Bitcoin’s newest downturn has brought on appreciable hypothesis about whether or not Technique’s (previously generally known as MicroStrategy) huge holdings are enjoying a job out there’s weak spot. The considerations escalated sharply when wallet-monitoring platforms flagged massive Bitcoin transfers linked to the corporate, sparking widespread claims {that a} main sell-off had begun.

The dialog gained much more traction when a broadly circulated report alleged that Technique had slashed its Bitcoin holdings by tens of hundreds of tokens. Michael Saylor moved rapidly to deal with the rumor, however the back-and-forth between on-chain interpretations and official statements raises questions of what’s actually taking place behind the scenes.

Associated Studying

How Pockets Actions Turned Into Full-Blown Promote-Off Rumors

The controversy began when Walter Bloomberg shared a submit citing Arkham Intelligence and claiming Technique had decreased its Bitcoin stash from 484,000 BTC to roughly 437,000 BTC.

The alleged drop of about 47,000 BTC instantly led to questions as as to whether the corporate had quietly begun liquidating. Saylor responded instantly beneath the submit, stating, “There isn’t any reality to this rumor,” dismissing the declare outright.

There isn’t any reality to this rumor.

— Michael Saylor (@saylor) November 14, 2025

Because the state of affairs unfold throughout social platforms, Arkham Intelligence later clarified what really occurred. In a submit on X, the agency defined that Technique had moved 43,415 BTC since midnight UTC, value over $4.2 billion, but in addition famous that the exercise consisted of routine custodian rotations.

Based on Arkham, the transfers have been resulting from motion from Coinbase Custody to a brand new custodian, together with inner rebalancing and pockets refresh processes. Not one of the actions indicated gross sales and that Technique steadily performs these custodial transitions. Anybody monitoring these pockets clusters over the previous two weeks would have seen related flows, ultimately adopted by relabeling as soon as new addresses have been established.

Saylor’s Public Reassurance And Continued Bitcoin Accumulation

In response to the swirling hypothesis, Saylor took a definitive stance to calm markets. Whereas talking at an interview on CNBC, Saylor addressed the controversy, stating that Technique had not offered any Bitcoin and had no plans to take action.

His remarks left no ambiguity as he stated, “We’re shopping for; we’ll report our subsequent buys on Monday morning.”

He went additional to explain the corporate’s monetary place and long-term confidence, noting that the agency has put in a really sturdy base round right here with its Bitcoin holdings. Saylor additionally highlighted that Technique’s debt construction doesn’t impose instant obligations, saying the debt continues to be “4.5 years out.” This implies there may be at present no monetary strain that might require liquidation of Bitcoin.

Associated Studying

Shortly after the interview, he strengthened his message on X, stating plainly, “We purchased bitcoin day by day this week,” which instantly contradicts any claims of ongoing promote strain from Technique.

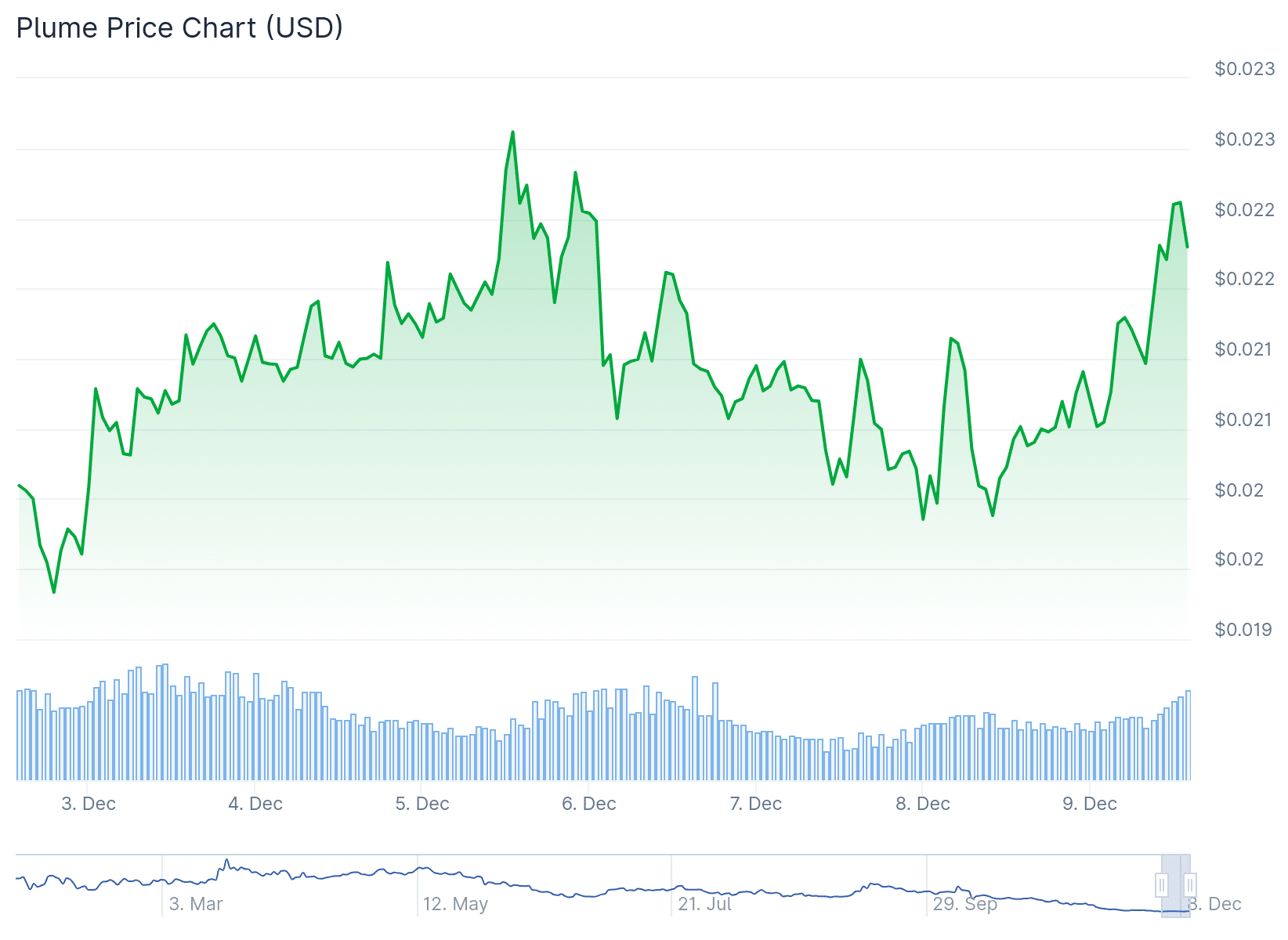

By way of value motion, Bitcoin has spent most of this week on a downtrend, which now places its value buying and selling beneath $100,000. On the time of writing, Bitcoin is buying and selling at $96,084.

Featured picture from Unsplash, chart from TradingView