This text gives an in depth information to the 5 handiest strategies to obtain crypto “totally free” or with nearly no capital: Airdrop; Referral & Study-to-Earn/Earn Packages; Staking/Rewards; LP & Yield Farming & Liquidity Mining; On-chain Lending.

Airdrop

Airdrops are nonetheless the most typical free technique to obtain tokens from new initiatives, particularly from Layer 1/Layer 2, DeFi, AI/DePIN apps, and web3 video games. At current, many initiatives are conducting or have introduced clear alternatives for airdrops: for instance, Mitosis (MITO) – a cross-chain liquidity protocol with a confirmed & ongoing airdrop; Nexus (NEX) with its testnet program; and Debank, additionally urged on this month’s airdrop lists.

Moreover, there are different possibilities with Monad, MegaETH, OG Labs, Ambient Finance,…

1/6

Able to lastly meet together with your long-awaited DeBank XP? Let it witness your on-chain journey, and increase with DeBank!

Snapshot was taken at 0:00, July 4th (UTC+0). All energetic addresses have the possibility to assert an preliminary XP airdrop. Verify it now!👉 https://t.co/Gum7P9xJl2 pic.twitter.com/uyrK540bgY

— DeBank (@DeBankDeFi) July 8, 2024

The DropHunting board from CryptoRank updates “potential airdrops” with particular duties (for instance Vana, Irys, Nerite) together with estimated reward sizes. As well as, you possibly can observe by way of instruments comparable to CoinGecko Airdrops, DefiLlama Airdrop, NFTPlazas, Airdrop.io…

Supply: Coingecko

For brand new initiatives, expectations vary from a number of dozen to a couple hundred USD for normal customers; previous “blue-chip/L2 giant” airdrops have supplied a number of hundred to even hundreds of USD for energetic addresses, although this isn’t assured to repeat.

Customers must also notice: use a secondary pockets to work together if involved about dangers; preserve interplay historical past in case the challenge requires a snapshot. Rigorously learn eligibility situations (KYC, area, required holdings, testnet vs mainnet) earlier than finishing duties. By no means pay for “claims” from unofficial sources — depend on trusted trackers (CoinGecko, CryptoRank, Airdrop.io) to confirm.

For extra: Greatest Free Crypto Airdrop 2025: Optimize Airdrop Potential

Referral and Study-to-Earn

Referral and Study-to-Earn are low-risk strategies that require little or “no capital”, which suggests “free cash” and appropriate even for learners. At the moment, many new packages with clearer numbers present excessive effectiveness if you happen to full all steps and benefit from regional promotions.

CEX Referral

Some examples:

Binance Referral / Affiliate: The August 2025 Binance report exhibits that energetic customers within the referral program can earn 40–50% of invitee buying and selling charges if the invited particular person trades continuously.

As well as, customers can diversify their implementation strategies comparable to creating content material to convey affiliate hyperlinks, creating priceless communities.

Check with this channel: NFT Buying and selling Group

Coinbase Quests: The Quests program permits customers to be taught in regards to the new tokens that launch on the platform. Customers want to finish the quizzes via watching movies after which obtain free tokens. In Q3/2025, Coinbase’s Earn program introduced a brand new token marketing campaign – about 10–20 USD price of tokens per particular person if all steps are accomplished (region-dependent).Bybit: The Referral + Deposit/Buying and selling reward program remains to be energetic with regional limits; just lately introduced “Refer & Earn USDT” within the Asia-Pacific area with rewards as much as ~1,717 USDT if the invitee achieves the required buying and selling quantity when you preserve referral exercise.

Referral Packages

Referral packages normally observe this construction:

Direct rewards for each referrer and invitee (for instance, some USD / tokens while you invite somebody new to enroll & KYC or deposit/commerce a minimal quantity)Fee from invitee buying and selling charges (relying on the change, normally 20–50%)Studying bonuses + small presents in Study-to-Earn packages (normally new tokens, low worth however an “entry level”)

Supply: Binance

You probably have a neighborhood of 1,000 energetic folks and a 5% conversion charge who meet the buying and selling situations, commissions of 20–50% of buying and selling charges can convey extra sustainable revenue than airdrops due to compounding. Nonetheless, many packages have regional quotas, and rewards could also be vested/locked, however keep in mind to all the time learn phrases rigorously.

In case your neighborhood is small or has little engagement, referral earnings gained’t be excessive instantly, however with the precise method (content material, steerage, clear advantages), it could possibly change into a gentle revenue.

