The Bitcoin market has been in a state of uncertainty over the previous few weeks, following its uncharacteristically destructive efficiency in October. Whereas the overall market sentiment means that the top of the bull cycle is likely to be close to, the most recent on-chain information signifies that the premier cryptocurrency would possibly merely be present process a reset. In keeping with a blockchain agency’s report, the latest sluggishness appears to be setting the stage for the coin’s subsequent main transfer.

BTC Not In A Cycle Exhaustion Section: XWIN

Within the newest Quicktake submit on the CryptoQuant platform, XWIN Analysis Japan revealed that the present state of affairs of Bitcoin appears much less like the top of a cycle and extra like a restructuring part. The DeFi agency believes that the market foundations are being reset after the clearing out of extra leverage in latest weeks.

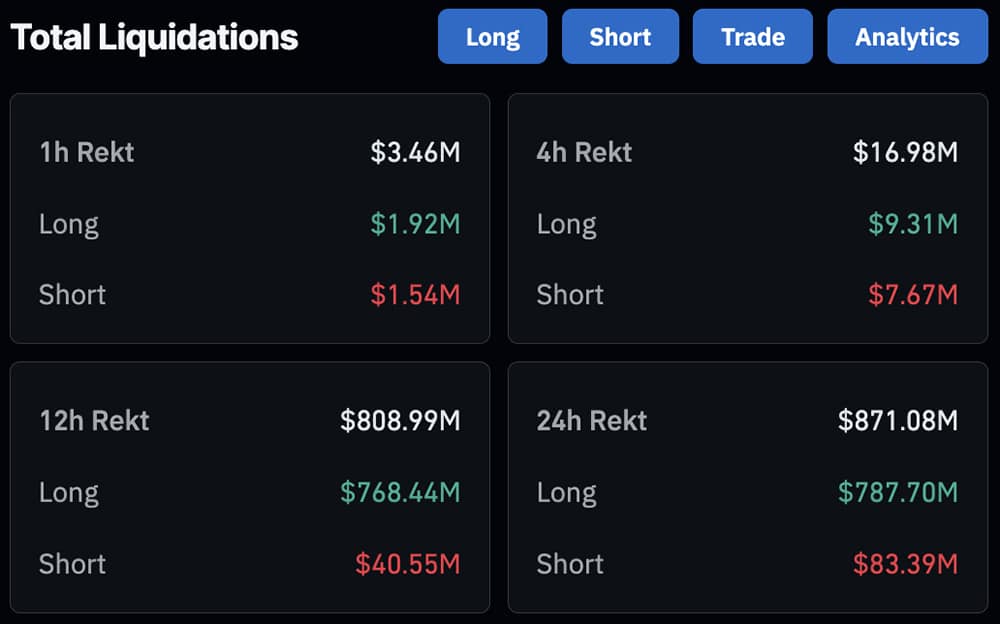

Supporting the declare of decreased leverage, XWIN Analysis highlighted that open curiosity within the Bitcoin future market has decreased considerably since late October. This decline in open curiosity alerts the exit of short-term merchants from their leveraged positions.

The blockchain agency famous that, in previous cycle peaks, leveraged trades typically elevated even at excessive worth ranges. Nevertheless, this euphoric buildup of market positions shouldn’t be at present the case for Bitcoin, that means {that a} cycle high is probably going not what’s being witnessed.

Supply: CryptoQuant

Moreover, XWIN Analysis Japan mentioned that the Bitcoin worth is at present missing momentum and never lacking structural help. The blockchain agency pinpointed declining demand from United States institutional buyers—as spotlighted by the destructive Coinbase Premium Index—as one of many elements behind the dearth of momentum.

As of this writing, Bitcoin is valued at round $101,930, reflecting no important motion up to now 24 hours. The flagship cryptocurrency is deep within the pink on the weekly timeframe, although, having suffered an 8% worth decline within the final seven days.

Bitcoin Market Exhibits Each Strengths And Weaknesses

Regardless of the weakened institutional demand for BTC, XWIN Analysis highlighted some constructive indicators that might contribute to the cryptocurrency’s eventual restoration. As an illustration, the DeFi agency revealed that Bitcoin change reserves stay at multi-year lows, that means {that a} restricted provide remains to be out there.

Moreover, stablecoin liquidity is progressively flowing again into the market; because of this buying energy can be returning, and buyers would possibly simply be ready for the precise time. Nevertheless, XWIN Analysis famous that, regardless of the apparent market resilience, the present sentiment suggests a range-bound motion within the brief time period.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.