Key Takeaways:

Qatar Nationwide Financial institution (QNB), the Center East’s largest lender, now processes company USD funds in as little as two minutes through JPMorgan’s Kinexys blockchain platform.The transfer supplies 24/7 instantaneous settlement for greenback transactions, a significant leap over conventional banking rails that usually take days.The adoption highlights the accelerating institutional shift towards blockchain, with potential ripple results on crypto markets like Bitcoin, Ethereum, and Chainlink.

Qatar Nationwide Financial institution (QNB) has made a landmark transfer by adopting JPMorgan’s Kinexys blockchain platform to energy company US greenback transactions. The system, already processing billions each day worldwide, is now delivering near-instant funds for QNB’s purchasers, decreasing settlement instances from a number of days to minutes.

Learn Extra: JPMorgan’s Kinexys Enters New Period as Marex Launches First Actual-Time Blockchain Settlements

QNB Pushes Forward with Blockchain Integration

QNB, with belongings of greater than $300 billion, is the biggest monetary establishment within the Center East and North Africa (MENA). By becoming a member of Kinexys, it has positioned itself on the entrance of a regional race to modernize monetary infrastructure and reduce out the inefficiencies of legacy techniques.

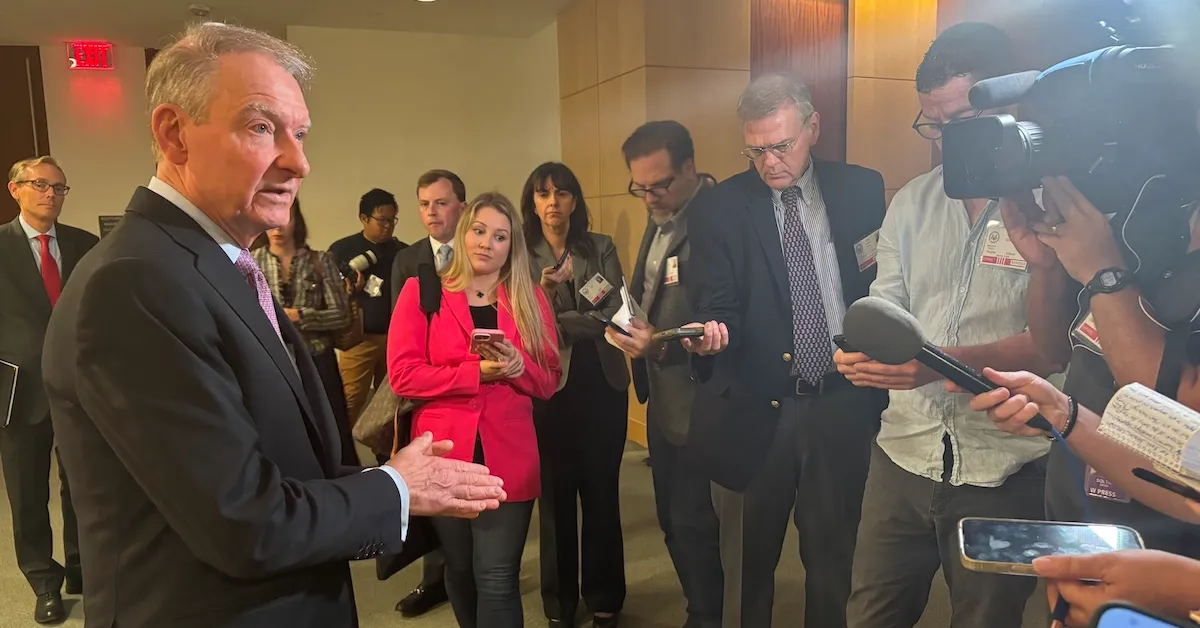

The brand new service supplies 24/7 company greenback settlement, giving multinational purchasers uninterrupted entry to liquidity. Kamel Moris, Government Vice President of World Transaction Banking at QNB, described the improve as “a treasurer’s dream,” underlining how blockchain now solves one of the vital persistent ache factors in cross-border banking.

Learn Extra: JPMorgan–Coinbase Deal Shakes Up Crypto: Credit score Card Buys, USDC Rewards, and Direct Financial institution Hyperlinks Coming

Kinexys: JPMorgan’s Rising Blockchain Wager

Launched in 2019, Kinexys builds on JPMorgan’s earlier blockchain experiments like Quorum and the Interbank Info Community. The platform has already processed greater than $1.5 trillion in transactions globally, with each day averages exceeding $2–3 billion.

The system makes use of blockchain-based deposit accounts and programmable funds, enabling real-time settlement and automation of treasury capabilities. As a substitute of ready days for worldwide wires to clear, QNB’s purchasers can now transfer {dollars} throughout borders nearly immediately.

How It Works for Corporates

Purchasers open blockchain-based accounts that mirror conventional deposits.Transactions are executed and verified on the Kinexys distributed ledger.Settlement happens inside minutes, with automated compliance checks inbuilt.

This efficiency has seen Kinexys achieve the curiosity of banks within the MENA area whose cross-border greenback flows are key to vitality export and worldwide commerce.

Aggressive Stress on Regional Banks

The motion by QNB is prone to create a domino impact within the banking trade of the Gulf. Legacy establishments that proceed to make the most of a legacy-based correspondent community may now discover themselves beneath stress to maneuver extra quickly in the direction of blockchain adoption or danger the lack of a consumer base that wishes a sooner and cheaper transaction.

As Qatar strives to ascertain itself as a world monetary heart, blockchain can be in keeping with its technique of a nationwide digital financial system. The benefits change into instantaneous to firms coping with worldwide commerce: they’ve entry to funds sooner, there’s extra transparency, and compliance is facilitated.

A Step Towards Tokenized Finance

JPMorgan has been clear that Kinexys isn’t just about sooner funds. It might probably additionally kind the inspiration of tokenized finance, wherein belongings comparable to bonds, cash market funds and even commerce receivables might be simply transferred throughout blockchain networks.

Asset managers comparable to BlackRock and Franklin Templeton are experimenting with tokenized funds already. The implementation of QNB demonstrates that the Gulf banks are prepared to unite the normal finance and blockchain-based monetary markets.

With additional blockchain adoption, this may open the door to a rise in institutional engagement within the wider crypto market, which additional reinforces the long-term funding argument round BTC and ETH.