Crypto-linked cost playing cards have developed from a distinct segment product right into a mainstream cost methodology, with utilization now measurable on a big scale.

In Q3 2025, Easy Pockets analyzed anonymized transactional knowledge from 1,000 randomly chosen European cardholders to measure precise spending habits. On the similar time, we at Changelly surveyed over 3,000 of our customers worldwide to seize self-reported adoption tendencies. Collectively, this knowledge gives probably the most detailed seems at how crypto playing cards are utilized in apply so far.

Changelly is a number one prompt cryptocurrency alternate platform and international blockchain API supplier.

Key Findings

60.6% of surveyed customers already use crypto playing cards.

High use instances: on-line transactions (66%) and on a regular basis purchases (61%).

Common transaction dimension in Europe: €40.

High advantages: ease of use (65%), cashback (56%), flexibility (43%).

Key obstacles: 58% don’t know what crypto playing cards are, and 43% cite restricted service provider acceptance (Changelly survey, 2025).

Adoption: 60% Already Use Crypto Playing cards

Survey knowledge from over 3,000 Changelly customers exhibits that 60.6% are already utilizing a crypto card, whereas 39.3% should not. Transaction data from 1,000 Easy Pockets cardholders in Europe again this up, exhibiting hundreds of real-world purchases every month with a mean ticket dimension of about €40. This mixture of self-reported and noticed knowledge factors to a transparent majority of lively crypto customers already spending by playing cards.

Consumer Motivations: Over 60% of All Transactions Are On a regular basis and On-line Purchases

Crypto spending has shifted from occasional cash-outs to on a regular basis use. Easy Pockets’s June 2025 evaluation of 1,000 European cardholders exhibits that between 60% and 70% of all transactions go to routine bills akin to groceries, subscriptions like Netflix and Spotify, transport, utilities, on-line buying, and cafés. One other 15% to twenty% covers journey and cross-border spending: inns, automobile leases, purchases exterior the EU, and tolls. In the meantime, solely 10% to fifteen% pertains to topping up consumer accounts in neobanks like Revolut or high-ticket gadgets. The typical transaction dimension is about €40, and most funds are settled in USDC robotically transformed at checkout.

Changelly’s international survey tells the identical story: 66% say they use crypto playing cards for on-line transactions and 61% for on a regular basis purchases, in contrast with 45% for fiat conversion and 41% for journey.

Collectively, these findings point out that crypto playing cards are functioning as utility cost rails, not simply liquidation instruments. Suppliers trying to seize this market have to deal with seamless, low-friction on a regular basis use instances and advantages that mirror conventional playing cards.

“When a Easy Pockets consumer pays for groceries, streaming, or transport with USDC, it exhibits the shift: crypto isn’t a future promise, it’s already a part of the on a regular basis financial system,” says Alex Emelian, CEO of Easy Pockets.

What Customers Worth Most: 65% Say Simplicity, 56% Say Rewards

Each survey and transaction knowledge factors to the identical conclusion: crypto cardholders worth the identical issues as mainstream bank-card customers. In Changelly’s international survey, 65% cited ease of use as the highest advantage of crypto playing cards, 56% highlighted cashback and different rewards, and 43% pointed to flexibility—the power to carry crypto till cost and spend on demand.

Easy Pockets’s inside metrics and insights based mostly on years of expertise mirror these findings. Clients use crypto playing cards as a result of they behave like bizarre financial institution playing cards: tap-to-pay by way of Apple Pay/Google Pay, automated conversion in the intervening time of buy with no pre-swaps, and no disclosure of pockets balances to retailers or banks. Funds keep in crypto till cost, letting holders stay invested proper as much as checkout.

