses have been greater than the buying and selling charges they earned.

How Does Crypto Impermanent Loss Work?

Impermanent loss primarily occurs due to how automated market makers, or AMMs, are designed to maintain the pool balanced. Mainly, each liquidity pool change is dependent upon sustaining a continuing and equal worth of the 2 belongings it holds.

Immediately, the commonest form of pool, utilized by platforms like Uniswap V2, makes use of a simple arithmetic formulation to handle this steadiness…

X * Y = Ok

Right here, this formulation means the amount of Token A (X) multiplied by the amount of Token B (y) should all the time equal a continuing worth (Ok).

And, it is best to know, that fixed worth, Ok, is why the pool robotically adjusts. So, when an precise commerce occurs, it modifications the ratio of the 2 tokens within the pool. As an example, if somebody buys a number of Token A, the provision of Token A within the pool goes down, and the provision of Token B will go up.

Now, to maintain the product (Ok) the identical, the value of Token A contained in the pool has to go up, and the value of Token B goes down.

Therefore, right here come the arbitrage merchants. Really, they’re those who principally make impermanent loss happen. They’re always watching the costs of tokens contained in the pool in comparison with the exterior market value on exchanges like Coinbase or Binance.

So, if the value of Token A goes up on an out of doors trade, it turns into cheaper inside your liquidity pool. Right here, arbitrage merchants will then purchase the cheaper Token A out of your pool, bringing in additional of Token B, till the value ratio within the pool matches the surface market once more.

You, the LP, find yourself with extra of the token that hasn’t modified as a lot in worth and fewer of the token that simply grew to become extra beneficial. Therefore, this automated rebalancing goes to trigger the distinction, or the loss, in comparison with when you had simply held each tokens.

Value Divergence and Token Ratio

The quantity of impermanent loss is dependent upon how far aside the token costs transfer. , small swings typically create minor variations solely, however large divergences actually chew.

As a result of the loss grows sooner than the value change, a doubling in value causes an even bigger hit than a 50% improve. Therefore, the impact is symmetrical: a 2x improve or a 50% lower each result in the identical proportion loss.

Instance State of affairs: ETH/USDT Pool

Let’s stroll you thru a easy instance so you possibly can see precisely how impermanent loss works in actual life…

Preliminary State

You deposit: You determine to deposit an equal greenback quantity of ETH and USDT. So, let’s say ETH is priced at $2,000.Your deposit is $4,000 complete: You deposit 1 ETH (price $2,000) and a couple of,000 USDT (price $2,000).HODL Worth: Now, you understand, when you simply held your tokens, your worth can be $4,000 (however that by no means occurs due to market volatility)

State of affairs After Value Change

Let’s say the value of ETH doubles on exterior exchanges, going from $2,000 to $4,000. However the value of USDT stays at $1.00.Now, arbitrage merchants discover that ETH remains to be cheaper in your pool. So, they begin shopping for ETH out of your pool, depositing extra USDT, till the brand new value of ETH within the pool is near $4,000.

Remaining Pool Place vs. HODL Worth

If you happen to HODLed the unique 1 ETH and a couple of,000 USDT, your holdings would truly be price $6,000 (1 ETH price $4,000 + 2,000 USDT)However within the Liquidity Pool, your share would have robotically rebalanced. Therefore, you’d find yourself with much less ETH (about 0.707 ETH) and extra USDT (about 2,828 USDT).Your Pool Worth: Your new holdings within the pool can be price: ($4,000 * 0.707) + ($2828) = $5,656.

The Impermanent Loss

The distinction between HODL ($6,000) and Pool Worth ($5,656) is $344.Now, $344 divided by $6,000 is roughly 5.7%.

Nicely, that 5.7% distinction is your impermanent loss. By the way in which, this loss proportion holds true just for any 2x value change, up or down, in a normal 50/50 pool. There could also be completely different eventualities as properly.

Impermanent Loss Estimation in Crypto Liquidity Swimming pools

Estimating impermanent loss helps you determine whether or not offering liquidity is price it, and the only strategy is to check the buying and selling charges you anticipate to gather with the potential shortfall. Clearly, assuming a normal 50/50 pool ratio.

Listed here are the approximate loss percentages for various ranges of value divergence:

Value Change (Ratio of New Value / Previous Value)Impermanent Loss (vs. HODL)1.25x (25% change)0.6% loss1.5x (50% change)2.0% loss2x (100% change)5.7% loss3x (200% change)13.4% loss4x (300% change)20.0% loss5x (400% change)25.5% loss

Look, as you possibly can see, a 5x value change means you might be principally dropping over 1 / 4 of the worth you’d have when you had simply held the tokens. Nicely, that’s a reasonably large market-making danger to tackle, so that you wish to make sure you might be being compensated sufficient by the buying and selling charges.

Easy methods to Calculate Impermanent Loss?

