The fourth quarter of 2025 is poised to be a watershed second for crypto markets, pushed by institutional capital flows by Bitcoin ETFs and probably the most important regulatory coordination effort in US crypto historical past.

The market actions usually are not suggesting simply one other cyclical rally, however a structural shift that could be completely altering how digital property combine with conventional finance.

The numbers inform a compelling story of institutional urge for food returning with pressure after Bitcoin ETFs skilled internet outflows by August, leading to cumulative flows dropping from $54.9 billion to $54.2 billion by month’s finish.

September delivered a reversal. Farside Traders’ information highlighted that Bitcoin ETFs attracted $2.56 billion in September alone, bringing the overall cumulative flows to just about $56.8 billion by Sept. 26, fully erasing August’s weak point.

This month-to-month surge represents extra than simply recovered momentum, signaling how traders are assured to incorporate Bitcoin of their portfolios.

Capital rotates however Ethereum holds regular

In the meantime, Ethereum (ETH) ETFs skilled the other trajectory after a liquidity rotation to those merchandise.

Farside Traders’ information confirmed that Ethereum ETF flows elevated from $9.65 billion to $13.54 billion in August, pushed by Ethereum’s spectacular 19% month-to-month acquire and a brand new all-time excessive of $4,957.41.

But, flows reversed course in September, declining to $13.155 billion as of Sept. 26. This $389 million outflow stresses how capital is rotating again to Bitcoin as the first institutional crypto play.

Regardless of the ETF outflow headwinds, Ethereum’s value motion reveals structural power that could be extra important than the headline numbers recommend.

Buying and selling at $4,147.97 as of press time, ETH has demonstrated resilience, significantly throughout the sharp 6.7% correction on Sept. 25, which briefly pushed the asset beneath $4,000.

Consequently, the swift restoration signifies that demand stays strong at the same time as institutional flows favor Bitcoin this month.

Moreover, Coinglass information indicated that change balances for Ethereum reached a one-year low of 13.03 million ETH on Sept. 29, representing a big decline from 15.48 million ETH in the beginning of August.

This 2.45 million ETH discount in change provide means that traders are withdrawing Ethereum for custody fairly than promoting into weak point, portray an optimistic long-term outlook.

This provide dynamic creates a possible setup for Ethereum’s upward transfer as soon as institutional consideration returns, characterised by a lowered liquid provide and continued demand progress.

Regulatory revolution: the tip of US crypto gridlock

Maybe much more transformative than the ETF flows is the unprecedented degree of regulatory coordination rising between the US Securities and Alternate Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC).

After years of jurisdictional uncertainty and conflicting steering, each companies at the moment are pursuing collaborative frameworks that would lastly present the readability the trade has demanded.

A pivotal second arrived on Sept. 17 when the SEC authorised generic itemizing requirements for commodity-based belief shares throughout Nasdaq, Cboe, and the New York Inventory Alternate. This streamlined approval course of marks a dramatic shift from the prolonged opinions that beforehand plagued crypto ETF purposes.

By lowering regulatory delays, the SEC has successfully opened new pathways for broader crypto funding merchandise, with a number of altcoin ETF purposes awaiting ultimate choices in October.

The regulatory momentum started earlier in February when CFTC Appearing Chairman Caroline Pham launched a pilot program exploring using tokenized collateral, together with stablecoins, in regulated derivatives markets.

By March, each companies had restarted staff-level conversations, with SEC Commissioner Hester Peirce confirming renewed cooperation efforts. This early coordination set the stage for extra bold initiatives.

July marked a turning level with SEC Chairman Paul Atkins asserting “Undertaking Crypto,” a commission-wide initiative designed to modernize securities guidelines for blockchain exercise and assist shift US markets “on-chain.”

The challenge aimed to determine clear token classification steering, create purpose-built exemptions for ICOs and airdrops, and allow SEC-regulated venues to supply complete crypto providers beneath unified licensing.

The regulatory momentum accelerated by September with a sequence of coordinated bulletins. On Sept. 2, each companies issued a joint workers assertion affirming that registered exchanges can supply spot crypto asset merchandise, signaling that regulatory obstacles are being systematically eliminated.

This was adopted by Sept. 23 bulletins of the CFTC’s tokenized collateral initiative and Atkins’ dedication to implement an “innovation exemption” by year-end.

