Analyst Weekly, November 11, 2025

Bitcoin: Much less Noise, Extra Conviction

After six straight days of ETF outflows, Bitcoin simply flipped the script with almost $240M in inflows marking its sharpest rebound in weeks. It’s a signal that Bitcoin’s market construction is maturing.

The outdated four-year growth–halving–bust cycle is fading quick. With over 93% of Bitcoin already mined, halvings now transfer sentiment greater than provide. Institutional gamers like BlackRock, Constancy, and ARK are absorbing cash whereas leveraged merchants exit. It’s a quiet switch of energy: from speculators to allocators.

A New Section for Bitcoin

Roughly 400,000 BTC have shifted from long-term holders to institutional traders in simply the previous month. Every dip is met with accumulation, not panic. Volatility is compressing, now beneath 30%, a stage unseen since pre-ETF days, signaling that Bitcoin is behaving extra like a structural asset than a speculative one. It’s beginning to decouple from gold and the Nasdaq, transferring to its personal rhythm.

If inflows maintain and leverage stays muted, Bitcoin’s evolution from cyclical commerce to long-term allocation could possibly be underway. Recoveries are quicker, drawdowns smaller, conviction stronger.

Crypto: Structural Rotation Underway

Institutional flows proceed to favor Bitcoin’s readability over Ethereum or Solana however that doesn’t make the latter any much less vital. We keep structurally bullish on each: Ethereum and Solana are rising as the 2 primary roads to the tokenized future, powering stablecoins, real-world belongings, and DeFi infrastructure.

Earnings Preview: Week of November 10, 2025

Utilized Supplies (AMAT): Utilized Supplies (AMAT) will ship its fiscal This fall 2025 earnings on Nov. 13 because the semiconductor tools chief contends with US export curbs which have curtailed gross sales to China and a cautious chipmaking capex setting. Traders are targeted on whether or not surging demand for AI server chip instruments can offset softer orders from reminiscence and logic prospects. AMAT had warned of a drop on this quarter’s income as a result of Chinese language chipmakers pausing new tools purchases and if administration’s steerage or feedback on its backlog point out that the business downturn is bottoming, which might drive the inventory’s response.

JD.com (JD): JD.com (JD) is slated to report Q3 2025 earnings on Nov. 13, and its outcomes will present how China’s e-commerce setting is faring amid a lukewarm client and intense competitors. Analysts count on roughly 13% YoY income progress however a pointy drop in revenue as JD’s heavy investments in new companies (like meals supply and prompt retail) have squeezed margins. Traders will look ahead to indicators that JD’s pivot to an “efficiency-first” technique is paying off; if the corporate can translate stable gross sales progress into improved money move and margins, it may mark a turning level from latest cautious sentiment to renewed optimism on the inventory.

Tencent Holdings (TCEHY): Tencent Holdings (TCEHY) is predicted to publish stable Q3 2025 progress, with forecasts for roughly 13–14% larger income and mid-teens earnings positive aspects pushed by a rebound in its gaming and internet marketing companies alongside enhancing margins. Market consideration will heart on whether or not Tencent’s heavy investments in AI and cloud (the corporate budgeted round RMB 100 billion in AI capex this 12 months) are sustaining its momentum, new hit recreation launches and AI-enhanced advert know-how have buoyed outcomes, and the way China’s macro setting or tech rules would possibly mood its outlook, as these elements will affect investor response.

Sea Restricted (SEA): Sea Restricted (SE) will launch Q3 2025 outcomes on Nov. 11, and the market is anticipating robust top-line progress (~40% YoY income surge to almost $6 billion) pushed by its Shopee e-commerce and SeaMoney fintech items. Nonetheless, profitability is beneath the microscope, the corporate’s gross sales and advertising and marketing bills have spiked (~30% YoY final quarter) and a few analysts warning Sea is “more likely to commerce margins for progress” so traders will watch whether or not Sea can present enhancing margins or price self-discipline even because it chases progress, which shall be vital for the inventory’s post-earnings response.

Occidental Petroleum (OXY): Occidental Petroleum is scheduled to publish Q3 2025 outcomes on Nov. 10, and Wall Avenue anticipates declines from a 12 months in the past (round $6.7 billion income, -6% YoY, and ~$0.48 EPS, -50% YoY) as final 12 months’s oil value surge. Key focal factors shall be OXY’s manufacturing volumes and capital returns; the corporate has elevated output within the Permian and aggressively lower debt (decreasing curiosity bills by $410 million) to bolster margins, together with any commentary on commodity value tendencies or shareholder payouts, which may sway the inventory’s response.

Cisco Methods (CSCO): Cisco Methods (CSCO) will announce its earnings after the Nov. 12 shut, with consensus round $14.8 billion in income (+~7% YoY) and $0.98 in EPS. Traders shall be watching if Cisco’s core networking enterprise can maintain strong progress, fueled by a multi-year improve cycle in AI infrastructure and enterprise campus refreshes and whether or not administration’s steerage and order backlog verify surging demand (Cisco almost doubled its AI-related gross sales goal final quarter), as these elements will closely affect the inventory’s post-earnings transfer.

