Introduction: The Lexicon of a Digital Empire

The 2021-2022 market growth for Non-Fungible Tokens (NFTs) was not an remoted occasion. It was a “excellent storm,” a confluence of macroeconomic lodging, widespread cultural lockdowns, and the sudden, explosive maturation of a know-how that seemingly solved an issue central to the digital age: how you can personal one thing that may be infinitely copied.1 In a span of 24 months, “collectible NFTs” advanced from a distinct segment technological experiment into the dominant, world “lexicon of digital possession”.3

This speedy ascent created a speculative empire constructed on digital artwork and social signaling, with valuations that defied conventional monetary fashions. This report will forensically analyze the three acts of this narrative:

The Rise: How the COVID-19 pandemic offered the macroeconomic “gas” (unprecedented liquidity) and the social “fireplace” (a world lived on-line), permitting NFTs to change into a brand new vector for social standing.1

The Fall: The inevitable “Tulip Mania” comparability and the following 2022-2024 market crash, the place a reversal of macroeconomic coverage and a sequence of crypto-native catastrophes “sucked speculative capital” from the ecosystem, vaporizing trillions in worth.5

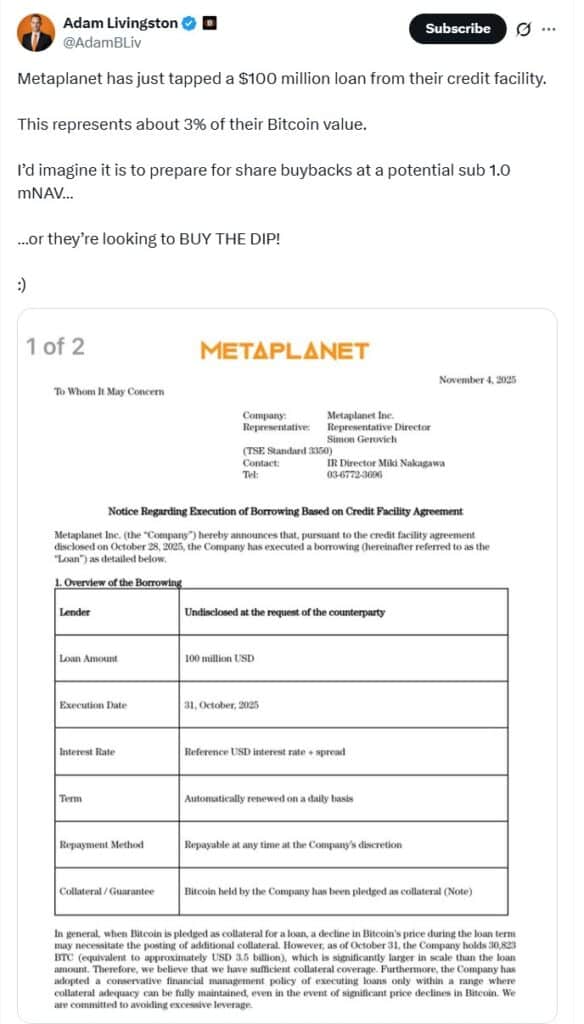

The Consolidation & Rebirth: An evaluation of the present November 2025 market, which reveals a “flight to high quality” and the emergence of a brand new, sustainable mannequin primarily based on real-world utility, mental property, and verifiable entry—a future the place the know-how is “inevitable,” even because the poisonous “NFT” branding is deserted.

Half I: The Rise — Forging the “Good Storm”

The Macroeconomic Catalyst: COVID-19 and the “Sprint for Money”

The 2021 NFT explosion is meaningless with out first understanding the worldwide financial response to the COVID-19 pandemic. The disaster triggered a “deep financial downturn” and widespread enterprise closures.4 In response, the Federal Reserve (Fed) “stepped in with a broad array of actions to maintain credit score flowing”.4

This response was “unprecedented”.4 The Fed minimize its goal for the federal funds price to a variety of 0% to 0.25%.4 It enacted huge purchases of U.S. authorities and mortgage-backed securities 4, whereas Congress handed the Coronavirus Assist, Aid, and Financial Safety (CARES) Act, offering as much as $500 billion to help Fed packages.8

This financial easing, mixed with authorities stimulus, injected trillions of {dollars} of recent liquidity into the economic system. Concurrently, world lockdowns and work-from-home insurance policies meant a captive viewers was spending extra time than ever on-line.9 This setting created a brand new class of “armchair gamblers” who, flush with liquidity and extra time, regarded for brand spanking new avenues of funding.1 This “excellent storm” of straightforward cash, tech-company funding, and a physically-distanced society searching for new types of connection drove an enormous speculative surge into high-risk property, with NFTs representing absolutely the apex of this threat curve.

