Bitcoin has managed to reclaim the $100,000 stage after briefly dipping beneath it earlier this week — a transfer that triggered widespread panic promoting and bolstered bearish sentiment throughout the market. The sharp selloff liquidated leveraged positions and despatched concern metrics surging, however the swift restoration exhibits that consumers are nonetheless energetic close to key demand zones.

In accordance with a brand new report by CryptoOnchain, the latest market turbulence coincides with a surge in “sizzling cash” flows to Binance. Information from CryptoQuant reveals a notable spike in month-to-month Bitcoin inflows to the trade throughout October 2025, signaling heightened speculative exercise. What’s significantly important is that this influx is pushed virtually fully by “younger” cash — UTXOs aged between 0 and 1 day — suggesting that short-term merchants and algorithmic members are dominating latest actions.

This development highlights a transparent uptick in intraday and momentum-driven buying and selling, typically linked to volatility and short-lived worth swings. Whereas such dynamics can amplify draw back threat, in addition they are likely to precede sturdy market reversals as soon as liquidity stabilizes. As Bitcoin regains footing above the $100K threshold, the market now watches carefully to see whether or not this wave of speculative capital marks the start of a broader restoration or simply one other momentary bounce.

“Sizzling Cash” Drives Alternate Exercise, however Lengthy-Time period Holders Keep Agency

In accordance with CryptoOnchain, inflows from “younger” Bitcoin cash have surged sharply, leaping from roughly $18 billion in September to just about $26 billion in October. This marks one of many highest influx ranges previously 12 months, underscoring heightened exercise amongst day merchants, speculators, and arbitrage bots. Such habits usually emerges when markets expertise elevated volatility or uncertainty, as short-term members transfer belongings onto exchanges to place for fast trades.

Traditionally, sharp will increase in trade inflows typically trace at bearish sentiment or potential promoting stress, as merchants put together to take earnings or hedge threat. Nonetheless, the UTXO age breakdown tells a extra layered story. Inflows from older cash, usually held by long-term holders (LTHs), stay negligible and near zero. This divergence signifies that the latest exercise is essentially short-term in nature, confined to merchants reacting to fast market circumstances fairly than long-term buyers exiting positions.

In essence, whereas “sizzling cash” inflows might amplify short-term volatility, Bitcoin’s structural basis stays intact. The core investor base continues holding off-exchange, displaying resilience amid market turbulence.

The report means that the Bitcoin market is cut up into two: speculative capital chasing short-term alternatives on one facet, and long-term conviction holders quietly standing agency on the opposite. This steadiness might decide whether or not the subsequent transfer is one other shakeout or the beginning of a brand new accumulation section.

Bitcoin Faces Resistance After Transient Restoration

Bitcoin’s 4-hour chart exhibits a fragile restoration following its sharp decline beneath the $100,000 stage earlier this week. After hitting a low close to $98,900, BTC rebounded modestly to $103,000, the place it now faces fast resistance from the 20-day and 50-day transferring averages (blue and inexperienced traces). These averages have began to slope downward, confirming the short-term bearish development and capping upside makes an attempt.

The $105,000–$107,000 zone represents the subsequent important resistance space. A break above this vary would doubtless appeal to brief overlaying and sign the primary indicators of stabilization. Nonetheless, failure to reclaim this zone might result in renewed promoting stress, with potential retests of $100,000 and even $97,500, a key psychological help stage.

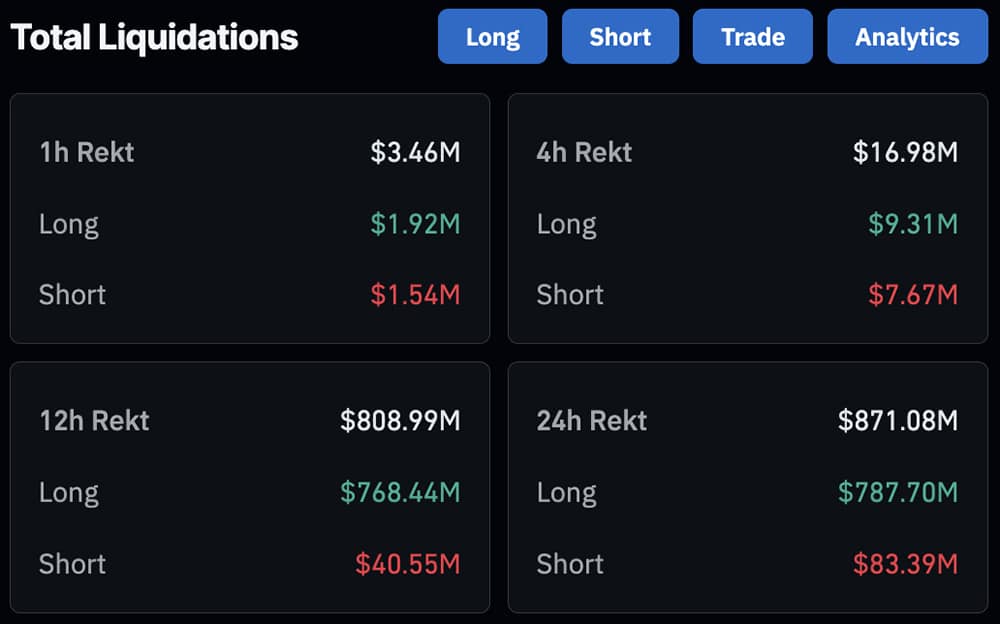

Buying and selling quantity stays elevated, reflecting ongoing market volatility and uncertainty. Whereas bulls have managed to defend $100K for now, momentum stays weak, and sentiment continues to be closely bearish throughout derivatives and spot markets.

Bitcoin is consolidating inside a fragile construction, trying to construct a base after important liquidations. To regain bullish momentum, BTC should reclaim its short-term transferring averages and maintain above $107K — in any other case, draw back dangers persist as merchants stay cautious following the latest leverage wipeout.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.