Coinbase isn’t your odd crypto alternate. Even when most of immediately’s Ethereum killers have been ideas, the ramp helped merchants and traders wager large cash on 1000X cash. In 2025, Coinbase isn’t an alternate however a thriving ecosystem powering a number of the trade’s core infrastructure.

Their leaning on compliance may need pushed it down the market rankings, permitting Binance to shine. Even nonetheless, Coinbase is a crypto powerhouse. As of late October 25, Coinbase generated over $2.4 billion in 24-hour buying and selling quantity, which is roughly 10X lower than what Binance and Gate processed inside that window.

(Supply: Coingecko)

Whereas buying and selling quantity is a metric that almost all analysts use, they need to be cautious of wash buying and selling and different manipulation techniques used to pump alternate exercise in exchanges exterior the USA and the EU. Coinbase’s very pro-regulation stance helps clear it from wash buying and selling, a vice that prevented the SEC from approving spot Bitcoin and Ethereum ETFs for years.

DISCOVER: Greatest Meme Coin ICOs to Spend money on 2025

Coinbase Q3 2025 Earnings: What to Anticipate?

As crypto grew, so did Coinbase, and the demand for extra providers and choices equally exploded. The alternate buckled beneath the strain, increasing the variety of cash to incorporate a number of the high Solana meme cash.

Test your cellphone – the wait is over.

Discover thousands and thousands of property, moments after they launch, proper from the Coinbase app.

DEX buying and selling is reside for all U.S. customers (ex. NY).

Coming quickly: extra property, extra networks, extra nations. pic.twitter.com/XryNvDXkdL

— Coinbase

(@coinbase) October 8, 2025

Coinbase additionally went public, and COIN is now buying and selling on NASDAQ with a market cap of over $91Bn.

After GOOGL, Meta, and Microsoft launched their Q3 2025 earnings stories yesterday, on October 28, the funding group is raring to see whether or not Coinbase will beat analysts’ expectations tomorrow, on October 30.

In a press launch earlier this month, on October 10, when a number of the greatest cryptos to purchase all of a sudden plunged, Coinbase World mentioned it will publish its Q3 2025 shareholder letter, which incorporates monetary outcomes, tomorrow, October 30, after market shut.

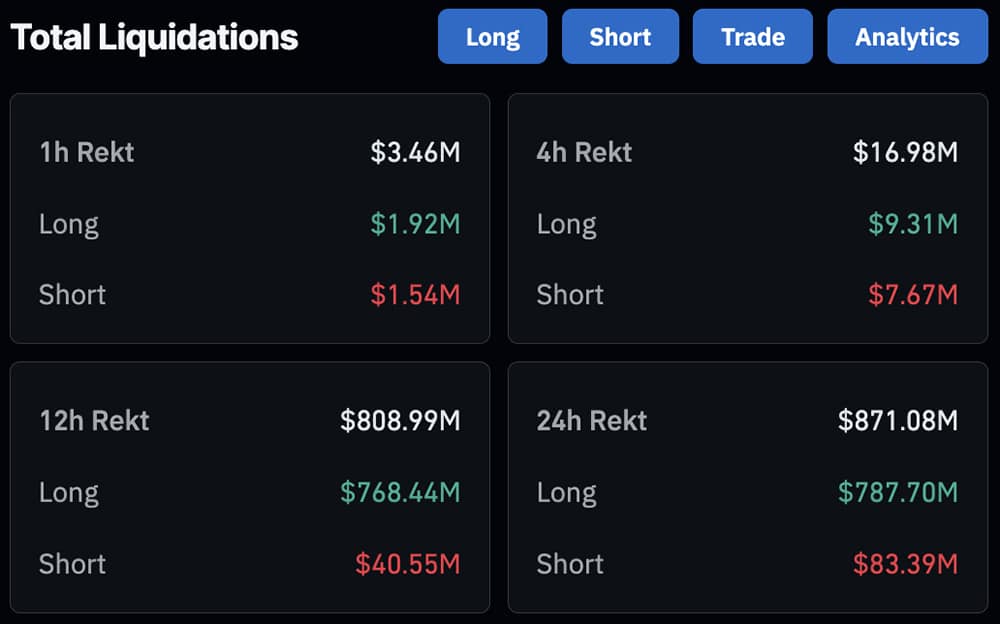

General, analysts are cautiously optimistic however nonetheless anticipate a powerful year-on-year rebound from a lackluster Q2 2025. The consensus is that income may develop to over $1.76Bn, up +44% YoY. In the meantime, internet revenue may balloon to over $400M, a +150% YoY change.

Drivers may embrace rising crypto costs, which additionally influence buying and selling income generated from, amongst others, subscriptions and institutional choices, together with staking and custody. Traders must also watch the variety of month-to-month transacting customers (MTUs), which can develop to over 8.5M, and income from Circle, the USDC issuer.

DISCOVER: Greatest New Cryptocurrencies to Spend money on 2025

What Occurred In Q2 2025? Is Coinbase Closely Reliant on Circle For Income?

In Q2 2025, Coinbase’s MTUs missed estimates by +10%. Due to this fact, an enlargement in Q3 2025 may sign a revival in retail buying and selling exercise. On the similar time, as one analyst notes, a giant chunk of Coinbase’s income got here from Circle. This isn’t good.

The analyst observes {that a} large chunk of Coinbase’s $1.5Bn income got here from its strategic investments.

Though Coinbase’s “investments” have been utterly hidden from Q2 2025 earnings, it was revealed that Coinbase solely made one funding in Circle, which matured in Q2 2025.

He added that if the overall income from Circle is deducted (at $1.47Bn, which stays paper beneficial properties till the alternate sells), Coinbase’s revenue will fall drastically, leaving them with an working revenue of $30M.

Some VERY INTERESTING numbers from @Coinbase's newest quarterly earnings.

Thoughts you this firm is value $90 BILLION DOLLARS.

Firm had $2.5B in income and $1.5B in working bills. Leaving us with an internet revenue of $1B.

Spectacular proper? Not while you dig deeper. pic.twitter.com/cuxwhsz2r3

— Derivatives Monke (@Derivatives_Ape) October 28, 2025

Circle, it needs to be famous, went public in June 2025, and shares surged post-IPO, successfully inflating the worth of Coinbase’s holdings, since they personal a minority stake within the USDC issuer.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Coinbase Q3 2025 Earnings Report: What to Anticipate?

Coinbase is a mega alternate with thousands and thousands of customers

The Q2 2025 report was underwhelming

Coinbase has a minority stake in Circle

Will Coinbase beat expectations in Q3 2025?

The put up Coinbase COIN Earnings Report: What To Anticipate? Will Circle Save COIN? appeared first on 99Bitcoins.