Raoul Pal believes the crypto cycle will not be nearing a peak however getting into an extended, extra highly effective enlargement that may run effectively into 2026, pushed by a world liquidity uptrend tied to authorities debt dynamics. In a particular Sept. 25 “Every thing Code” masterclass with International Macro Investor (GMI) head of macro analysis Julien Bittel, the Actual Imaginative and prescient co-founder laid out a tightly interlocked framework connecting demographics, debt, liquidity and the enterprise cycle to asset returns—arguing that crypto and tech stay the one asset lessons structurally able to outpacing what he calls the hidden debasement of fiat.

Every thing Code: Liquidity Is Crypto’s Grasp Swap

“The most important macro variable of all time,” Pal stated, “is that world governments and central banks are rising liquidity to handle debt at 8% a 12 months.” He separated that ongoing debasement from measured inflation, warning traders to assume in hurdle charges, not headlines: “You’ve acquired an 11% hurdle price on any funding that you’ve got. In case your investments usually are not hitting 11% you’re getting poorer.”

Pal and Bittel’s “Every thing Code” begins with pattern GDP because the sum of inhabitants progress, productiveness and debt progress. With working-age populations declining and productiveness subdued, public debt has crammed the hole—structurally lifting debt-to-GDP and hard-wiring the necessity for liquidity.

“Demographics are future,” Pal stated, pointing to a falling labor-force participation price that, in GMI’s work, mirrors the inexorable rise in authorities debt as a share of GDP. The bridge between the 2, they argue, is the liquidity toolkit—steadiness sheets, the Treasury Common Account (TGA), reverse repos and banking-system channels—deployed in cycles to finance curiosity prices that the economic system can not organically bear. “If pattern progress is ~2% and charges are 4%, that hole must be monetized,” Pal stated. “It’s a narrative as previous because the hills.”

Associated Studying

Bittel then mapped what he known as the “dominoes.” GMI’s Monetary Circumstances Index—an econometric mix of commodities, the greenback and charges—leads whole liquidity by roughly three months; whole liquidity leads the ISM manufacturing index by about six months; and the ISM, in flip, units the tone for earnings, cyclicals and crypto beta. “Our job is to dwell sooner or later,” Bittel stated. “Monetary situations lead the ISM by 9 months. Liquidity leads by six. That sequence is what danger markets truly commerce.”

In that sequence, crypto will not be an outlier however a high-beta macro asset. “Bitcoin is the ISM,” Bittel stated, noting that the identical diffusion-index dynamics that govern small-cap equities, cyclicals, crude and rising markets additionally map onto BTC and ETH.

Because the cycle accelerates from sub-50 ISM towards the high-50s, danger urge for food migrates down the curve: first from BTC into ETH, then into massive various L1s and, solely later, into smaller caps—coinciding with falling BTC dominance. Pal cautioned traders who count on “prompt altseason” that they’re combating the phasing of the actual economic system: “It all the time goes into the following most secure asset first… solely when the ISM is de facto pushing larger and dominance is falling arduous do you get the remainder.”

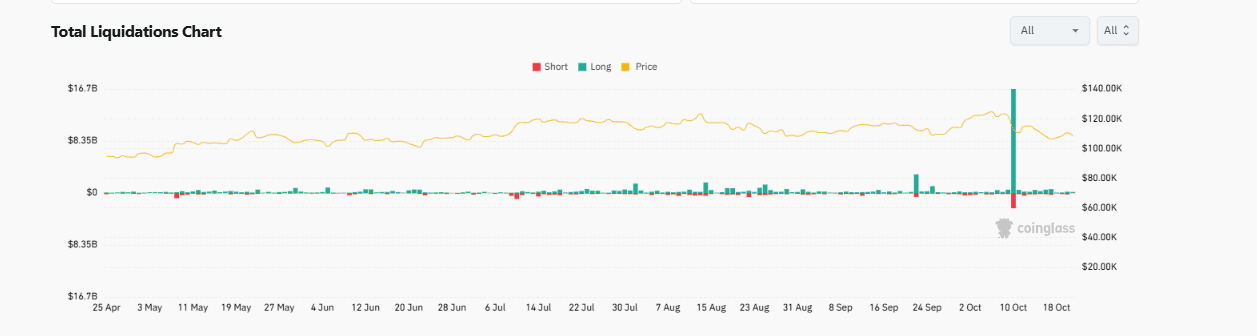

A part of the latest “sideways chop,” they argued, mirrored a pointy TGA rebuild—an exogenous liquidity drain that disproportionately impacts the far finish of the chance curve. Bittel highlighted that the $500 billion price of change since mid-July successfully eliminated gas that in any other case would have buoyed crypto costs, whereas stressing that the drain is nearing an inflection.

