Blockchain evaluation platform Glassnode has shared some vital insights on Bitcoin’s liquidity ranges amid a slightly risky market interval. Notably, the main cryptocurrency has struggled to keep up its “Uptober” type after a value surge to $126,000 was adopted by a heavy correction to beneath $105,000. Whereas Bitcoin has proven some restoration exercise since then, it’s but to interrupt above the $115,000 resistance, whereas its complete month-to-month acquire stands at 0.47%.

Bitcoin Liquidity Rises, Testing Demand Energy

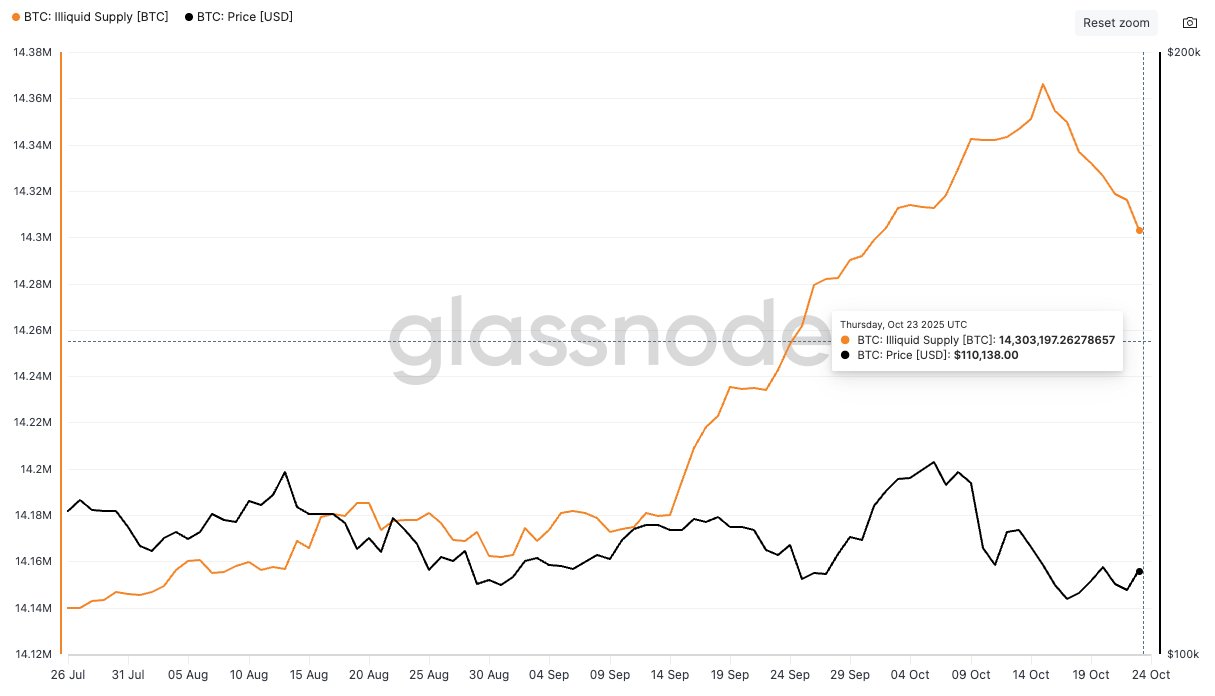

In an X publish on October 25, Glassnode experiences that Bitcoin’s illiquid provide has fallen by 62,000 BTC since mid-October. For context, Illiquid Bitcoin refers to BTC that’s held in wallets with little to no historical past of promoting. They’re primarily cash which might be unlikely to maneuver as a result of their holders hardly ever spend and are thought-about off the market.

Due to this fact, a decline in illiquid BTC means that extra cash are returning to energetic circulation, rising out there provide. This dynamic could make sustained value progress tougher except offset by a powerful surge in demand.

Glassnode explains that illiquid provide progress has been a constructive catalyst on this market cycle earlier than this current decline occurred. Traditionally, related pullbacks, such because the 400,000 BTC decline in January 2024, have tended to sluggish market momentum by rising the quantity of Bitcoin in energetic circulation.

Who’s Behind The Sale?

In analyzing this fall in illiquid BTC, Glassnode additional found that Bitcoin whales’ accumulation exercise has accelerated. Particularly, BTC wallets have elevated their holdings over the previous 30 days and have but to liquidate any giant positions since October 15.

Due to this fact, the rise in BTC liquidity has been pushed by retail traders. Extra knowledge from Glassnode reveals that wallets holding between 0.1-10 BTC, i.e. $10,000 to $1,000,000, have been producing constant heavy outflows. Particularly, this set of merchants has been steadily decreasing their BTC publicity since November 2024.

In relation to current value motion, Glassnode analysts observe that momentum patrons, primarily retail traders, are more and more exiting the market. Though dip patrons i.e., whales, have stepped up their exercise, their demand has not been enough to soak up the surplus provide, resulting in the worth imbalance presently noticed.

On the time of writing, Bitcoin is buying and selling at $111,570, reflecting a modest 0.89% acquire over the previous 24 hours. On larger timeframes, the main cryptocurrency has recorded a 4.11% improve over the previous week and a marginal 0.05% rise over the previous month.

Featured picture from Flickr, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.