Bitcoin is going through renewed promoting stress, however to date, bears are struggling to push the value under the important thing $110,000 help. This stage has emerged as a crucial battleground for the market, with buyers intently watching whether or not bulls can preserve management. Regardless of the broader volatility, Bitcoin’s resilience right here is fueling hypothesis that after the present wave of promoting stress fades, BTC may very well be poised for one more surge.

Concern is creeping in as merchants weigh the dangers of additional corrections. Regardless of this, optimism lingers that Bitcoin’s underlying demand stays robust sufficient to maintain increased ranges in the long term.

Prime analyst Axel Adler shared recent insights that will tilt the steadiness towards the bullish facet. Based on Adler, if we “take away the noise,” the centralized change (CEX) market at the moment appears to be like cooled down when considered by change flows. Gross exercise has dropped sharply from earlier peaks, suggesting fewer speculative strikes and pointing towards what he describes as “HODL mode.” This cooling impact may restrict draw back dangers whereas setting the stage for accumulation-driven momentum.

Bitcoin Alternate Flows Present Indicators of Accumulation

Based on Adler, Bitcoin’s present change dynamics spotlight a major shift in market habits. Move Exercise Stress now stands at 9, which locations it within the decrease zone. This studying signifies that general circulation exercise is subdued, signaling decreased speculative actions on centralized exchanges. Adler explains that the present common Gross circulation (Influx + Outflow) is 70,000 BTC, a dramatic discount in comparison with the 266,000 BTC peak recorded in March 2024. This stark decline displays a market atmosphere that’s quieter and extra accumulation-driven, fairly than dominated by heavy buying and selling exercise.

As well as, Adler factors to the Web Move 30D Z-Rating of −0.7, which exhibits a reasonable bias towards purchases relative to the annual baseline. Because of this the cash coming into exchanges are largely being absorbed, with demand successfully consuming the accessible provide. Adler emphasizes that “every thing that involves exchanges will get purchased up,” whereas reserves proceed to be spent to fulfill this regular urge for food from consumers.

This kind of exercise usually alerts underlying power in Bitcoin’s construction. Whereas short-term volatility stays a priority, the decreased circulation exercise and regular absorption of provide trace at an accumulation part. Within the greater image, this dynamic helps the thesis that BTC is getting ready for continuation as soon as market sentiment shifts again in favor of consumers.

Technical Particulars: Testing Key Help

Bitcoin (BTC) continues to battle promoting stress, with the value at the moment hovering round $111,802. The 12-hour chart exhibits BTC urgent towards a crucial help zone, simply above $111K, which has held a number of occasions over the previous few months. A breakdown under this stage may expose the market to deeper corrections towards the psychological $110K mark and even the 200-day transferring common close to $105K.

The transferring averages are reflecting combined momentum. The 50-SMA is rolling over, signaling near-term weak point, whereas the 100-SMA and 200-SMA stay under the present worth, nonetheless reflecting longer-term bullish construction. For now, this means that whereas bears are urgent arduous, bulls haven’t totally misplaced management.

On the resistance facet, BTC continues to face a ceiling close to $118,000, a stage it failed to interrupt on a number of makes an attempt over the summer time. Solely a decisive breakout above this space would verify renewed bullish momentum.

Within the brief time period, volatility is predicted to stay elevated as merchants check the sturdiness of this help zone. Holding above $111K would reinforce the bullish case, whereas a break decrease dangers shifting sentiment towards a extra prolonged correction.

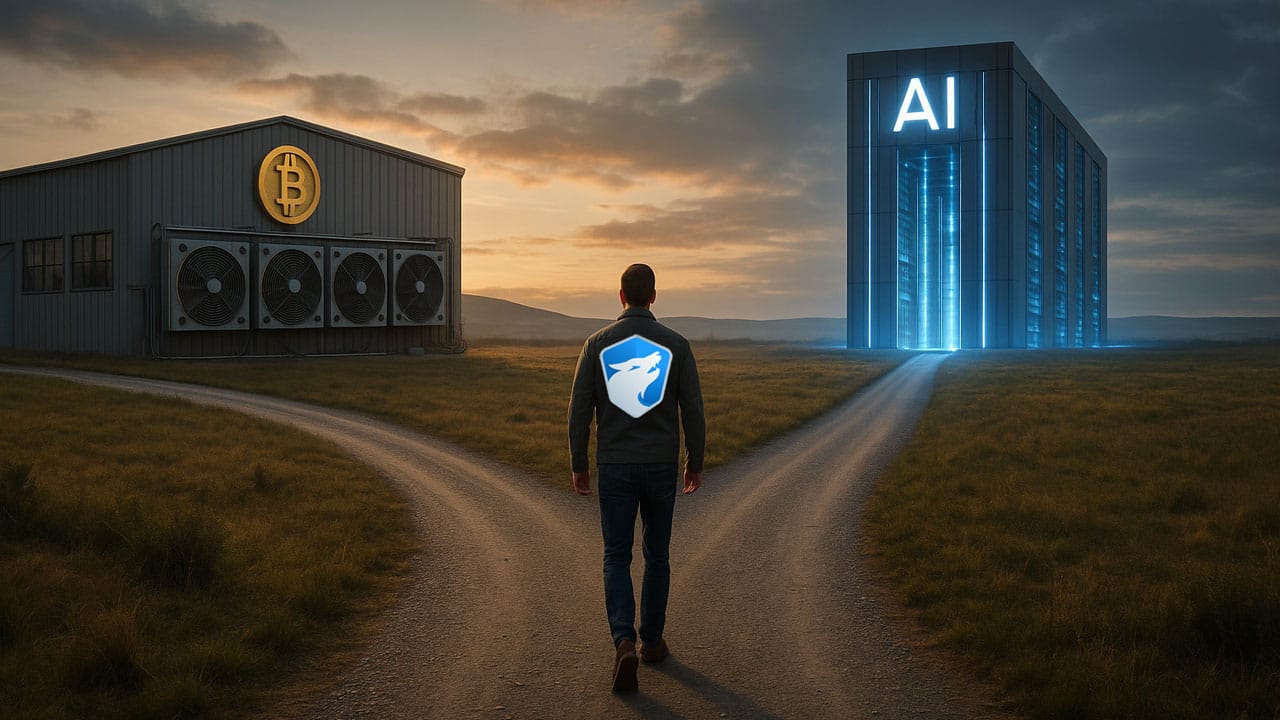

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.