The Social Catalyst: How “JPEGs” Grew to become the Lexicon of Possession

The macroeconomic setting offered the gas, however the know-how offered the engine. For many years, digital property had been outlined by their “simply and endlessly duplicated” nature.2 Non-Fungible Tokens, first developed in 2017, provided a novel answer: a “technical improvement” that “make[s] it technically attainable for digital property to be owned and traded,” introducing “the idea of shortage within the digital realm for the primary time”.11

Whereas the know-how was initially area of interest, it “reached the mainstream in 2021” 11 when Christie’s auctioned a digital collage by the artist Beeple for $69.3 million.2 This occasion signaled that “collectible NFTs” had change into a brand new “lexicon of digital possession”.3

The true social “genius” of the NFT empire, nevertheless, was not in excessive artwork however within the Profile Image (PFP). Collections like CryptoPunks (launched 2017) and Bored Ape Yacht Membership (BAYC, launched 2021) turned the dominant “blue chip” property.12 Their worth was not merely as artwork, however as highly effective social signifiers. Proudly owning certainly one of these property, and verifiably displaying it as a social media profile image, offered “emotional dividends”.14

This created a strong, self-reinforcing suggestions loop:

An asset’s value would rise, rising its monetary worth.

This monetary worth made it a stronger social sign of wealth, early-adopter standing, and “insider” entry.15

This enhanced social standing, or “bragging rights” 16, drove new demand from people searching for that standing.

This new demand raised the worth additional, and the loop repeated.

The blockchain’s public ledger, analyzable on social media 17, allowed this social “efficiency” to be verified, making a “single group” 15 that was, for a time, essentially the most unique and culturally related “membership” on the planet.18

Half II: The Fall — Deconstructing the “NFT Empire” (2022-2024)

Anatomy of a Trendy Mania: The Tulip Comparability

The comparability of the NFT growth to the 1637 Dutch Tulip Mania is each widespread and analytically helpful, offered one separates the psychology from the know-how.7

The psychological parallels are similar. Each occasions had been textbook speculative bubbles 6 pushed by “irrational exuberance and group psychology”.7 Throughout Tulip Mania, “folks from numerous walks of life… entered the market, hoping to revenue from the rising costs” 6, simply as “armchair gamblers” did in 2021.1 The bubbles burst in exactly the identical vogue. For tulips, “consumers all of a sudden vanished, resulting in a catastrophic collapse in costs”.6 For NFTs, the market skilled its first main crash as early as April 2021, when common costs “plummeted nearly 70%” from their February 2021 peak 19, a prelude to the devastating, protracted bear market of 2022-2023.

Nonetheless, the technological parallel fails. Tulip shortage was an “phantasm”.20 Essentially the most-prized “damaged” bulbs had been uncommon resulting from an uncontrollable aphid-borne virus 21, and different bulbs might merely be grown. In sharp distinction, an NFT’s shortage is “hardcoded” and “rooted in math”.20 There’ll solely ever be 10,000 CryptoPunks.22

The 2022-2023 crash was due to this fact not a failure of the know-how’s core premise (verifiable shortage). It was a catastrophic failure of valuation. The market, in its mania, wildly mis-priced the worth of “bragging rights”.16 The crash was a painful however obligatory correction, washing away the “over-saturation” of low-quality initiatives 19 and “hopeful pricing methods” 23 that outlined the bubble.