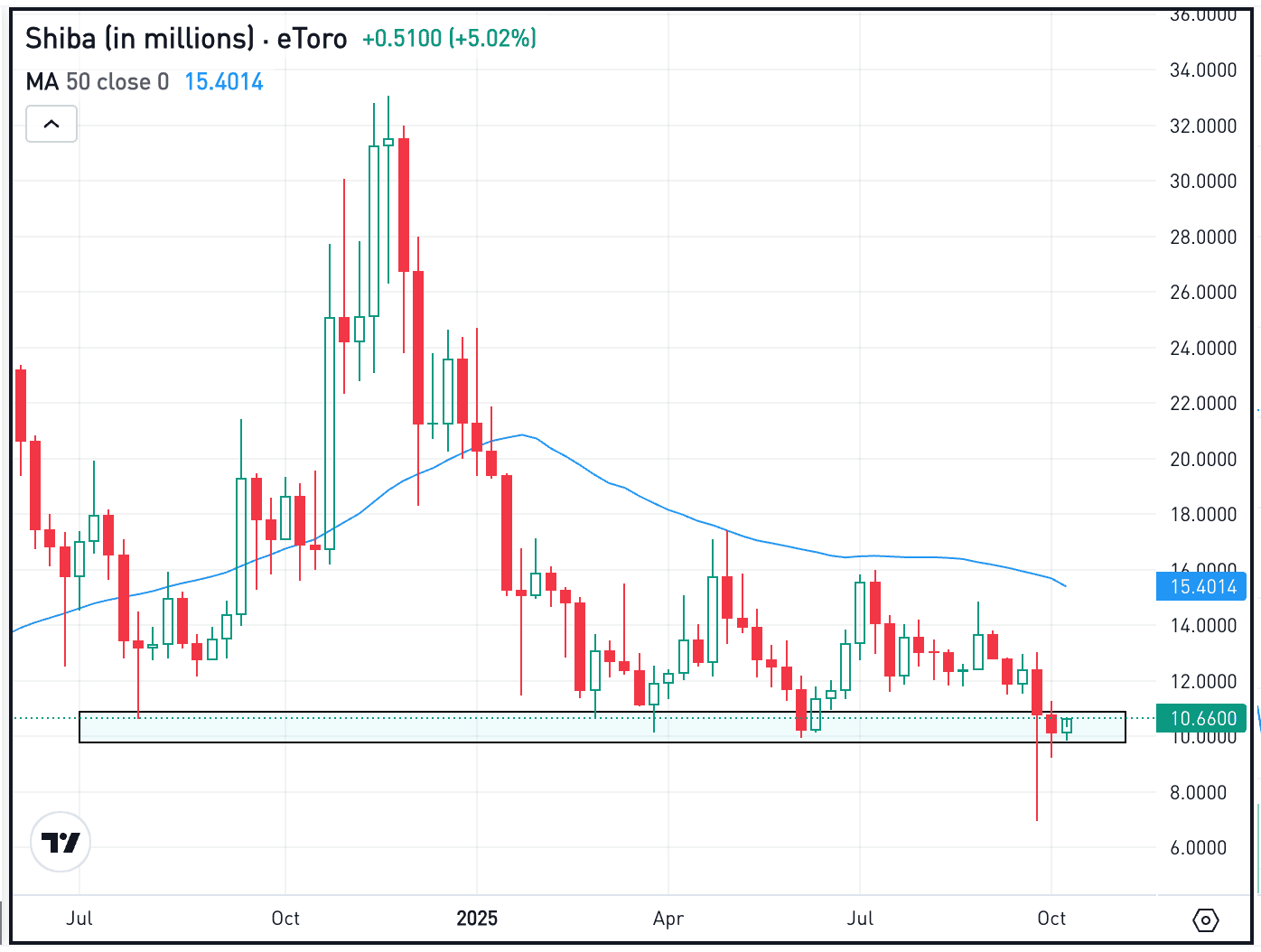

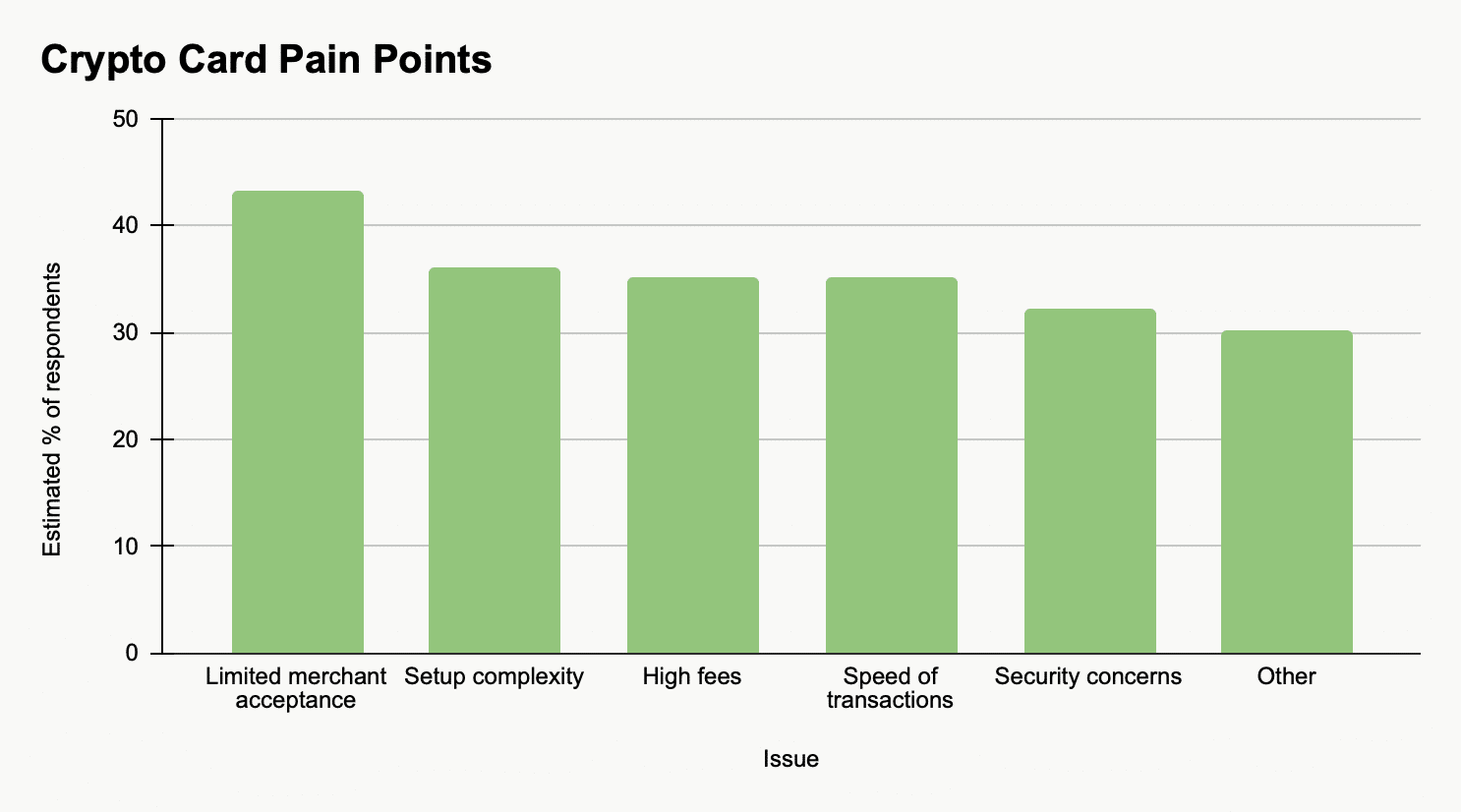

Ache Factors: 58% Non-Customers Declare Lack of Data as Key Barrier

Changelly’s survey exhibits that crypto card customers report comparatively few issues. In truth, 59% of respondents stated they skilled no challenges. Amongst those that do, the principle points are restricted service provider acceptance (43%), setup complexity (36%), excessive charges (35%), velocity of transactions (35%), and safety issues (32%).

For non-users, the image is totally different. 58% cite lack of know-how as the first cause for not adopting crypto playing cards, adopted by “I don’t personal crypto” (24%) and smaller shares mentioning price or belief points.

