The Bitcoin choices market has quietly change into one of the crucial revealing arenas for gauging dealer sentiment. And proper now, it’s flashing combined however telling alerts. Whereas Bitcoin has clawed its means again from the early-October washout that vaporized tens of billions in leveraged bets, the choices knowledge suggests buyers are nonetheless hedging their pleasure with warning.

Time period construction flattens after the shakeout

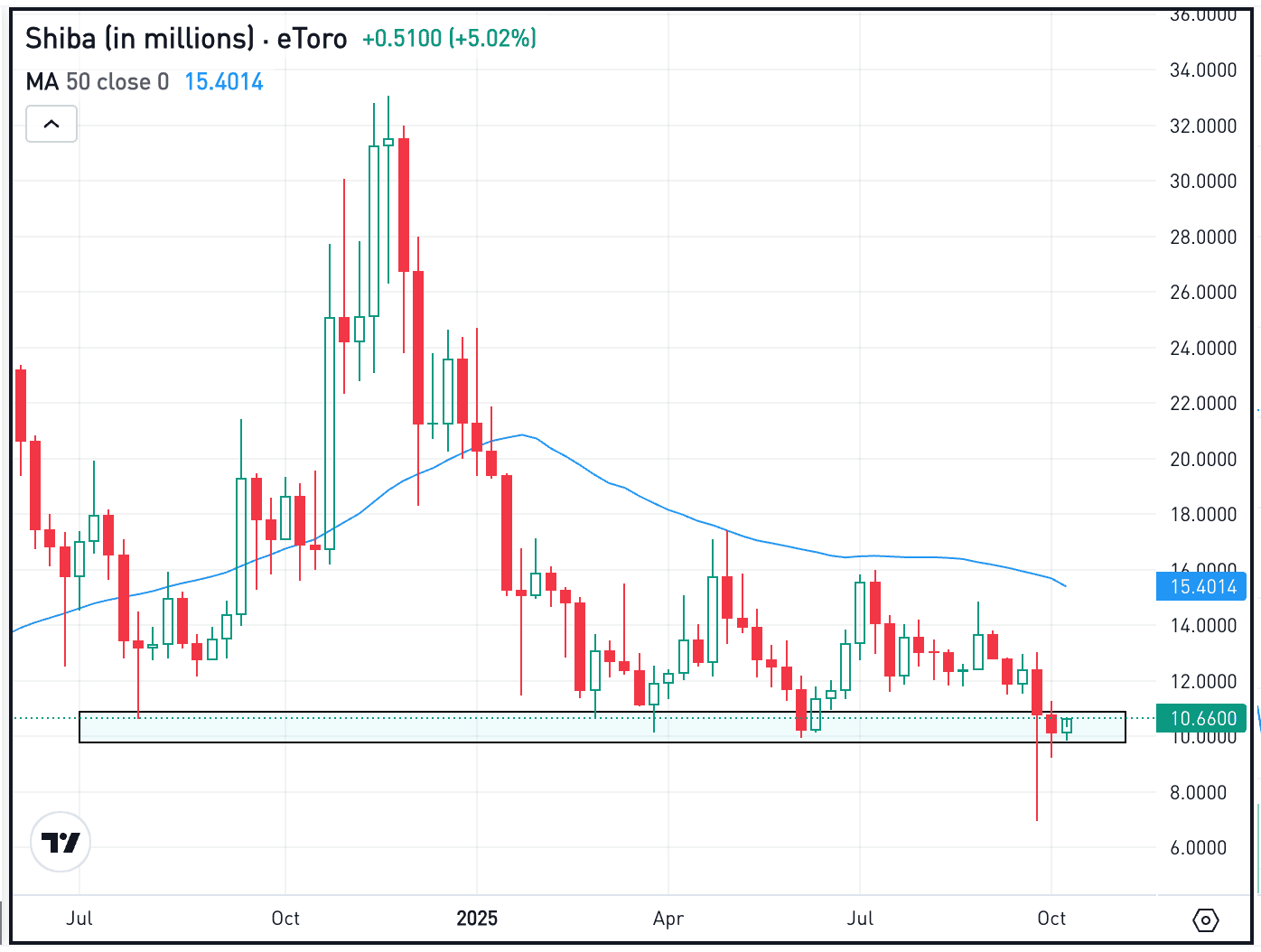

The backdrop for all it is a market that’s nonetheless digesting one of many sharpest deleveraging occasions in crypto historical past. October’s collapse worn out over 19 billion {dollars} of leveraged positions, leaving futures open curiosity at its lowest in months earlier than slowly rebuilding as merchants repositioned. Glassnode’s newest Choices Weekly exhibits that open curiosity has reset and is now rising once more into This autumn. That’s what they name a “cleaner” market construction, free from expiry-driven noise.

But the volatility time period construction, basically how merchants value danger throughout time, has steepened once more on the quick finish. Brief-dated implied volatility stays elevated, hovering close to 50%. That’s merchants paying up for near-term insurance coverage, signaling wariness about additional shocks quite than religion in a clean rebound.

Skew exhibits draw back bias

Skew is an indicator measuring whether or not merchants favor upside calls or draw back places. It echoes the identical story. Glassnode factors to persistent demand for places, with the 25-delta skew a number of vol factors larger towards draw back safety, even after Bitcoin’s temporary bounce to round $120,000. Establishments, Glassnode notes, have been layering in these hedges whereas taking earnings into energy, which is an indication of “defensive positioning” quite than capitulation.

In different phrases, the market isn’t screaming risk-off, however the urge for food for upside is cautious. Merchants are being attentive to macro catalysts and preserving safety in place. That’s a stark distinction to early 2025, when short-volatility methods dominated.

The carry commerce dies down

The once-lucrative volatility carry commerce (shorting choices to earn premium as realized volatility stayed dormant) has successfully vanished. With realized and implied vol now converging, that simple revenue has disappeared, leaving merchants to actively handle publicity quite than merely accumulate yield.

October’s volatility, triggered by President Trump’s renewed tariff threats in opposition to China, jolted implied volatility from 40% to over 60%. Whereas it’s cooled barely, it stays effectively above pre-crash ranges. That stickiness in implied vol suggests merchants stay unsettled about liquidity and autoredeleveraging danger.

Defensive flows dominate Bitcoin choices

Current possibility flows affirm that the market’s bias remains to be on the defensive. Roughly $31 billion in Bitcoin choices are set to run out over Halloween week, which is without doubt one of the largest expiries on file. What’s telling is how these contracts are structured. Heavy put focus across the $100,000 strike and calls clustered close to $120,000, virtually completely bracketing Bitcoin’s current vary. Sellers are quick gamma on the draw back and lengthy on the upside, a setup that tends to suppress rallies and intensify selloffs.

Bloomberg’s early-October reporting described merchants piling into $140,000 calls throughout Bitcoin’s euphoric transfer above $126,000. However because the rally light, that bullish momentum gave solution to hedging and profit-taking.

Ready for CPI

For now, the following main volatility reset hinges on macro knowledge. Merchants are holding off till the upcoming U.S. CPI report after the federal government shutdown backlog clears, which is able to probably form cross-asset volatility pricing. Glassnode analysts notice that with this compressed setup, elevated front-end volatility, defensive skew, and a fading carry, any macro jolt may rapidly swing the market again towards directional extremes.

Briefly? The Bitcoin choices market is displaying much less euphoria, extra knowledge. Merchants have realized from October’s shock and are balancing the optimism of “Uptober” with an unusually sober method to danger. Volatility isn’t going away, it’s simply being managed higher.

On the time of press 3:11 pm UTC on Oct. 25, 2025, Bitcoin is ranked #1 by market cap and the worth is up 1.15% over the previous 24 hours. Bitcoin has a market capitalization of $2.23 trillion with a 24-hour buying and selling quantity of $34.53 billion. Be taught extra about Bitcoin ›

On the time of press 3:11 pm UTC on Oct. 25, 2025, the overall crypto market is valued at at $3.76 trillion with a 24-hour quantity of $105.2 billion. Bitcoin dominance is at present at 59.20%. Be taught extra concerning the crypto market ›