He additionally flagged DeMark timing alerts pointing to a reversal within the TGA’s contribution to internet liquidity. “That ought to now reverse and work decrease into year-end, which then will drive our liquidity composites larger,” he stated, including that the Individuals’s Financial institution of China’s steadiness sheet at all-time highs has partially offset US drags.

In opposition to that backdrop, the pair contend that the forthcoming 12 months are vital. “We’ve acquired $9 trillion of debt to roll over the following 12 months,” Pal stated. “That is the 12 months the place most cash printing comes.” Their base case has coverage charges shifting decrease right into a still-subdued however enhancing cycle, with central banks centered on lagging mandates—unemployment and core companies inflation—whereas early-cycle inflation breadth stays contained. Bittel underscored the sequencing inside inflation itself: commodities first, then items, with shelter disinflation mechanically lagging, giving central banks cowl to chop whilst progress accelerates.

The implication for portfolio development, Pal argued, is radical. “Diversification is useless. One of the best factor is hyper-concentration,” he stated, framing the selection not as a style for volatility however as arithmetic survival in opposition to debasement. In GMI’s long-horizon tables, most conventional property underperform the mixed debasement-plus-inflation hurdle, whereas the Nasdaq earns extra returns over liquidity and Bitcoin dwarfs each. “What’s the level of proudly owning another asset?” Pal requested rhetorically. “That is the super-massive black gap of property, which is why we personally are all-in on crypto… It’s the best macro commerce of all time.”

Associated Studying

Bittel overlaid Bitcoin’s log-regression channel—what Pal known as the “community adoption rails”—on the ISM as an instance how time and cycle amplitude work together. As a result of adoption drifts value targets larger via time, longer cycles mechanically level to larger potential outcomes. He confirmed illustrative channel ranges tied to hypothetical ISM prints to clarify the mechanism, from mid-$200Ks if the ISM rises into the low-50s to materially larger if the cycle extends towards the low-60s. The numbers weren’t introduced as forecasts however as a map for a way cycle power interprets into range-bound honest worth bands.

Macro Liquidity Extends The Crypto Bull Run

Critically, Pal and Bittel argued the present cycle differs from 2020–2021, when each liquidity and the ISM peaked in March 2021, truncating the run. In the present day, they are saying, liquidity is re-accelerating into the debt-refinancing window and the ISM continues to be beneath 50 with ahead indicators pointing up, organising a 2017-style This autumn impulse with seasonal tailwinds—and, in contrast to 2017, a better chance that power spills into 2026 as a result of the refinancing cycle itself has lengthened. “This can be very unlikely that it tops this 12 months,” Pal stated. “The ISM simply isn’t there, and world liquidity isn’t both.”

The framework additionally locates crypto inside a broader secular S-curve. Pal contrasted fiat debasement, which lifts asset costs, with GDP-anchored earnings and wages, which lag—explaining why conventional valuation optics look stretched and why proudly owning long-duration, network-effect property turns into existential.

He positioned crypto’s consumer progress at roughly double the web’s at a comparable stage and argued that tokens uniquely enable traders to personal the infrastructure layer of the following net. On whole addressable worth, he utilized the identical log-trend framing to all the digital asset market, sketching a path from roughly $4 trillion right this moment towards a possible $100 trillion by the early 2030s if the area tracks its “honest worth” adoption channel, with Bitcoin finally occupying a task analogous to gold inside a a lot bigger digital asset stack.

Pal closed with operational recommendation according to an extended, liquidity-driven enlargement: keep publicity to confirmed, large-cap crypto networks, keep away from leverage that forces capitulation throughout routine 20–30% drawdowns, and match time horizon to the macro clock reasonably than headlines. “We’re 4 % of the best way there,” he stated. “Your job is to not mess this up.”

At press time, the entire crypto market cap stood at $3.67 trillion.

Featured picture created with DALL.E, chart from TradingView.com