In a serious transfer for the digital asset neighborhood, Fort Crypto has introduced the acquisition of NFT-Stats.com, a number one portal for NFT market analytics. This integration combines one of the vital in depth information dashboards monitoring the worldwide NFT ecosystem with Fort Crypto’s information of blockchain media and cryptocurrency. Collectively, Fort Crypto will be capable to advance NFT stats protection and supply buyers, collectors, and followers with a extra complete, clear, and helpful understanding of the market.

Why This Deal Issues

The NFT market is often characterised as erratic, quick-moving, and difficult to observe in actual time. Initiatives have fluctuated almost immediately, from the height of 2021 to the cyclical declines and recoveries of 2023–2025. Making sense of the cacophony now requires having dependable, exact statistics; it’s not a selection.

With this acquisition, Fort Crypto good points entry to detailed metrics on buying and selling volumes, gross sales, transactions, collections, and blockchain-level efficiency throughout Ethereum, Solana, Polygon, Arbitrum, Base, BNB Chain, and past. The synergy is not going to solely profit Fort Crypto’s readers but in addition broaden its affect as a go-to hub for professional-grade Web3 intelligence.

A Market Outlined by Highs and Lows

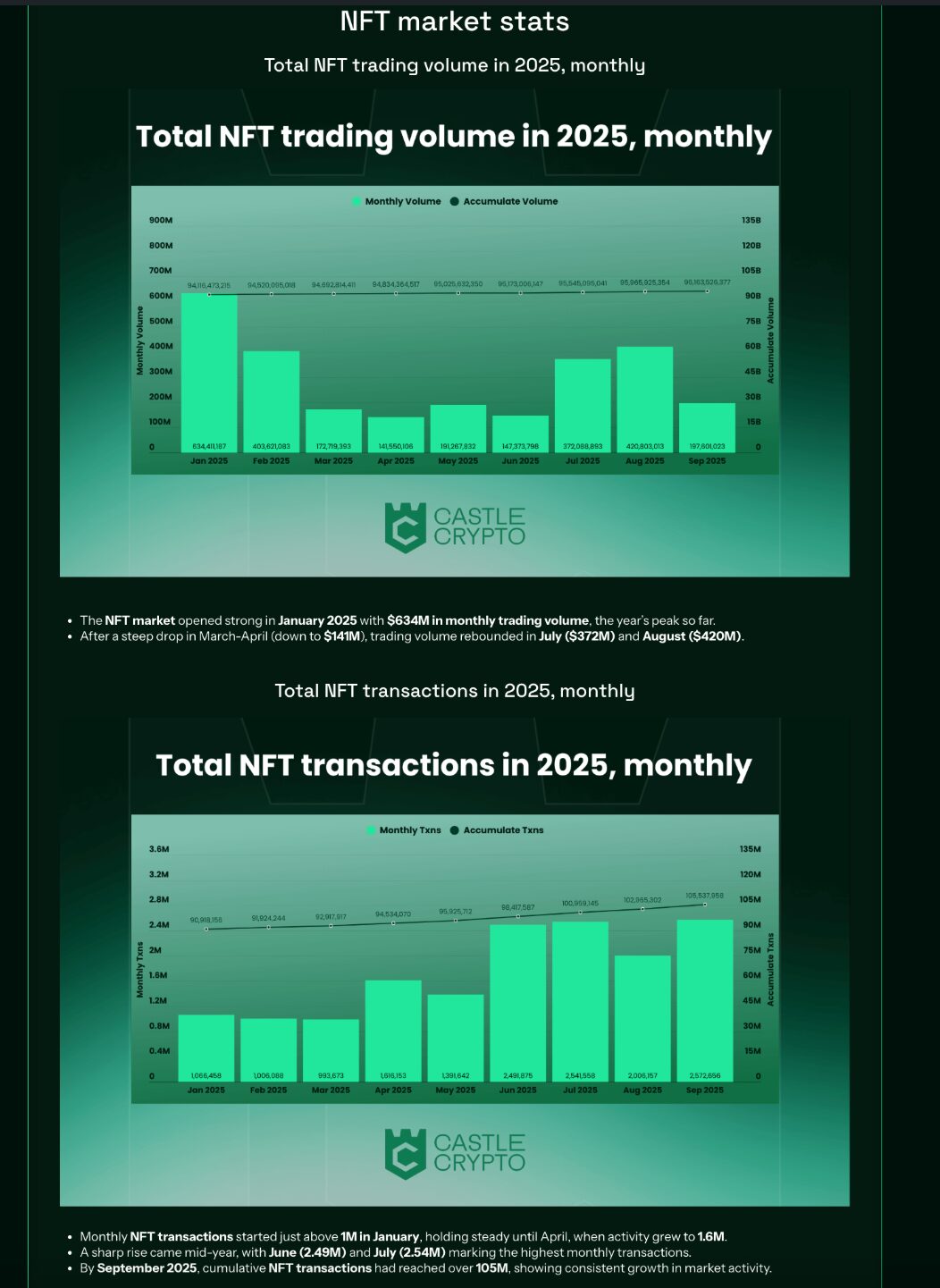

The NFT ecosystem in 2025 illustrates how rapidly fortunes can shift. Buying and selling volumes, for instance, reached a yearly peak of $634 million in January, solely to plunge to only $141 million by March–April. A pointy rebound in midsummer noticed volumes get well to $372 million in July and $420 million in August, underscoring the cyclical nature of the house.

Transaction counts inform an identical story. Month-to-month exercise started at roughly 1 million transactions in January, accelerated to 1.6 million by April, and spiked above 2.5 million throughout June and July. By September, cumulative transactions exceeded 105 million, proof that regardless of volatility, engagement continues to broaden.

Gross sales, nonetheless, reveal the delicate aspect of demand. The market peaked in April however dropped considerably afterward, with late-summer exercise barely reaching 1–4 million gross sales per 30 days. The imbalance between consumers and sellers was particularly pronounced in spring, though the second half of the yr noticed the 2 sides almost equalize at round 450,000 every by September.

Multi-Chain Competitors and Growth

Ethereum stays the undisputed heavyweight, commanding $90.93 billion in whole buying and selling quantity and greater than 38 million transactions. But the story of 2025 is not only Ethereum’s dominance however the speedy emergence of challengers.

