A US authorities shutdown and the weak jobs report have pushed digital asset funding merchandise to their strongest weekly inflows on document.

In keeping with the newest CoinShares report, crypto-related funding merchandise attracted $5.95 billion in inflows final week, pushing complete property underneath administration (AUM) to an all-time peak of $245 billion.

The rally didn’t emerge from retail pleasure or on-line hypothesis. As a substitute, it stemmed from macroeconomic unease following the US authorities shutdown and disappointing employment information.

Buyers appeared to interpret each as warning indicators in regards to the nation’s fiscal resilience and the Federal Reserve’s coverage course.

James Butterfill, head of analysis at CoinShares, defined that the inflows mirrored a delayed investor response to the Federal Open Market Committee’s current fee lower and present US authorities occasions.

In keeping with him:

“We imagine this was resulting from a delayed response to the FOMC rate of interest lower, compounded by very weak employment information, as indicated by Wednesday’s ADP Payroll launch, and issues over US authorities stability following the shutdown.”

This resulted in a wave of capital looking for refuge in property perceived as each liquid and resilient.

The CoinShares report advised that buyers look like treating digital property not as speculative performs however as macro hedge devices that reply to fiscal turbulence and liquidity shifts.

Bitcoin sees its strongest week

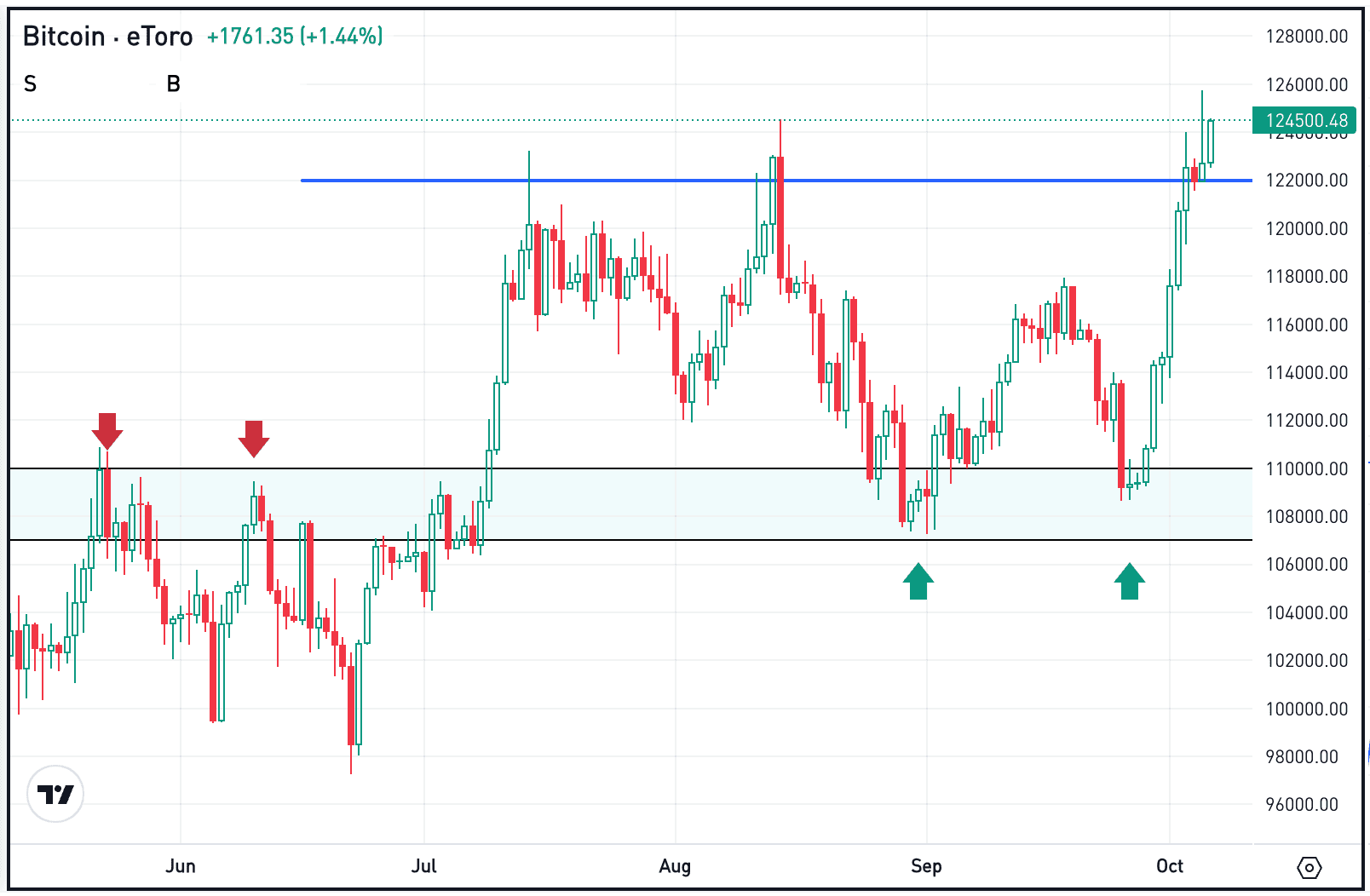

As anticipated, Bitcoin absorbed most of final week’s inflows, capturing a document $3.55 billion in contemporary capital. That is its strongest week in historical past.