The best strategy to calculate impermanent loss is to check your remaining token worth to your unique HODL worth, as we did within the instance, however there’s additionally a standardized formulation.

Impermanent Loss Formulation

The official formulation utilized by many protocols, assuming the pool is a normal 50/50 cut up, is predicated solely on the value ratio change. Mainly, the magnitude of the value distinction is all you want.

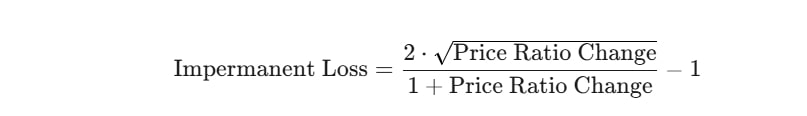

So, the way to calculate impermanent loss? Nicely, the impermanent loss formulation is:

Alright, let’s plug within the numbers from our ETH instance the place the value doubled…

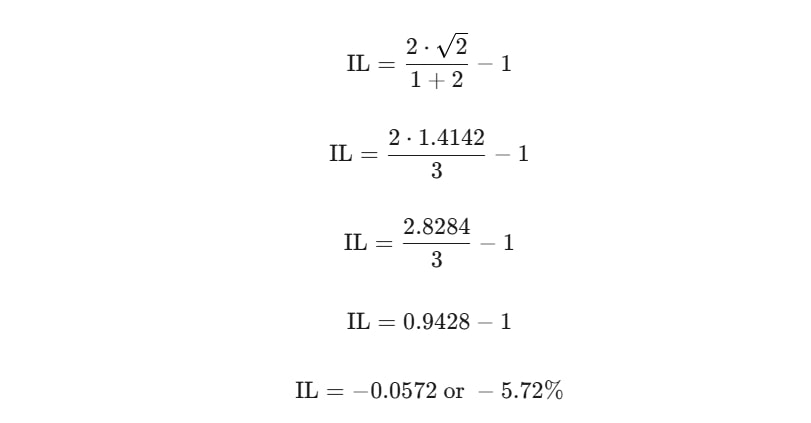

Utilizing Impermanent Loss Calculators

Essentially the most easy approach for an on a regular basis consumer is to skip the guide math and use one of many many on-line impermanent loss calculators. The most effective impermanent loss calculators are: Coingecko calculator and dailydefi.org.

Primarily, these calculators will typically provide the breakdown of your remaining token quantities within the pool versus the unique token quantities. However a fast warning additionally, many easy calculators solely present the impermanent loss itself, not your complete revenue or loss. So, you should embody the buying and selling charges you earned whereas your funds have been within the pool.

Right here is the instance from the CoinGecko calculator:

Easy methods to Reduce Impermanent Loss?

You can’t keep away from impermanent loss in most liquidity swimming pools, however you possibly can positively select methods that decrease your publicity to it.

Choose Stablecoin Swimming pools: That is the most effective strategy, as when you present liquidity for a pair of stablecoins, reminiscent of USDC/DAI or USDT/USDC, the value divergence will probably be fairly minimal since each tokens are pegged to the identical greenback worth. On this case, impermanent loss is nearly non-existent. Nonetheless, your price rewards would normally be decrease as a result of the buying and selling charges are all the time decrease for these pairs.Use Correlated Asset Pairs: You’ll be able to neatly decide tokens that transfer in correlation, for instance, ETH/WBTC, which will even cut back the danger as a result of their costs normally observe comparable market tendencies. Therefore, the ratio between them doesn’t change as drastically as it will with an altcoin paired with a stablecoin.Uneven Liquidity Swimming pools: On among the platforms, swimming pools could be created that aren’t a standard 50/50 cut up. They could be 80/20 or 60/40. Normally, you possibly can hedge the pool to a much less unstable asset. Subsequently, in an 80% stablecoin / 20% unstable token pool, you might be much less uncovered to the value swings of the token.Focus Your Liquidity: A few of the newer fashions for an AMM, reminiscent of concentrated liquidity in Uniswap V3, allow you to present liquidity solely inside a sure value vary. So, if the token value stays inside the vary you set, you’re making a lot extra in charges whereas taking up much less impermanent loss.

Conclusion

In a nutshell, impermanent loss is the hole between what your liquidity place is price and what you’d have when you merely held the cash. Primarily, it comes from AMMs rebalancing the ratio of tokens as costs transfer, and leaves you with extra of the asset that falls in worth and fewer of the one which rises.

Additionally, by understanding how value divergence, charges, and time horizons work together, you possibly can simply verify whether or not offering liquidity matches or it’s simply too dangerous. Therefore, when you do a little bit of your analysis and use the methods we’ve talked about right here, you possibly can positively handle the danger and probably make your liquidity offering worthwhile.

_id_8d2ebcba-c5e1-4a13-ac2f-ccb364526946_size900.jpg)