Thailand’s Securities and Change Fee (SEC) is getting ready new guidelines to permit native spot crypto-based exchange-traded funds (ETFs) and broaden the potential lineup past Bitcoin (BTC).

Thai SEC To Widen ETF Lineup With New Guidelines

On Wednesday, Thailand’s SEC Secretary-Common, Pornanong Budsaratragoon, revealed that the regulatory company is working to broaden its crypto ETF plans past Bitcoin and embody different digital property within the coming months.

In an interview with Bloomberg, the regulator said that the SEC and different companies are drafting new guidelines to permit native mutual funds and establishments to supply digital asset-based ETFs for the primary time, with the rollout anticipated for early 2026.

It’s value noting that Thai traders can presently achieve publicity to those merchandise by investing in funds managed by licensed asset administration corporations that spend money on abroad crypto ETFs.

In June 2024, Thailand’s SEC formally accepted One Asset Administration to launch a fund-to-fund Bitcoin ETF, which permits institutional traders to achieve publicity to BTC-based funding merchandise listed abroad.

In January, the Secretary-Common unveiled that the regulatory company was evaluating the itemizing of native spot Bitcoin ETFs to strengthen the nation’s digital property market, affirming the regulator’s intention to allow each people and establishments to spend money on regionally listed Bitcoin ETFs.

“We’ve to adapt and be sure that our traders have extra choices in crypto property with correct safety,” she defined on the time. The brand new guidelines would transcend the present limitations and broaden the potential ETF lineup to a broader basket of crypto property.

“Our risk now could be to broaden the factors for the crypto akin to a basket of cryptocurrencies,” Pornanong instructed Bloomberg. “We need to have broader provide of these crypto property within the ETFs.”

Thailand Continues Crypto Hub Efforts

The Secretary-Common additionally highlighted traders’ need to diversify their portfolios and undertake digital property as a part of their funding methods, particularly amongst younger individuals, noting that the company’s predominant process is to “facilitate” that demand beneath a authorized framework.

Thai regulators have been accelerating their efforts to turn out to be a regional crypto hub, the report said, creating a number of insurance policies aimed toward making tokenized merchandise mainstream funding selections.

Earlier this yr, the SEC, alongside the Financial institution of Thailand (BOT), launched a crypto sandbox in vacationer areas to reinforce the nation’s attraction as a tech-savvy vacation spot, promote innovation, and the usage of digital property to spice up the financial system and tourism business.

As reported by Bitcoinist, the TouristDigiPay sandbox, launched in August, goals to facilitate the conversion of digital property into Thai Baht for the spending functions of international guests, permitting Bitcoin and digital property as cost strategies in vacationer areas to drive adoption.

Furthermore, the regulatory company has additionally proposed rule adjustments to offer crypto exchanges with flexibility whereas enhancing investor safety and oversight, permitting digital asset platforms to checklist their utility tokens or tokens issued by affiliated entities.

In the meantime, Thailand’s Deputy Finance Minister, Julapun Amornvivat, shared a plan to drop capital good points tax on digital property for 5 years. The minister introduced that, beginning January 1, 2025, till December 31, 2029, traders who promote their property by means of licensed crypto service suppliers gained’t need to pay taxes on the income.

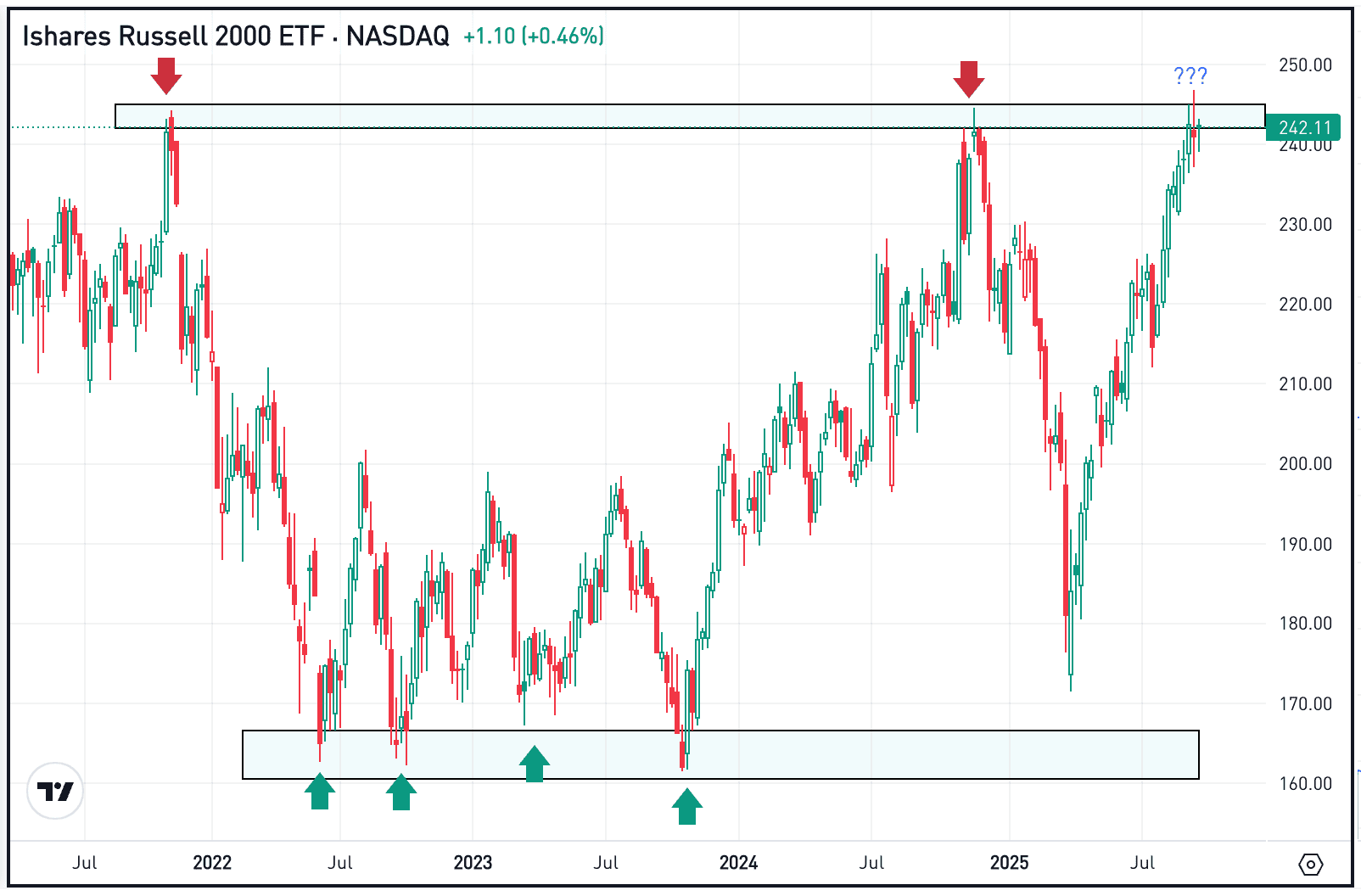

Bitcoin (BTC) trades at $118,897 within the one-week chart. Supply: BTCUSDT on TradingView

Featured Picture from Unsplash.com, Chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.