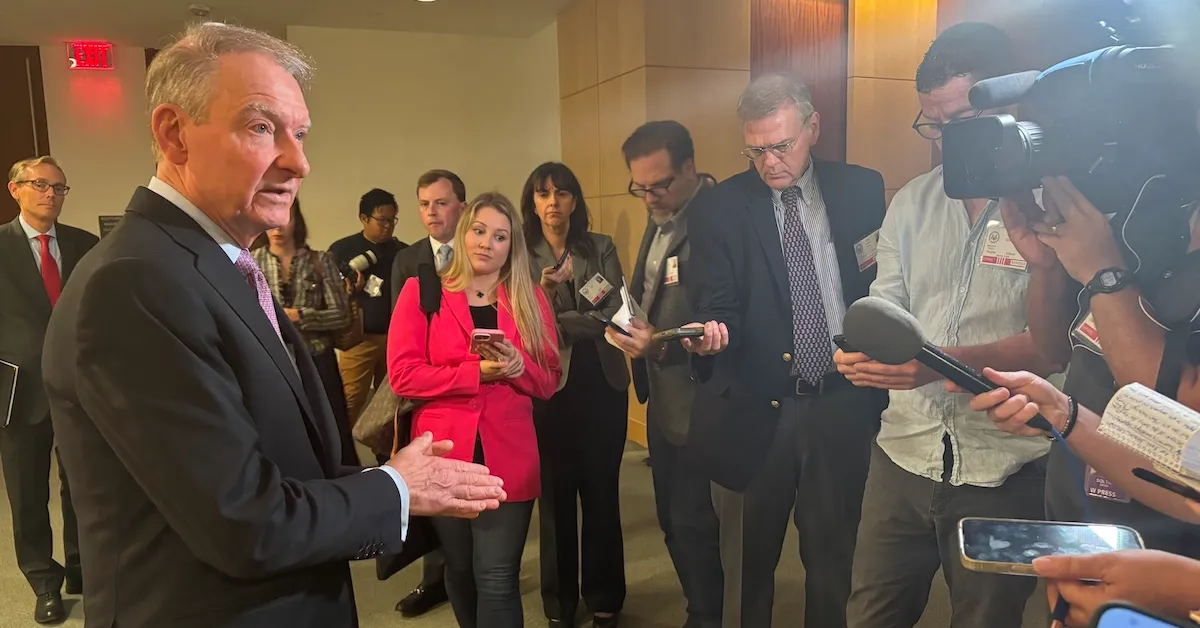

The Sept. 29 joint roundtable represents the fruits of those efforts, specializing in prolonged buying and selling hours, portfolio margining frameworks, and DeFi secure harbors.

This degree of inter-agency coordination is unprecedented in crypto regulation, signaling a basic shift from obstruction to facilitation.

The dying of crypto’s 4-year cycle

Conventional crypto market evaluation has lengthy relied on Bitcoin’s four-year halving cycle to foretell main value actions, however institutional participation is essentially altering these dynamics.

Bitwise CIO Matthew Hougan argued in July that the cycle’s affect is waning as provide shocks from halvings lose their efficiency in an more and more mature market.

The macro surroundings has additionally shifted dramatically. Rates of interest not create the identical downward stress on crypto property, whereas clearer regulatory frameworks are lowering the intense volatility and collapse dangers that when outlined crypto bear markets.

As an alternative of boom-bust cycles pushed by retail hypothesis and regulatory crackdowns, the market is witnessing extra sustained institutional accumulation.

This structural change is obvious in present market habits, the place company treasury accumulation and institutional portfolio building substitute whales promoting into retail euphoria.

New period of crypto-traditional finance integration

What makes the fourth quarter probably transformative isn’t simply the person developments in ETFs or regulation, however how these forces are converging to blur the traces between crypto and conventional finance.

ETF flows at the moment are amplifying the influence of Federal Reserve coverage choices on crypto markets, whereas regulatory harmonization is enabling institutional merchandise that had been beforehand unimaginable.

The prolonged bull construction in play differs essentially from earlier cycles. Somewhat than retail-driven hypothesis adopted by inevitable crashes, institutional participation is fostering extra constant and long-term progress patterns.

That is highlighted by Bitcoin’s fall to historic lows in realized volatility, based on a report by Bybit on Sept. 24.

The regulatory readability rising from the coordination between the SEC and CFTC is equally important. For the primary time, US establishments have a transparent pathway to supply complete crypto providers with out navigating conflicting regulatory interpretations.

Amid rising market maturity, the fourth quarter represents a basic inflection level. The mixture of institutional flows, unprecedented regulatory coordination, and structural market modifications suggests Bitcoin and Ethereum are turning from a speculative asset class to an built-in element of the worldwide monetary system.

Whether or not this proves to be crypto’s most transformative second might rely on how successfully the trade capitalizes on this unprecedented regulatory and institutional momentum.

Talked about on this article