Solana generated $2.48 billion in quantity with notable spikes on Magic Eden, although exercise cooled sharply in Q3.Polygon processed over 22.9 million transactions, cementing its position as a high-velocity, lower-cost hub.Base, a relative newcomer, surpassed 10 million transactions and delivered 124 billion gross sales in January earlier than settling into steadier ranges later within the yr.BNB Chain’s transactions collapsed from round 1,000 in April to solely 36 by September, whereas Arbitrum’s quantity dropped from $6.8 million in January to only $1.8 million in September. Each corporations discovered it troublesome to maintain their momentum.

This cross-chain competitors reveals that whereas Ethereum units the benchmark, the NFT market is way from monolithic. Every community cultivates distinctive communities, marketplaces, and use circumstances.

Blue Chips and Rising Stars

NFT collections present one other lens on market well being. Legacy tasks like Crypto Punks and Bored Ape Yacht Membership (BAYC) stay iconic, however their efficiency displays ongoing hype cycles.

BAYC surged to $34.2 million in buying and selling quantity in August, greater than six occasions greater than June. Ground costs hover close to $39,000, up from a mint worth of simply $26.Crypto Punks, initially free to mint, boast a ground worth exceeding $182,000 and cumulative buying and selling quantity surpassing $3.28 billion.

Different collections inform tales of explosive progress and equally dramatic corrections:

Doodles hit a excessive of $41.9 million in buying and selling quantity in February with 3,800+ gross sales, however exercise pale towards the autumn.Pudgy Penguins delivered one of many strongest returns on funding, with a mint worth of $1.18 rising to a ground of over $42,000.Azuki, as soon as driving excessive at $116.5 million in January quantity, misplaced greater than 98% of month-to-month exercise by September.Rising collections like Mad Lads and Milady showcased sturdy ROI for early adopters, although their buying and selling volumes trended downward by means of the yr.

Such statistics spotlight the twin nature of NFTs: on one hand, they create long-term blue chips with enduring cultural cachet, and on the opposite, they produce tasks topic to speculative bursts and steep declines.

Market Wars

Equally telling is the battle amongst NFT marketplaces.

Magic Eden dominates Solana with month-to-month volumes exceeding $33 million, whereas rivals like TensorSwap almost vanished.OpenSea stays the first driver on Ethereum, Polygon, and Base, main in each gross sales and transaction counts. In June alone, OpenSea processed greater than 248,000 Ethereum transactions.Blur, a fast-rising competitor, peaked at $341 million in buying and selling quantity in January however struggled to keep up that momentum because the yr progressed.On BNB Chain, PancakeSwap and Tofu competed for scraps, dealing with volumes measured in 1000’s quite than thousands and thousands.

These dynamics reveal not simply the place liquidity concentrates however how neighborhood belief and community results can rapidly consolidate round a number of dominant platforms.

