Bitcoin has loved consideration as some of the rewarding shops of worth lately, with institutional adoption reaching new highs this 12 months. One such landmark Bitcoin acquisition was made by Harvard College, arguably the world’s most prestigious educational establishment.

Earlier in August, Harvard disclosed an funding portfolio containing $117 million price of shares in BlackRock’s spot Bitcoin exchange-traded fund (ETF) as of the tip of Q2. In keeping with its newest disclosure, the college’s BTC publicity practically tripled during the last quarter.

BlackRock’s IBIT Turns into Harvard’s Largest Funding

In its newest 13F submitting, Harvard College revealed that it held 6,813,612 shares of BlackRock’s iShares Bitcoin Belief (IBIT) valued at roughly $443 million as of September 30.

This extra acquisition highlights the establishment’s expansive capital allocation technique, which additionally noticed its SPDR Gold Belief (GLD) holdings develop to 661,391 shares (price roughly $235 million) in 2025 Q3.

Notably, Harvard’s present holding of the main spot BTC ETF represents a 257% enhance from the disclosed 1,906,000 shares declared as of June. As of now, BlackRock’s exchange-traded fund is the one largest funding of the college’s reported holdings.

Whereas the present IBIT place makes solely a small portion of Harvard’s endowment of $57 billion, it’s important sufficient to make the college the Sixteenth-largest IBIT holder. As inferred earlier, tales of institutional adoption akin to this additional add credence to Bitcoin’s standing as a strategic reserve asset and the rising demand for exchange-traded funds.

Bloomberg ETF analyst Eric Balchunas wrote on X:

It’s tremendous uncommon/troublesome to get an endowment to chunk on an ETF- esp a Harvard or Yale, it’s nearly as good a validation as an ETF can get. That mentioned, half a billion is a mere 1% of complete endowment. Large enough to rank Sixteenth amongst IBIT holders tho.

BlackRock Bitcoin ETF Information Its Largest Outflow Day

The US-based Bitcoin ETFs have suffered waning investor demand in latest weeks, with the previous week notably disappointing. In keeping with the most recent market information, the exchange-traded funds registered a complete internet outflow of $1.1 billion previously week.

Main these withdrawals was BlackRock’s iShares Bitcoin Belief, which is at present on a three-day outflow streak. Knowledge from SoSoValue reveals that $463.1 million flowed out of the BTC ETF on Friday, November 14.

As of this writing, BlackRock’s IBIT nonetheless ranks as the most important spot Bitcoin ETF, with internet belongings price roughly $74.98 billion.

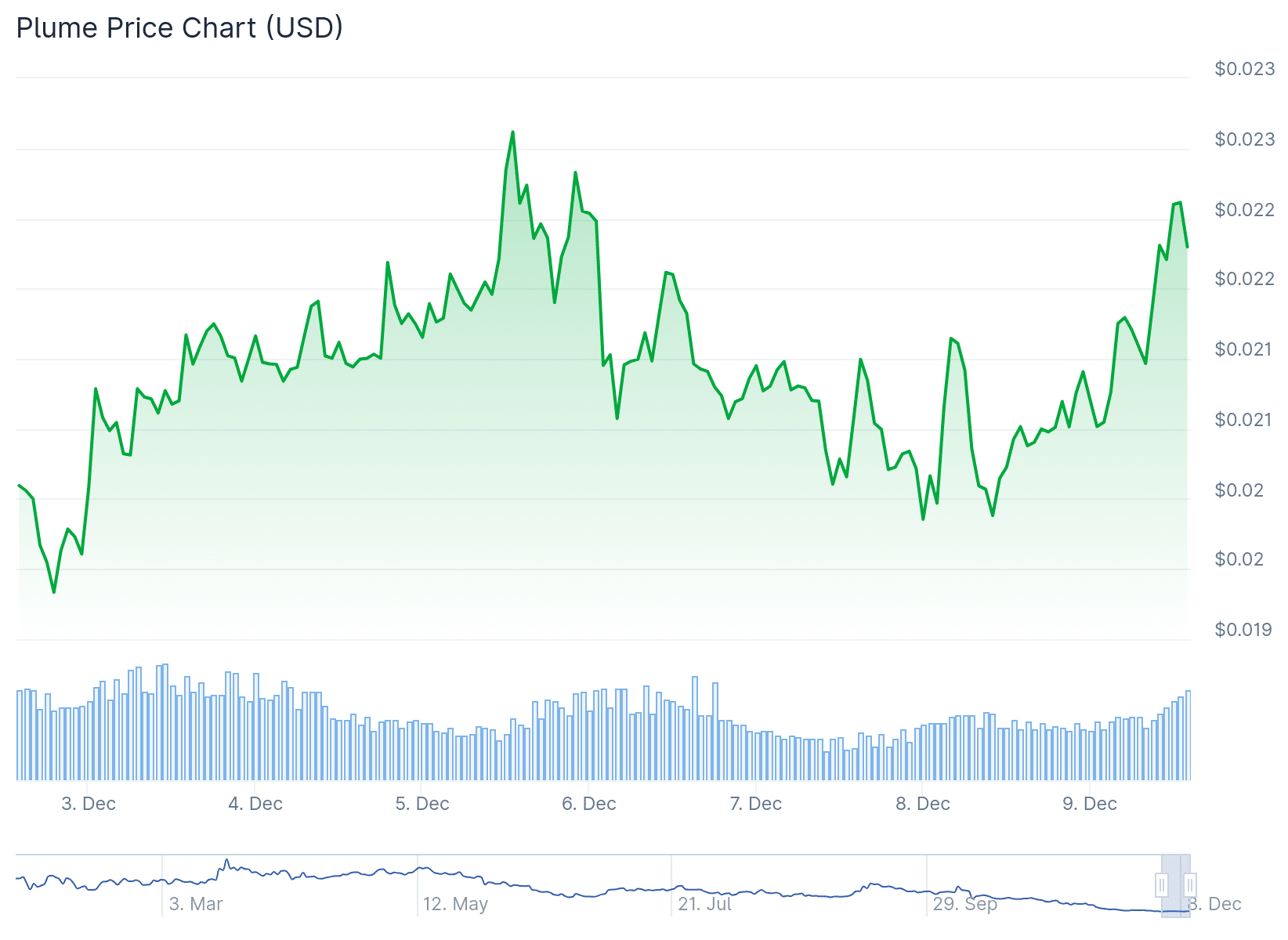

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from Rick Friedman/AFP through Getty Photos, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.