Notably, the 12 US-based Bitcoin ETF suppliers, together with BlackRock, accounted for roughly $3.2 billion of that complete, which is their second-strongest weekly efficiency since launch final yr.

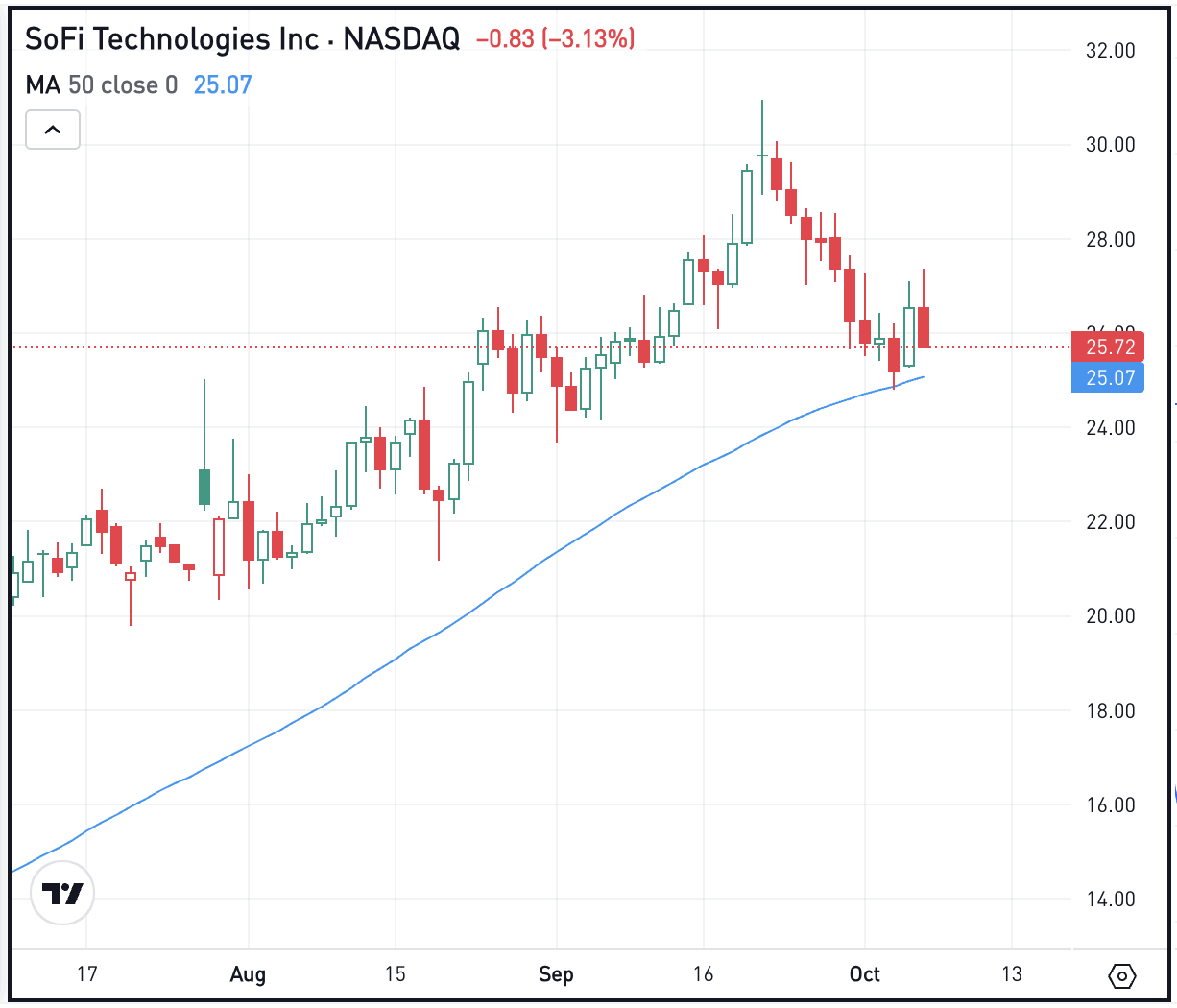

Conversely, brief Bitcoin merchandise noticed no flows for the week, signaling renewed investor confidence as costs strategy new highs. BTC worth reached a brand new all-time excessive of greater than $125,000 through the weekend.

This transfer highlights Bitcoin’s enduring function because the market’s liquidity anchor and a most well-liked hedge in unsure instances.

Ethereum and Solana lead inflows

Ethereum additionally turned a nook through the interval.

After weeks of redemptions, the asset drew $1.48 billion in new capital, lifting its year-to-date complete to $13.7 billion. Notably, that is almost triple its complete inflows for final yr.

On the similar time, Solana-focused funds hit an all-time excessive of $706.5 million, pushing their 2025 tally to $2.85 billion, whereas XRP noticed $219.4 million amid anticipation of recent spot funding merchandise.

These inflows present that crypto markets are now not reacting to hype however to macro alerts, together with liquidity tendencies, fee coverage, and institutional sentiment.

Talked about on this article