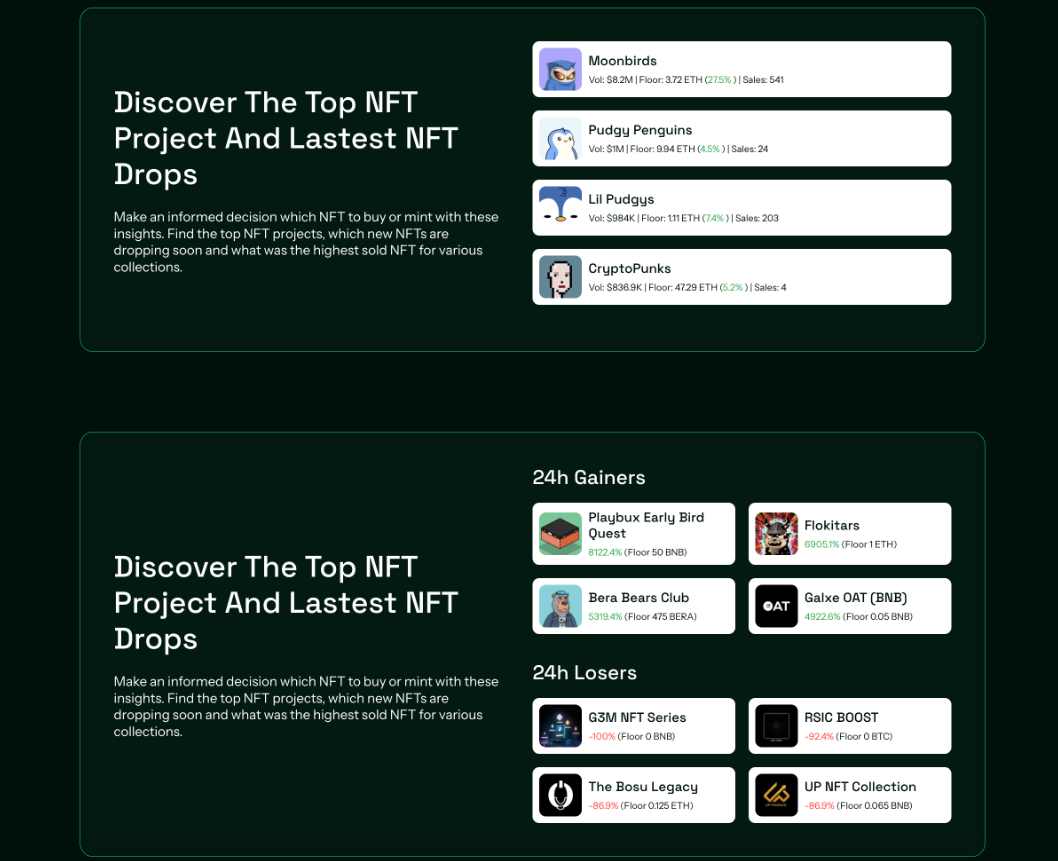

The Worth of Clear NFT Stats

The mixing of NFT-Stats.com into Fort Crypto’s ecosystem will make these insights extra accessible and contextual. For skilled merchants, seeing real-time winners and losers throughout 24-hour home windows offers a tactical benefit. For long-term buyers, understanding possession distribution, ground worth stability, and cross-chain enlargement gives a extra strategic perspective.

Fort Crypto’s editorial experience will be sure that uncooked information just isn’t solely introduced but in addition interpreted. Fairly than a static dashboard of numbers, readers can count on deep dives into what these numbers imply, how they connect with broader market shifts, and the place alternatives or dangers might lie.

Trying Forward

The acquisition is a symptom of how significantly the crypto media scene is altering, and it goes past a easy monetary deal. Fort Crypto hopes to determine a brand new benchmark for dependability and transparency in a discipline that’s typically tainted by hype by integrating sturdy NFT analytics into its wider protection of blockchain and Web3 video games.

Correct information will affect how builders, buyers, and collectors traverse this quickly evolving discipline as NFTs proceed to search out their manner into video games, metaverse platforms, and real-world purposes. With Fort Crypto’s relocation, anyone with an curiosity in NFTs may have a single location with thorough information, professional evaluation, and actionable insights.

Remaining Ideas

Regardless of its volatility, the NFT market of 2025 reveals resilience, innovation, and rising multi-chain acceptance over the long term. By buying NFT-Stats.com, Fort Crypto locations itself on the forefront of this growth by offering not simply information but in addition the tales that accompany it.

This new alliance marks a turning level for anyone who’s critical about understanding NFTs: the beginning of a extra sustainable, clear, and knowledgeable period for digital possession.