Walt Disney Co. (DIS): Walt Disney (DIS) stories fiscal This fall 2025 outcomes forward of the Nov. 13 open, with consensus projecting about $1.02 in EPS (-10% YoY) on $22.8 billion income (+~1% YoY). Traders shall be eyeing Disney’s streaming subscriber tendencies and theme park momentum versus continued weak point in its conventional TV networks, these metrics, together with any new cost-cutting or strategic updates (akin to plans round ESPN or content material spending), will set the tone for the way the inventory reacts to the earnings.

Valuations Are Stretching However So Is the Market’s Breadth

The highest of the S&P 500 remains to be residing massive. The median price-to-earnings (P/E) a number of of the highest 5 S&P 500 names sits at 30.2x, towering over the broader market’s 23x and the median inventory’s 19x. Traders are nonetheless paying a steep premium for the most important gamers.

What’s fascinating this 12 months, although, is that the common inventory, not the megacaps, has seen the larger valuation bump. The “S&P 493” (the remainder of the index minus the Magnificent Seven) has really skilled extra a number of growth, which means traders are actually prepared to pay extra for every greenback of earnings even outdoors Massive Tech.

That’s helped carry the general market a number of, but it surely’s additionally flashing a light warning signal. At 19x, the median inventory’s valuation is now simply two turns beneath its 2021 peak of 21.3x, which marked the final main market high. Fundamentals stay robust, however valuation tailwinds are getting drained. Costs can’t preserve rising simply because traders really feel good, ultimately, earnings need to do the heavy lifting.

Earnings Beat Expectations, and Then Some

Company America remains to be cranking out income. Third-quarter earnings season got here in up 14% year-on-year, blowing previous preliminary forecasts that referred to as for mid-single-digit progress. That’s regardless of a backdrop of slowing job progress and a brief authorities shutdown, each of which, surprisingly, barely dented earnings outcomes. We count on a macro slowdown in This fall is slower, as hiring cools down, but the company backside line hasn’t flinched. That has, to date, helped maintain investor confidence.

No shock: the Magnificent Seven, Apple, Microsoft, Alphabet, Amazon, Meta, Tesla, and Nvidia, proceed to dominate on each income and efficiency. Their earnings progress has powered a lot of the S&P 500’s positive aspects for a number of quarters. That mentioned, by the second half of 2026, the hole in earnings progress between the Magazine 7 and the remainder of the S&P 500 (the “493”) may begin to compress.

Meaning earnings breadth might lastly widen as extra sectors contribute to revenue progress, not simply tech titans. It’s the sort of shift that tends to make bull markets extra sustainable and fewer top-heavy.