These findings recommend that the principle bottlenecks are schooling, belief, and infrastructure, somewhat than the know-how itself. Addressing these elements is prone to have extra influence on adoption than incremental characteristic modifications.

8 key areas to evaluation your WEB3 advertising and marketing!

Get the must-have guidelines now!

Why Crypto Playing cards Matter

Crypto playing cards should not nearly spending tokens—they shut the loop between Web3 belongings and the actual financial system. Easy’s expertise exhibits that their worth lies in 4 operational benefits:

Comfort. Customers pay precisely like with a traditional card or Apple Pay/Google Pay. No further steps, no pre-conversion.

Privateness. For enhanced consumer privateness, the service provider solely sees a regular card transaction, with out entry to the consumer’s crypto pockets particulars.

Flexibility. Belongings keep in crypto till the second of buy, permitting holders to stay invested and solely convert at checkout.

Crypto-native design. Playing cards settle for direct crypto funding with a user-friendly compliance course of for funding your account.

This positions crypto playing cards as on a regular basis monetary instruments somewhat than speculative devices. For companies, they unlock new alternatives:

Pockets suppliers acquire larger stickiness and spend retention.

Exchanges open income streams past spot buying and selling.

In brief, crypto playing cards make crypto simpler to make use of in every day life and prolong its attain throughout the broader monetary ecosystem.

Strategic Implications

Survey knowledge exhibits that 58% of non-users cite lack of know-how as the principle barrier to adoption, making schooling the first development lever for issuers. Clear onboarding and in-app steering can convert a big share of potential customers with out main product modifications. For instance, Easy has lowered registration to a five-minute on-line passport/ID test for EEA residents, turning what was as soon as a fancy course of into a fast commonplace step, changing a better proportion of their pockets customers into crypto card clients consequently.

Rewards and cashback are additionally decisive: Within the Changelly survey, 56% of respondents named rewards as a key profit. For optimum ease of adoption, UX should additionally mirror conventional playing cards. Easy has addressed this by adopting a banking-style interface with a built-in alternate and automated collection of low-fee networks, eradicating confusion about charges and settlement.

Final however not least, with stablecoins akin to USDC and EURC dominating card spending, suppliers ought to optimize liquidity swimming pools and FX routing to reduce prices and enhance reliability.

Taken collectively, these measures—schooling, frictionless onboarding, rewards and stablecoin-optimized infrastructure—outline the roadmap for successful a share within the crypto card market over the subsequent few years.

“This survey exhibits that schooling and usefulness are the actual catalysts for wider crypto-card adoption,” says Zifa Mae, Head of Product at Changelly. “Instantaneous alternate API suppliers like Changelly can assist by making funding and conversion seamless, whereas crypto playing cards suppliers deal with quick onboarding, clear rewards and stablecoin infrastructure to match the comfort of conventional playing cards.”

The Subsequent 5 Years in Crypto Playing cards

Card performance is prone to turn into a regular characteristic of main crypto wallets over the subsequent few years. Non-custodial, stablecoin-denominated playing cards will let customers spend immediately from their wallets and keep away from double conversions or tax-triggering swaps.

On-line banks akin to Revolut and N26 are already including crypto options, signaling that mainstream monetary apps are prone to begin accepting and routing crypto natively sooner or later. The mannequin will shift from “convert then spend” to “spend immediately,” with payroll, freelance earnings and passive earnings flowing straight to crypto playing cards.

This research exhibits a transparent path ahead: shut the data hole with schooling, win customers over with seamless UX, and lock in loyalty by stablecoins and rewards. Suppliers who execute on these three levers will outline the subsequent technology of cost rails.

Changelly presents a complete suite of blockchain APIs for enterprise, with native crypto-to-crypto swaps, crypto-to-fiat purchases, and Changelly Pay—a singular answer for retailers trying to settle for funds in crypto.

Disclaimer: Please word that the contents of this text should not monetary or investing recommendation. The data supplied on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native laws earlier than committing to an funding.