The Nice Unwinding: Crypto Winter and the Collapse of Liquidity

The “on-ramp” of straightforward cash that fueled the growth turned the “off-ramp” that destroyed it. The macroeconomic setting reversed dramatically in 2022. Inflation peaked at 9.1% in June 2022 24, and the Fed started a cycle of aggressive rate of interest hikes to fight it.

This “sucked speculative capital out of NFTs”.5 As a high-risk asset, NFTs had been “typically the very first thing that will get offered” when “authorities stimulus funds stopped” and buyers sought to de-risk portfolios.24

This macro-driven downturn was massively accelerated by a sequence of crypto-native catastrophes. The “collapse of main crypto initiatives and exchanges (e.g. Terra/Luna’s implosion and FTX’s chapter)” 5 evaporated liquidity, destroyed institutional belief, and despatched the “broader crypto bear market” 5 right into a deep freeze.

The end result was annihilation. Buying and selling volumes collapsed.5 By September 2023, one report claimed that 95% of over 73,000 NFT collections had a market capitalization of zero.25

Quantifying the Collapse: A Blue-Chip Put up-Mortem

Even the “blue-chip” collections, as soon as deemed untouchable, had been decimated. The autumn of those marquee initiatives quantifies the “decline and fall” of the empire.

Bored Ape Yacht Membership (BAYC): The icon of the 2021 bull run, which had attracted a slew of movie star homeowners 26, reached an all-time excessive (ATH) flooring value of 153.7 ETH in Might 2022 18, valued at roughly $429,000.27 By June 2024, its flooring value had collapsed by over 90%, falling under 10 ETH for the primary time since 2021.26

Mutant Ape Yacht Membership (MAYC): The BAYC “by-product” assortment, suffered an excellent worse destiny, down 95% from its all-time excessive by June 2024.28

Azuki: This anime-themed undertaking hit an ATH flooring of 31.8 ETH in April 2022.29 In June 2023, the crew’s controversial “Elementals” mint was broadly panned by the group as a “promise gone mistaken”.30 The backlash was speedy, inflicting the ground value of the unique assortment to “dip by 34%” nearly immediately.30

Moonbirds: A main instance of a hype-driven collapse, Moonbirds reached a staggering 38.5 ETH flooring value in April 2022.31 By 2024, its flooring “fell as little as 0.5 ETH” 32, representing a 98.7% worth destruction.

Half III: The Consolidation — A Knowledge-Pushed Snapshot of the Market (November 2025)

The offered real-time market information from November 5, 2025, presents a definitive snapshot of the post-crash consolidation. The market just isn’t useless; it’s unstable, lively, and has undergone a profound re-evaluation of worth.

Evaluation of the November 5, 2025 Market Knowledge

The information reveals a extremely lively, if

bearish, 24-hour cycle. CryptoPunks (#1) exhibits a staggering 325.48% improve in 24-hour quantity, reaching $1.35 million. Milady Maker (#5) and Meebits (#9) additionally present triple-digit quantity spikes (143.75% and 601.68%, respectively). This isn’t an illiquid, useless market; it’s a market of lively merchants, whilst most flooring costs are declining within the quick time period.

Essentially the most important information level is the hierarchy. CryptoPunks, the 2017 “vintage” 15, has firmly reclaimed its throne because the #1 assortment with a $117,633 flooring value. Bored Ape Yacht Membership, the 2021-2022 hype king, has fallen to #3, with its flooring value of $19,564 representing solely 16.6% of a CryptoPunk’s worth.

This demonstrates a transparent flight to historic significance. Within the wake of a speculative crash that worn out 95% of initiatives 25, the remaining capital has consolidated across the property with essentially the most provable historic relevance. CryptoPunks, as one of many very first PFP initiatives, is now handled as a real digital vintage, whereas BAYC’s worth, which was extra tied to modern movie star hype and social signaling 26, has confirmed far much less sturdy.

The “Flip-pening” and the Rise of the Utility Thesis

Essentially the most essential development revealed by the November 2025 information is the near-parity of Pudgy Penguins (#2, $18,758 flooring) and Bored Ape Yacht Membership (#3, $19,564 flooring). This “Flip-pening” is a tectonic shift, proving the market has essentially modified its valuation mannequin.

