Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth has slipped 2% over the past 24 hours to commerce at $101,647 as of 4.05 a.m. EST with the each day buying and selling quantity rising 37% to $110.41 billion.

The correction follows heavy promoting stress as US spot Bitcoin and Ethereum ETFs posted almost $800 million in outflows yesterday. Worries are rising throughout the crypto market about weaker demand, bearish institutional indicators, and what comes subsequent for the BTC worth.

Main losses began earlier this week when Bitcoin crashed by the important thing $100,000 assist. The sharp decline triggered a wave of concern, sparking excessive concern amongst merchants and analysts.

In keeping with CryptoQuant, if the $100,000 degree doesn’t maintain, Bitcoin might slide a lot decrease, presumably dropping to $72,000 within the subsequent couple of months.

For a number of days in a row, funds like BlackRock’s IBIT noticed big withdrawals, pulling liquidity from the Bitcoin market simply as different indicators turned unfavourable.

Bitcoin treasury demand is falling off a cliff.

One of many important causes we’re seeing this dump. pic.twitter.com/B4TPipd9sB

— Crypto Rover (@cryptorover) November 5, 2025

When ETF inflows are optimistic, they often assist Bitcoin by decreasing obtainable provide, however after they flip unfavourable, they’ve the alternative impact.

On-Chain Traits For Bitcoin Sign Waning Demand

CryptoQuant’s analysis factors to a gentle drop in spot demand since a large liquidation occasion hit the market on Oct. 11. That day noticed over $19 billion in leveraged positions worn out, marking the biggest single liquidation in crypto historical past. Since then, indicators resembling spot change flows, ETF flows, and the Coinbase premium have been largely unfavourable.

Day by day Change in Whole Bitcoin Holdings Supply: CryptoQuant

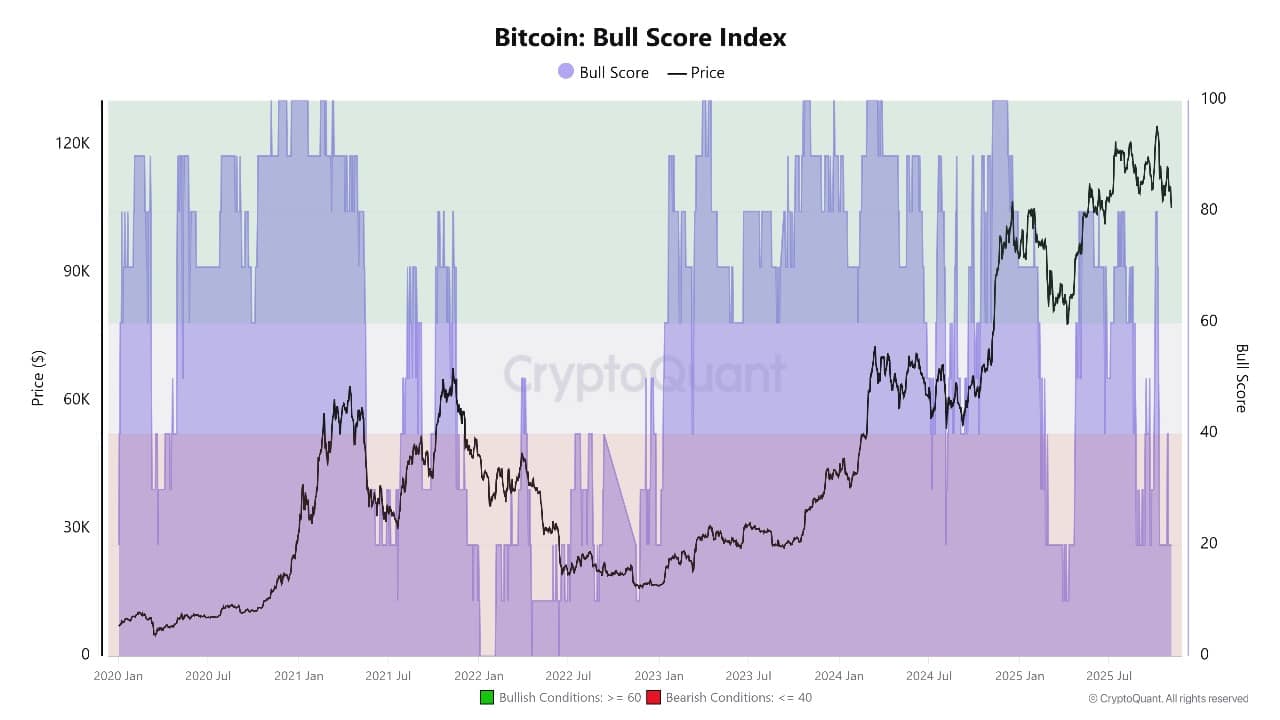

The Bull Rating Index, which tracks sentiment and momentum, has slumped to twenty. This low rating indicators a clearly bearish market. Decrease demand from US buyers and a unfavourable Coinbase premium present that American consumers are actually extra reluctant or promote greater than they’re shopping for.

Bitcoin Bull Rating Index Supply: CryptoQuant

Furthermore, historic parallels are being drawn to earlier bear market intervals, when Bitcoin’s spot demand weakened and worth corrections prolonged. With ETF outflows rising and buying and selling exercise dropping on exchanges, confidence in a quick rebound stays very low amongst analysts watching the blockchain knowledge.

Bitcoin Value Prediction: Might BTC Drop To $72,000?

The technical image for Bitcoin is rising extra bearish. In keeping with CryptoQuant and analysts like Julio Moreno, a very powerful degree to look at is $100,000. If Bitcoin trades under this era for a sustained time period, the danger of a fall to $72,000 will increase sharply within the subsequent one or two months.

On the weekly chart, Bitcoin continues to be in a large rising channel, however current candles look heavy, and sellers are pushing the worth in the direction of the center of the vary. The $102,940 degree matches Bitcoin’s 50-week easy transferring common (SMA), which acted as assist earlier than however might now change into resistance.

BTCUSD Evaluation Supply: Tradingview

If BTC fails to reclaim and maintain above that line quickly, extra draw back could possibly be forward.

In the meantime, momentum indicators level to rising weak spot: The RSI (Relative Energy Index) is round 44, a bearish studying that means bears are in cost and there’s room for a continued drop.

The MACD (Shifting Common Convergence Divergence) has crossed unfavourable, supporting the concept that a deeper downtrend is forming. Whereas the CMF (Chaikin Cash Movement) is barely above zero, reflecting minimal capital influx.

If promoting stress persists and Bitcoin can not construct new assist above $100,000, the channel’s decrease boundary, presently close to $75,000, will doubtless be examined subsequent. This traces up with CryptoQuant’s warning of a possible drop to $72,000. Historic assist round $80,000 to $85,000 might provide solely transient aid if panic promoting takes maintain.

On the upside, if Bitcoin rapidly recovers and reclaims $103,000–$105,000, it might start to stabilize. Key resistance lies at $110,000 and once more at $125,000, the place many merchants will probably be watching to see if bulls can return in drive. Nonetheless, with ETF outflows and on-chain weak spot dominating the headlines, sentiment stays cautious for now.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection