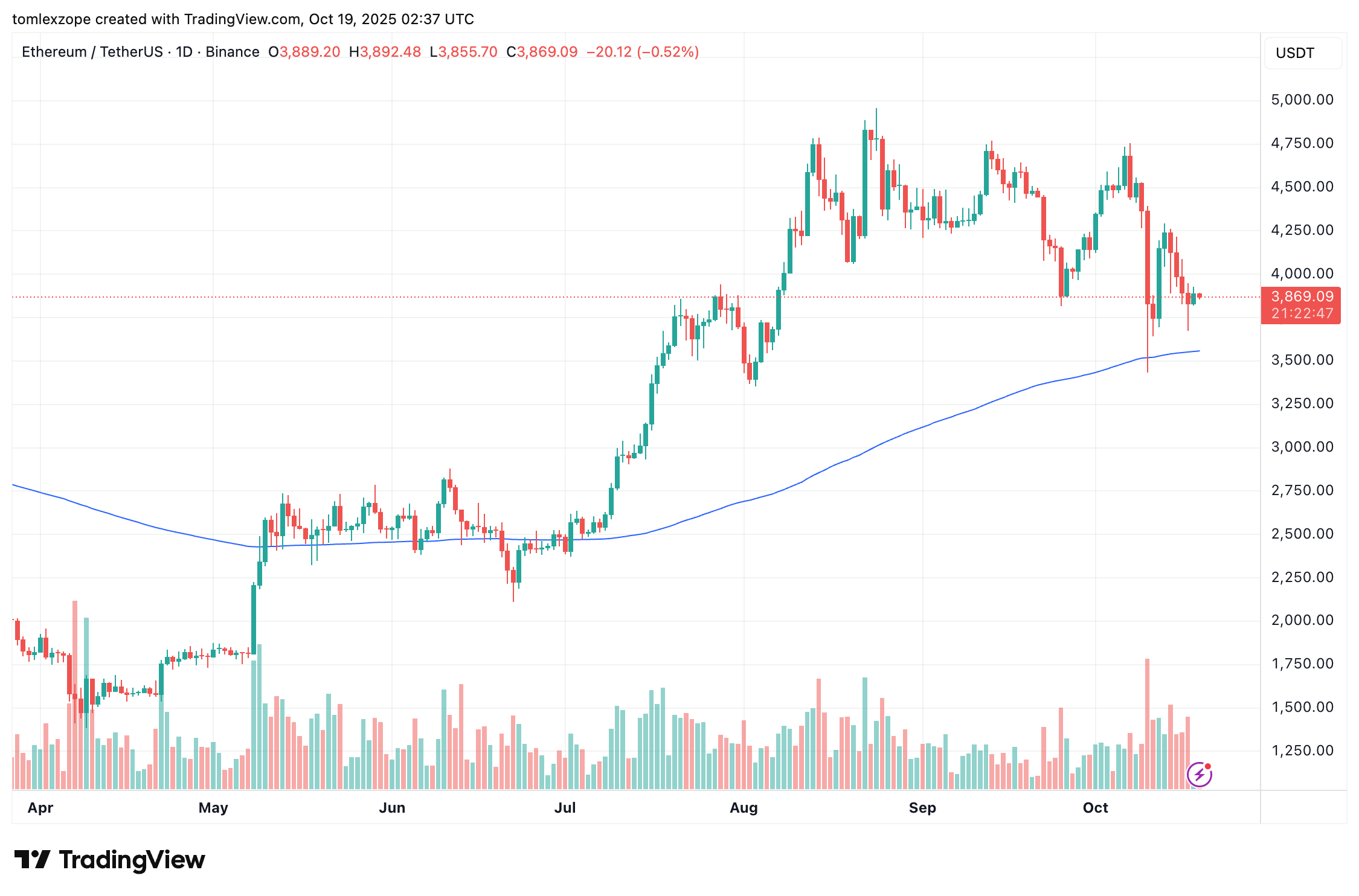

The worth of Ethereum seems to be recovering properly over the weekend after a interval of investor uncertainty. The “king of altcoins”, following what seemed like an aggressive return above the $4,200 degree earlier this week, is now lagging below the psychological $4,000 mark.

Whereas the Ethereum value has been constructing some constructive momentum over the previous day, the shadows of the October 10 downturn nonetheless appear to be weighing on investor sentiment. A market phenomenon often known as the “Kimchi Premium” suggests just a few tedious weeks forward for the second-largest cryptocurrency.

What Occurred Final Time Kimchi Premium Noticed A Comparable Surge

In a current publish on the social media platform X, market analyst CryptoOnchain revealed that the Kimchi Premium has been on the rise over the previous weeks. This remark relies on the motion of the on-chain indicator Korea Premium Index, which measures the worth distinction between South Korean exchanges and different international exchanges.

This metric, or the “Kimchi Premium,” exhibits how a lot additional Korean merchants are prepared to pay for a selected cryptocurrency (Ethereum, on this case). When the index is constructive, it implies that Korean retailers are prepared to pay a premium for the crypto property. In the meantime, a unfavourable Korean Premium Index alerts that the retailers are solely prepared to purchase the cryptocurrency at a reduction.

In keeping with CryptoOnchain, the Korea Premium Index for Ethereum not too long ago noticed a notable surge to round 8.2%, its second-highest degree this yr. The market analyst famous that this degree of Kimchi Premium is a troubling signal, because it traditionally suggests excessive retail FOMO (Concern of Lacking Out) and a possible value prime.

Sometimes, whales are likely to make the most of the worth hole by promoting on Korean exchanges when the Korea Premium Index is on the rise. On account of elevated promoting strain, the Ethereum value now faces a higher danger of correction.

As an example, the final time ETH noticed a Kimchi Premium this excessive was in January, coinciding with the worth fall to round $1,500. With this in thoughts, traders would possibly wish to tread with warning, as the percentages of a sustained downward pattern are considerably larger.

Ethereum Worth At A Look

As of this writing, the worth of ETH stands at round $3,875, reflecting no vital change up to now 24 hours. In what was anticipated to be a bullish interval for the cryptocurrency market, “Uptober” has not notably lived as much as the expectations of traders. After a constructive begin to the month, the Ethereum value is presently down by nearly 10%.