Pudgy Penguins, a 2021 undertaking, was acquired by new management in April 2022.33 This new crew pivoted away from counting on speculative tokenomics and as an alternative pursued an “aggressive playbook” targeted on “tangible merchandise” and constructing a sturdy “mental property”.33

This “retail-first technique” 33 resulted in “Pudgy Toys,” a line of bodily plushies offered in main retailers like Walmart and Goal.35 This initiative has been terribly profitable, producing over $13 million in retail income by late 2024 and promoting over 2 million toys by March 2025.36 The model is actively increasing its IP licensing into attire and different client items.36

The November 2025 information proves the “Utility Thesis.” The market is now rewarding initiatives that generate exterior, real-world income and construct a sustainable IP model (Pudgy Penguins) at a valuation practically similar to initiatives that when relied solely on inner, speculative, community-driven hype (Bored Ape Yacht Membership). The “fall” of the outdated, hype-based empire is being met by the rise of a brand new, utility-driven mannequin.

The New Guard: Utility because the Value of Admission

The market’s bifurcation is additional confirmed by the #10 assortment, “Infinex Patrons” ($4,809 flooring). This isn’t a PFP or artwork undertaking. It’s a assortment of 100,000 NFTs that “unlocks unique entry and advantages” for the Infinex platform.37 It’s a utility token in NFT kind.

The presence of Infinex Patrons within the Prime 10 demonstrates that the “NFT” market is not a monolith. It has matured and break up into three distinct, viable sectors:

Digital Antiques / Artwork: Valued on historical past, aesthetics, and cultural memetics (e.g., CryptoPunks, Milady Maker).

IP & Branding: Valued on real-world IP licensing, merchandise, and exterior income (e.g., Pudgy Penguins).

Digital Entry & Utility: Valued on the tangible platform advantages, entry, and perks it gives (e.g., Infinex Patrons).

Desk 1: The Nice Consolidation: NFT Blue-Chip Value Historical past (ATH vs. Nov 2025)

The next desk gives the quantitative proof for the “decline and fall” narrative, whereas concurrently demonstrating the “consolidation” by exhibiting the numerous remaining worth in November 2025. It contrasts the all-time-high (ATH) flooring costs of the “outdated guard” with their present (November 5, 2025) costs.

Notice: USD ATH values are estimated primarily based on ETH costs on the time of the height.

The information is evident. Speculative, hype-driven initiatives like BAYC, Azuki, and Moonbirds have seen catastrophic >95% losses. In distinction, the property which have consolidated worth are CryptoPunks (primarily based on historical past) and Pudgy Penguins (primarily based on utility), which have seen way more “modest” ~70% declines. This desk quantifies the market’s flight from hype to tangible worth.

Half IV: The Inevitable Rebirth — The Way forward for Verifiable Digital Property

The Toxicity of a Three-Letter Phrase and the Nice Rebranding

The time period “NFT” is now culturally poisonous. It’s inextricably linked to the 2022-2023 crash and is related to “scams,” “poisonous ‘mines’,” “misplaced life financial savings” 40, and “Ponzi scheme[s]”.25 The general public relations model is useless.

The prediction that “they gained’t name them NFTs” just isn’t a prediction; it’s a documented and profitable company technique already in movement. The trail to mass adoption for this know-how is invisibility and rebranding.

Case Research: Reddit: The social media platform “quietly onboarded hundreds of thousands of customers to Web3” not by promoting “NFTs,” however by “rebranding NFTs as simply ‘digital collectibles’”.41

Case Research: Starbucks: The espresso big launched its “Starbucks Odyssey” loyalty program.42 The NFTs had been explicitly abstracted as “collectible ‘stamps’” 41, “Journey Stamps” 43, and “collectable digital paintings”.44

The “NFT” as a speculative monetary instrument is being deserted, whereas the “digital collectible” as a utility-based, gamified, and brand-friendly asset is being embraced.