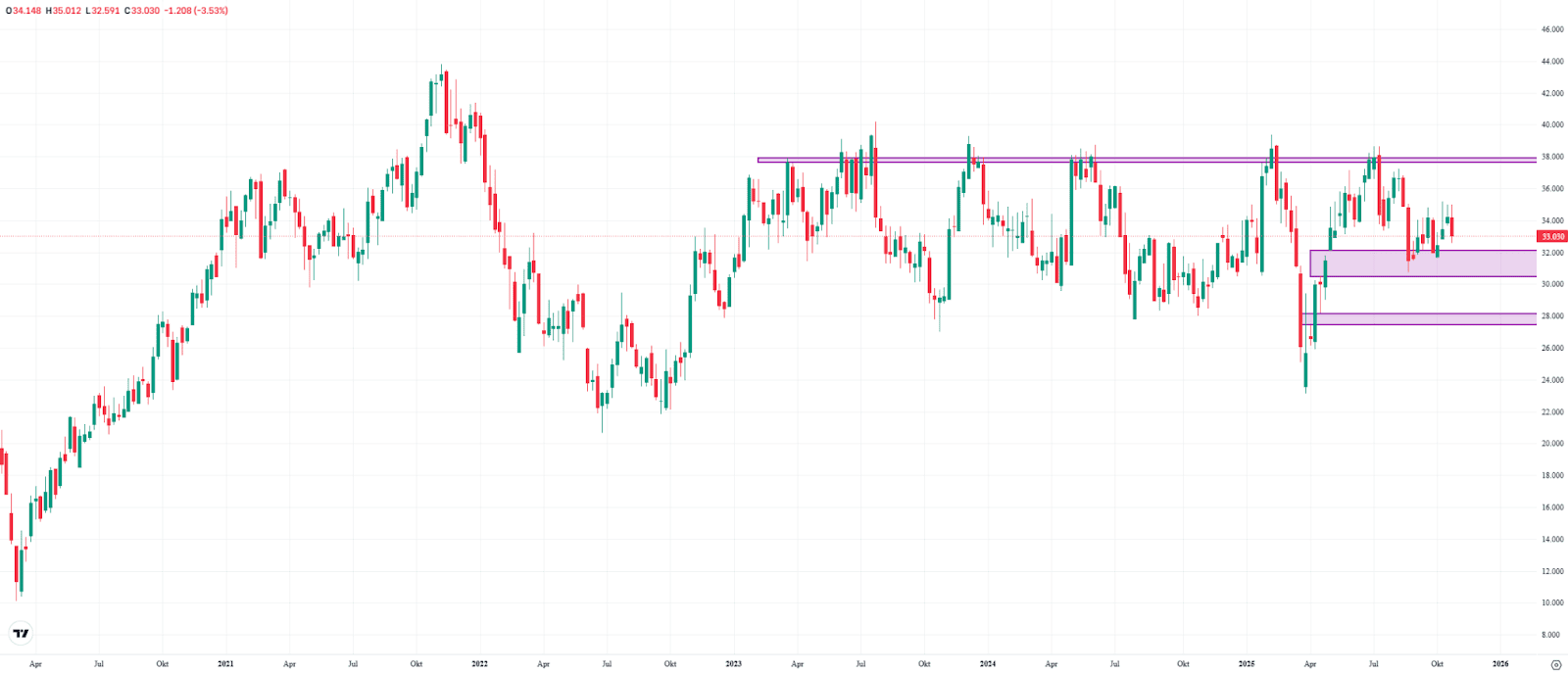

Bitcoin Slips: Can the $100,000 Degree Maintain?

Bitcoin fell about 7% final week after assist at $107,370 failed to carry. Sellers had already been placing stress in the marketplace in latest weeks. The cryptocurrency danced not solely across the psychologically essential $100,000 mark but in addition flirted with bear-market territory — at one level, the drop from the all-time excessive exceeded 20%.

Regardless of the pullback, the market confirmed some resilience. Bitcoin reacted to a widely known assist zone, the Truthful Worth Hole between $96,950 and $99,730, which was already defended in June. The weekly shut above the decrease boundary of this zone suggests a level of stabilization for now.

The long-term uptrend stays intact. Within the quick time period, nonetheless, the chart would solely enhance if Bitcoin regains the damaged assist at $107,370. If the $96,950 stage fails, the subsequent main assist zone may come into focus between $85,600 and $91,920.

Bitcoin, weekly chart. Supply: eToro

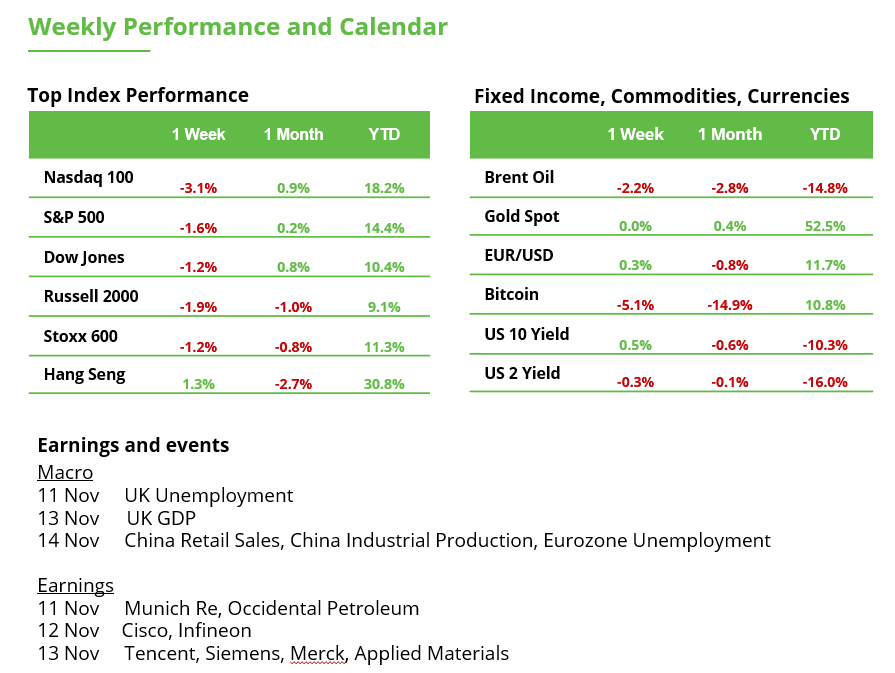

Infineon Forward of Q3 Earnings: Restoration Stalls, Stress Rises

Infineon shares fell about 3.5% final week, at present buying and selling round €33. This halted the three-week restoration part for now. Since September, the inventory has tried to rebound twice from the assist zone between €30.46 and €32.15, however to date it hasn’t managed to check the medium-term resistance at €38. A stage that has blocked any sustained transfer towards file highs since March 2023.

From a technical perspective, the prospect of one other upward transfer stays so long as the decrease boundary of the Truthful Worth Hole at €30.46 holds. Nonetheless, if this assist breaks, traders needs to be ready for a possible decline towards the €27.44–€28.17 vary. Infineon will report its Q3 outcomes on Wednesday, which may mark a decisive “make-or-break” second for the inventory.

Infineon weekly chart. Supply: eToro

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.