For extra: Binance Referral Code September 2025: QH6V74V5 ($100 USDT Signup Bonus)

Staking

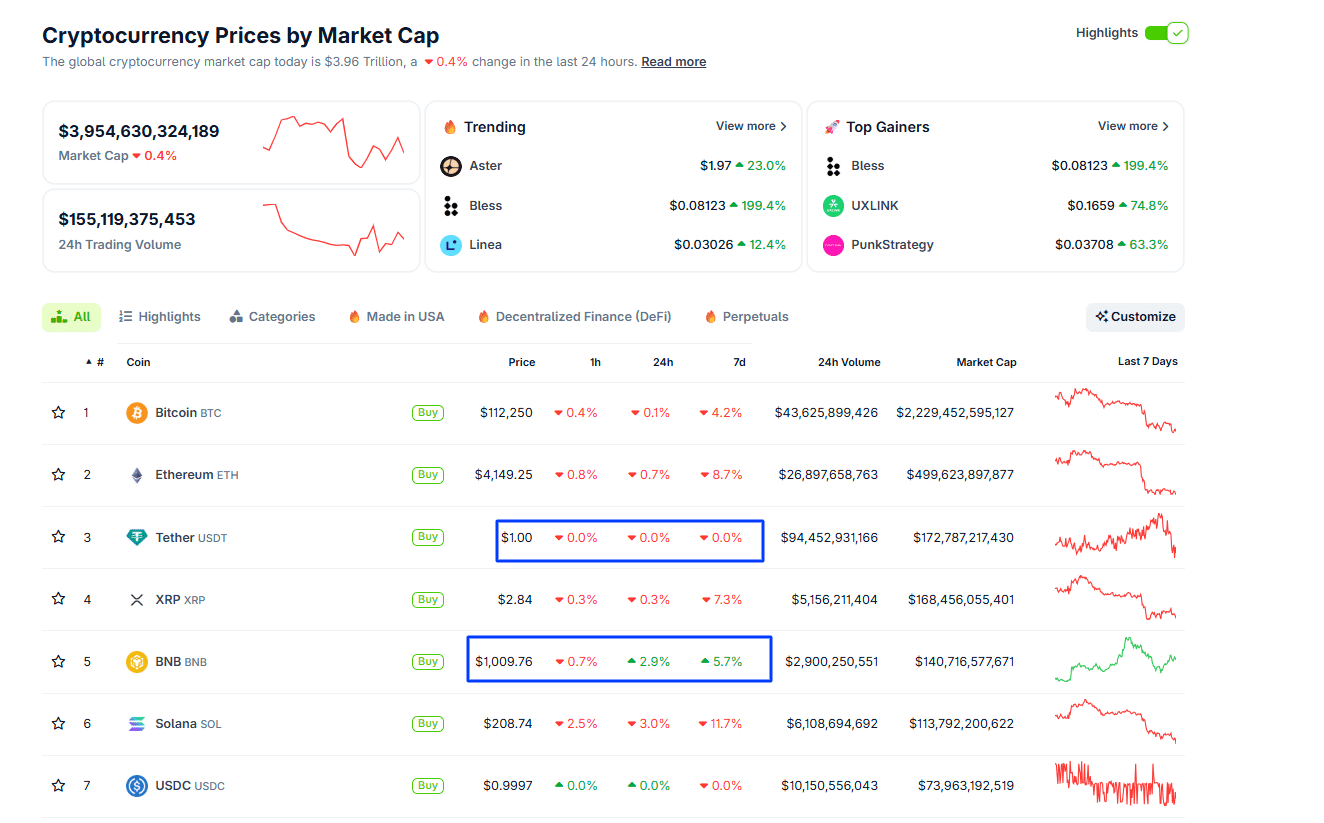

Staking or delegating the native coin of a blockchain has been a preferred technique because the inception of Proof-of-Stake chains. As of September 2025, there are round 35–37 million ETH staked on the Ethereum community. It accounts for practically 29–31% of the overall provide, displaying very excessive staking participation.

Supply: Binance

Staking APY is dependent upon the way you stake: staking via exchanges/custodians normally exhibits ~1.8–2.0% yearly (relying on supplier); staking immediately with a validator (32 ETH) can present larger yields by capturing MEV/charges — technical estimates recommend ~4–5.7% per yr with MEV-Increase in some analyses (not assured).

After the hype of staking, liquid staking, and liquid restaking in late 2024 and early 2025, staking at present now not presents the excessive yields seen throughout early DeFi incentive intervals, but it surely gives stability & decrease danger (if you happen to select respected networks). Customers in search of “free or very low capital” can stake current holdings or purchase small quantities of altcoins to strive. Among the most well-known protocols are Binance Staked, Lido, Eigenlayer, Rocket Pool, Jito…

You probably have little capital, take into account liquid staking (like Lido, Binance staking) to hitch with small quantities whereas conserving liquidity; if in case you have 32 ETH and sufficient ability, operating your personal validator might improve APY however comes with operational dangers.