The Philosophical Crucial: Why Digital Possession Is Inevitable

The persistence of this know-how is “inevitable” as a result of it solves a basic and rising drawback with the present digital economic system. Within the Web2 period, “possession” is an “ambiguous idea”.45 When a client “buys” a digital film, recreation, or e-book, they aren’t partaking in a purchase order within the conventional sense. As a substitute, they’re coming into a “licensing settlement”.45 Amazon, for instance, grants solely a “non-exclusive, non-transferable… restricted license” to view content material.45

This mannequin is essentially user-hostile. The Federal Commerce Fee (FTC) has issued client alerts titled, “Do you actually personal digital objects you paid for?”.46 Customers are dealing with “rising frustration” as firms like Sony (PlayStation) and Nintendo “shut down entry to total libraries”.45 When these platforms expire, the “bought” content material disappears perpetually.45

The widespread “right-click-save” criticism of NFTs 47 has at all times misunderstood the core drawback. The issue just isn’t copying a digital file; the issue is proving provenance and possession in a persistent, verifiable means.

Blockchain-based property are the one current know-how that gives a “public file of transactions” 48 that may monitor possession “exterior of the confines of any specific digital retailer’s non-public servers”.48 It permits a “shift in authorized classes” 48 away from revocable licenses and towards true, persistent digital private property. Adoption is inevitable not due to speculative JPEGs, however as a result of the Web2 various—renting your “purchases” on the mercy of a company server—is changing into insupportable.

The New Utility: From Collectible to Certificates (The Future, At the moment)

The “reborn” digital asset is already being deployed in high-utility, non-speculative sectors. The long run is not theoretical; it’s lively in 2025.

The IP Powerhouse Mannequin: As confirmed by Pudgy Penguins, the digital NFT serves because the “genesis” of a brand new mental property. This IP is then monetized by way of real-world merchandise, constructing a model the place the digital asset grants entry and standing inside that ecosystem.33

The “Phygital” Asset (Luxurious & Authentication): This can be a major, non-speculative use case. Luxurious manufacturers like Gucci, Dolce & Gabbana, and Prada are utilizing “digital twins” and “blockchain-based authentication”.49 This “revolutioniz[es] authentication” 51 by making a tamper-proof digital certificates for a bodily merchandise, combating the multi-billion greenback counterfeit market.52

The Immutable Ledger (Positive Artwork Provenance): The normal artwork world is utilizing blockchain to “guard in opposition to… pitfalls”.53 The know-how gives an immutable, clear file that “ensures… copyright, transparency in gross sales and the provenance of the works”.53 That is being utilized to the tokenization of works by main artists, together with Picasso.55

The Open Economic system (Gaming): Maybe the most important future sector, blockchain gaming is shifting from “locked” in-game property to a mannequin of “unequalled possession”.56 Gamers can really personal, promote, and commerce their in-game objects, creating “flourishing” digital economies.56 By Q3 2025, gaming NFTs generated $135 million in buying and selling quantity 57, and new AAA video games are launching with “token-based objects” and “RPG Tokenomics”.58

Conclusion: The “Empire” Is Gone. The Digital Asset Is Right here to Keep.

This evaluation has documented the “decline and fall” of the 2021-2022 “NFT Empire,” a traditional speculative bubble constructed on the “excellent storm” of COVID-era macroeconomic coverage 1 and the novel energy of verifiable social signaling.15 Its collapse, psychologically analogous to Tulip Mania 6 however technologically distinct 20, was quantified by the catastrophic, >90% value crash of former “blue-chips” like Bored Ape Yacht Membership.26

The November 2025 market information serves as definitive proof of the following consolidation. The market just isn’t useless however has matured, re-evaluating worth primarily based on provable historic significance (CryptoPunks) and real-world utility (Pudgy Penguins).33 The speculative, hype-driven valuation mannequin of 2021 has been changed by one which calls for tangible IP, exterior income, or verifiable entry.

Lastly, the “NFT” identify is poisonous 40 and is being efficiently shed by firms, that are rebranding the know-how as “digital collectibles” to drive mass adoption.41 This underlying know-how is the inevitable answer to the elemental flaws of the Web2 digital “license” mannequin 45 and is already being built-in as the brand new customary for authentication 50, provenance 53, and true digital possession.56

The “Empire” is gone. The period of the diversified, utility-driven, and “inevitable” digital asset has begun.