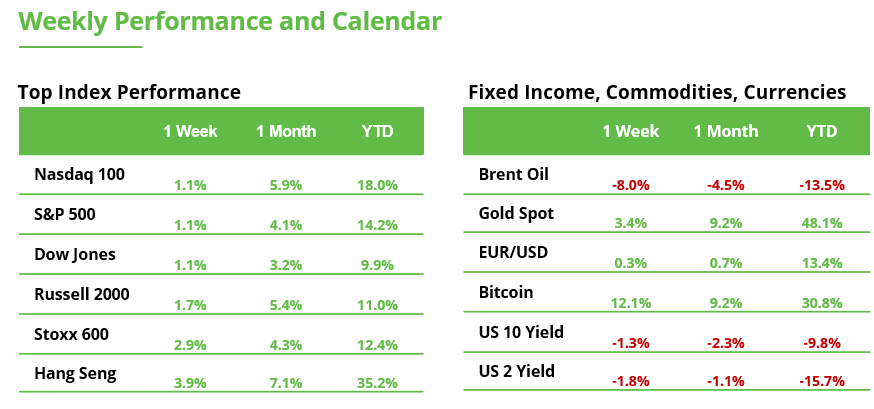

Analyst Weekly, October 6, 2025

After a quiet few months, Bitcoin is perhaps gearing up for its favourite seasonal commerce: the fourth-quarter comeback. Crypto’s finest three-month stretch traditionally begins proper about now, with median positive factors above 50% from October via December. The setup seems to be acquainted: yields are falling, volatility is low, and merchants are as soon as once more looking for risk-on belongings because the Fed’s easing cycle positive factors traction.

Bitcoin This fall 2025 Outlook

Bitcoin enters the fourth quarter with energy, coupled with indicators of warning. October has earned its “UpTober” fame, with double-digit positive factors in most cycles since 2013. The post-halving dynamic and the psychological part of merchants anticipating rallies may act as catalysts. Nonetheless, whereas the asset stays inside a structurally bullish technical transfer, we observe some traditional indicators of maturity. Though projections point out that an extension towards 150,000 is feasible, every further leg will increase the danger of exhaustion. On-chain indicators affirm this ambivalence, because the MVRV Z-score stays removed from historic peaks, however long-term holders are promoting and whales are starting to cut back publicity.

In the meantime, the tokenization wave is gaining pace. Stablecoins surpassed $300 billion in market capitalization for the primary time, with quarterly development outpacing many conventional asset courses. Narratives to observe embrace “agentic” funds pushed by AI with stablecoins as the bottom layer, interoperability amongst a number of issuers and platforms, and new regulatory tensions from Hong Kong to Europe. In parallel, CME is increasing its derivatives providing (with Solana and XRP choices this October, and the promise of 24/7 buying and selling in 2026), whereas the SEC’s simplification in ETF approval opens the door to merchandise based mostly on belongings far much less liquid than bitcoin.

Altogether, this attracts a well-recognized late-cycle image. When altcoins outperform BTC, when memecoins enter ETFs, when infrastructure tales dominate headlines, it’s extra typically a symptom of maturity than the beginning of a brand new part. Nothing prevents one final bullish leg, the market may effectively set new highs in This fall, however the greater threat is {that a} macro shock or an fairness market downturn coincides with indicators of crypto exuberance, turning euphoria into volatility.

Thus, the fourth quarter combines seasonal and structural tailwinds with rising proof that the cycle is in its superior stage. The check might be whether or not institutional flows and the momentum of tokenization can offset the load of macro dangers and investor overconfidence.

Healthcare’s Checkup: From Coverage Ache to Potential Achieve

Healthcare shares simply acquired a much-needed shot within the arm. The sector, which has trailed the S&P 500 for many of the previous two years, surged after information of a US–Pfizer deal that would reset expectations on drug pricing and tariffs.

Beneath the settlement, Pfizer agreed to decrease costs on Medicaid medicine in trade for 3 years of tariff reduction, a shock transfer that would trigger different pharma giants to observe swimsuit.

Investor Takeaway: With Pfizer pledging $70B in new US investments, agreeing to decrease drug costs, and the White Home shelving 100% drug tariffs, the sector’s coverage headache is easing. Different companies like Johnson & Johnson, AstraZeneca, and Roche are following swimsuit, highlighting a broader “Made in America” healthcare development that would assist jobs and capability growth. For long-term buyers, that’s a dose of stability the market’s been ready for. For the previous few years, drugmakers have confronted fixed uncertainty over how aggressively Washington would possibly attempt to minimize or management prescription drug costs. That uncertainty, about potential caps, negotiations, or tariffs, have made buyers hesitant to purchase healthcare shares, as a result of it was unclear how far the federal government would go.

A Rally on the Prescription Pad

Healthcare shares rallied final week, with large names like Pfizer, Eli Lilly, and AbbVie main, as merchants wager on a This fall rebound. The coverage enhance is sparking hopes for a “catch-up commerce” as buyers rotate into lagging defensive sectors.

SMID Cap Healthcare Shares Get a Tax-Time Increase

Washington’s new One Massive Stunning Invoice (OBBB) will give smaller well being and biotech companies a significant tax break. Firms can now instantly expense their R&D prices, as a substitute of spreading them out over years.

That’s a sport changer for smaller healthcare innovators, particularly for those that spend closely on analysis however don’t but have big earnings to offset it. It successfully lowers their tax invoice and frees up money, letting them make investments quicker in new medicine and applied sciences.

Shares That Stand Out

Shares may acquire most from this setup are those that spend most on R&D, equivalent to:

Roviant Sciences ($ROIV) – heavy R&D focus and pipeline-driven mannequin.ACADIA Prescription drugs ($ACAD) – smaller-cap biotech with excessive R&D-to-sales ratio.Arrowhead Prescription drugs ($ARWR) – early-stage biotech leveraging RNAi tech, sturdy beneficiary of upfront expensing.Dynavax Applied sciences ($DVAX) – vaccine developer with substantial US-based R&D.Jazz Prescription drugs ($JAZZ) – sturdy reinvestment profile, mid-cap identify with home operations.

What May Maintain the Rally for the Sector Going

Past politics, fundamentals are enhancing. The brand new R&D expensing guidelines from this summer time’s tax invoice permit healthcare and biotech companies, particularly for small and mid-cap gamers, to jot down off analysis prices instantly, boosting near-term profitability. Add in Fed price cuts and a backdrop of falling inflation, and the setup seems to be more and more supportive for long-duration sectors like well being and biotech. Lastly, ETF flows have been unfavorable, suggesting many buyers already capitulated, a contrarian setup.

Past Weight Loss: GLP-1s Energy a Lasting Pharma Transformation

GLP-1s have reshaped pharma into one of the highly effective development tales in world markets, creating tech-style winners like Eli Lilly and Novo Nordisk. Lilly is up almost 400% in 5 years and Novo stays far forward of friends, exhibiting that even with short-term pullbacks and job cuts, the long-term trajectory is unbroken. That’s as a result of the leaders aren’t simply driving a one-drug increase: they’re broadening entry with oral formulations, defending share in weight problems and diabetes regardless of pricing and formulary noise, and constructing sturdiness with development in oncology and immunology.

For buyers, which means GLP-1s have clearly shifted from a disruptive area of interest into a various, multi-franchise development engine, the place the chance lies in hanging the appropriate steadiness between chasing disruptive upside and anchoring in stability.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.