Yield Farming

Offering liquidity for DEXs (Uniswap, Curve, PancakeSwap, and many others.) earns buying and selling charges; many protocols additionally add reward tokens (liquidity mining/incentives) throughout sure phases to spice up TVL. LP is all the time thought of a extremely risky incomes technique however can provide massive alternatives if you happen to decide the precise challenge/pool/timing.

Instance incentive program:

Linea Ignition: The Linea Ignition is an incentive program accepted by the Linea Consortium. This system is to bootstrap the community TVL as much as 100B, and energy the upcoming new characteristic added.

What’s Linea Ignition?

A program accepted by the Linea Consortium to:– Speed up energetic TVL on Linea– Reward liquidity suppliers (LPs)– Energy Linea’s upcoming Native Yield characteristic

Goal: A further $1B TVL with 1B LINEA tokens distributed as rewards.

Finish Date: Linea…

— Linea.eth (@LineaBuild) September 2, 2025

Curve Finance / Cross-Chain Steady Swimming pools (e.g., Fantom or Arbitrum): On the time of writing, some stablecoin swimming pools present APR/rewards of ~5–20% yearly when together with reward tokens + swap charges, particularly on chains the place liquidity will not be but too giant to dilute rewards.

Supply: Curve

PancakeSwap (BSC / Binance Sensible Chain): Nonetheless presents new LP farms with double-digit APR for brand spanking new pairs + CAKE rewards; in some contemporary instances, APR can attain ~25–40% if reward tokens are closely incentivized.

If you wish to maximize returns whereas accepting some danger, select LPs with stablecoins or much less risky tokens, on chains with low gasoline charges, and protocols with clear incentives the place reward tokens are listed and liquid.

On-chain Lending

Lending in DeFi is a method to “deposit capital” to earn curiosity; you present belongings to cash markets (Aave, Compound, Venus…) and earn yield; charges change relying on provide and demand. Stablecoins normally scale back value volatility danger, however you have to nonetheless take into account contract and liquidity dangers.

Aave V3 (Ethereum): DefiLlama mixture exhibits USDC APY ~5.2% (30-day avg ~4.5%), pool TVL round $594M (at recording time; consistently altering).

Supply: Aave v3

Venus (BSC): The Dashboard exhibits USDT Provide APY ~5.7% at current; third-party aggregators mirror actual every day/30-day measured yield.Compound (Ethereum / Layer2): Charges replace in real-time in keeping with the market; the markets web page publishes provide/borrow APY for every asset (USDC/DAI/ETH…).

Stablecoin lending lowers value volatility danger, however you continue to pay gasoline charges (if the chain has excessive prices) and face good contract danger and liquidity danger if many withdraw directly.

When contemplating the lending choice, customers want to concentrate to rate of interest adjustments. When provide/demand adjustments, the rate of interest fluctuates too. When provide is simply too excessive, APY falls; when demand rises, APY will increase, however reward tokens or incentives might lag.

In order that, customers should prioritize giant & audited protocols with secure observe data (e.g., Aave, Compound, Venus). Should you maintain a number of stablecoins, unfold them throughout protocols to cut back single-point danger. You additionally want to watch rates of interest every day & provide/demand adjustments, so when yields begin to drop, you possibly can swap to different strategies (LP or staking) or withdraw.

For extra: Fastened Yield Farming in DeFi: An Knowledgeable Evaluation

FAQ

Airdrop: Is It Actually Free?

Sure, however you pay with time, gasoline charges, and/or privateness/KYC dangers; most “upcoming airdrops” stay rumors till formally introduced. Dependable watchlists embrace CoinGecko (07/2025) and Koinly; DropHunting boards present particular missions to “test in” early.

How A lot Is ETH Staking Yielding?

Is determined by the mannequin. Centralized suppliers present ~1.8–2.0%/yr; self-run validators + MEV-Increase can earn ~4–5.7%/yr in keeping with technical estimates; precise figures rely on MEV, charges, and the community’s staking ratio.

Does Yield Farming Convey Excessive Returns?

When incentives are sturdy, APR will be double digits, but it surely’s risky, and after the reward section there’s normally promote strain plus impermanent loss.

Is Lending Secure?

Comparatively protected if utilizing main platforms like Aave/Compound, however there’s nonetheless good contract danger or financial institution run eventualities.

Do Referrals Want Capital?

No, solely an change account. However outcomes rely in your advertising and marketing skill.

Is There A Assured Approach To Know Which Airdrops Will Occur?

No assure. Many initiatives are solely “rumors” or “potential.” For instance, Ambient and Hyperliquid are extensively mentioned however not but official.

If I Stake Or Lend, Can I Lose Cash If Token Costs Fall?

Sure. If the token you stake or the rewards you earn drop sharply in value, excessive nominal yield could also be worn out by token depreciation.

Do Referral Packages Have Regional Or Time Limits?

Sure. For instance, Coinbase Referral in Singapore has a deadline of 31 Oct 2025.