In line with remarks made at Yahoo Finance’s Make investments occasion, Eric Trump advised attendees he expects a significant shift in how cash flows between conventional shops of worth and newer digital property.

Associated Studying

He mentioned Bitcoin’s fastened provide of 21 million cash and rising institutional shopping for are key drivers. In a separate interview with Fox Enterprise in late September, he forecasted a long-term value goal of $1 million per Bitcoin, a prediction that underscores how bullish his view is.

Bitcoin Seen As A Quicker Mover Of Worth

Eric argued that Bitcoin – which he known as the “best asset” ever – strikes worth sooner and cheaper throughout borders than metallic that should be hauled and locked away.

He known as Bitcoin “digital gold,” and pushed the concept its code-based provide offers it a bonus over bodily bullion.

Based mostly on stories, he additionally framed crypto as a hedge in opposition to inflation, corruption, and weak financial coverage — causes he mentioned clarify rising adoption across the globe.

JUST IN: 🇺🇸 Eric Trump says a gold-to-Bitcoin rotation is imminent

“The ratio will disproportionately shift to Bitcoin.”

“It’s been the only best asset we’ve ever seen.” pic.twitter.com/4TYY1qALlm

— Bitcoin Archive (@BitcoinArchive) November 14, 2025

American Bitcoin’s Fast Rise

Eric and his brother Donald Trump Jr. co-founded American Bitcoin (ABTC), which went public in September and now carries a market valuation approaching $4 billion.

The agency has expanded rapidly after merging with Gryphon Digital Mining. In line with Bitcoin Treasuries, ABTC is the Twenty fifth-largest public firm holder of Bitcoin within the US.

Firm officers say their West Texas mines profit from low vitality prices, permitting them to provide Bitcoin at roughly half of the present spot value.

Supply: Bitcoin Treasuries

Firm Progress And Dangers

Progress has been quick, however analysts and critics warn of clear dangers. Mining companies acquire when costs rise, and so they can undergo when costs fall. Some fear {that a} mixed ABTC-Gryphon enterprise faces bigger swings in earnings and asset values as a result of crypto markets stay unstable.

There are additionally considerations about mixing political ties with finance; World Liberty Monetary, a Trump family-affiliated undertaking, manages a WLFI governance token and a USD1 stablecoin, and a few observers have flagged transparency questions.

A Lengthy Document Versus A Younger Community

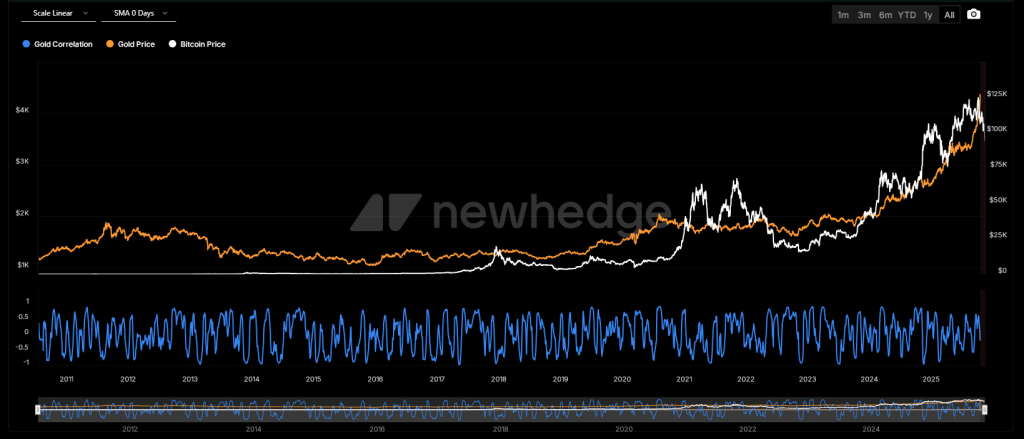

Gold has centuries of use as a retailer of worth and broad international acceptance. Bitcoin has existed since 2009 and reveals fast value strikes that may create massive winners and large losers.

Historic knowledge factors to sharp shifts: through the 2017 rally, the Bitcoin-to-gold ratio hit file highs earlier than it fell again when costs corrected. That historical past is commonly used to remind traders that beneficial properties could be adopted by steep pullbacks.

The correlation between the 2 has shifted over time, with every asset responding to completely different market pressures.

Bitcoin and gold correlation. Supply: Newhedge.

What Analysts And Critics Warn

Battle of curiosity is one widespread critique: executives who publicly reward Bitcoin also can profit straight when their firms maintain or mine extra cash.

Forecasts that put a single Bitcoin at $1 million are seen by many as speculative slightly than sure. Regulatory adjustments, tax guidelines, and coverage strikes within the US or overseas may change market circumstances rapidly, and people potentialities are harassed by cautious commentators.

Associated Studying

Eric Trump’s stance is obvious: he believes capital will shift from gold to Bitcoin over time. Markets will determine if that prediction proves true. For now, each property stay a part of the dialog, every with completely different dangers, prices, and histories that traders should weigh.

Featured picture from Alamy, chart from TradingView