Welcome to Slate Sundays, CryptoSlate’s new weekly function showcasing in-depth interviews, knowledgeable evaluation, and thought-provoking op-eds that transcend the headlines to discover the concepts and voices shaping the way forward for crypto.

On Wall Avenue and Crypto Twitter, few names spark debate like Michael Saylor and his Bitcoin-hungry software program firm, Technique.

Gone are the times when MicroStrategy was only a enterprise intelligence software program vendor. At present, “Technique” stands because the world’s largest company Bitcoin holder, packing away greater than 638,900 BTC (3% of the overall circulating provide).

For some Bitcoiners, Saylor’s conviction is a validation of the king of crypto’s coming-of-age as an institutional reserve asset.

For critics, it’s a warning: centralization danger, wrapped in a story. So, the place does the reality lie, and simply how a lot provide is an excessive amount of for any single entity?

Crossing the three% rubicon

It wasn’t all the time clear today would come. Within the early days, Bitcoin was for nerdy devs, quasi-religious cypherpunks, and early adopters. At present, one NASDAQ-listed agency sits atop a pile of digital gold that overshadows that of BlackRock, Tesla, and Coinbase mixed.

It’s not nearly numbers. As Nic Puckrin, CEO and founder at Coin Bureau, factors out:

“Having a NASDAQ-listed agency proudly owning such a big allocation of BTC exhibits that Bitcoin has moved from the perimeter to the highlight of mainstream company finance… For establishments nonetheless hesitant, Technique’s holdings act as a robust sign, telling others {that a} publicly traded agency can allocate billions of {dollars} to BTC, and so are you able to.”

Bitcoin has firmly entered the institutional period. For treasuries and pension funds looking for alternate options to money, Technique’s lead acts as a proof-of-concept.

However this milestone additionally swings the dialog again to first rules. Bitcoin was designed as a decentralized community, proof against the grip of any single firm, nation, or billionaire.

What occurs when one agency not solely holds a large place however relentlessly targets extra? Saylor has alluded to ambitions as excessive as 7% of the overall provide on quite a few events.

Ecosystem influence: boon or bastion?

Make no mistake, Technique’s holdings have shifted market dynamics. The float is tighter, and with a lot provide boxed up in long-term company treasuries, the availability shock idea could be very actual. And that’s a double-edged sword. Tony Yazbeck, cofounder of The Bitcoin Means, feedback:

“MicroStrategy proudly owning over 3% of Bitcoin isn’t a menace to the community itself, however it does carry some market implications. The primary concern is affect. As a big holder, he might be able to sway sentiment and set off value swings.”

For institutional Bitcoin evangelists, Technique’s success is a inexperienced mild, the mainstream embrace they’ve argued for since Bitcoin’s early days. Funding veteran and e-Cobalt founder Mitchell DiRaimondo says:

“Others will catch on, and once they do, 3% will seem to be just the start of a a lot bigger shift in capital.”

DiRaimondo sees Saylor’s conviction as transformative:

“His method has all the time been strong: replenish on onerous cash, ignore the noise, and prepare for long-term adoption.”

Whereas Puckrin additionally celebrates Technique’s achievement, he warns that cascading liquidations may very well be an actual menace:

“Regardless of the positivity, we will’t ignore the clear dangers right here… If, for any motive, Technique is compelled to liquidate even a fraction of its holdings, the influence on market confidence can be profound.”

And that danger isn’t simply theoretical. The previous few years have seen failed treasury performs, sudden liquidations, and gut-wrenching moments when Bitcoin’s value fell off a cliff triggered by the actions of some unscrupulous corporations. FTX anybody?

Focus dangers and the centralization of Bitcoin’s provide

What are the opposite dangers of concentrated holdings? As long-time Bitcoin advocate and safety knowledgeable Jameson Lopp beforehand informed Slate Sundays:

“If an excessive amount of Bitcoin will get concentrated in too few palms, we run the chance of primarily recreating a extremely centralized system.”

That’s why Lopp determined to spend money on David Bailey’s Bitcoin Treasury firm, Nakamoto, to forestall Technique from pulling a lot additional forward.

“It’s not as a result of I feel that company Bitcoin treasury adoption is the most effective factor since sliced bread. It’s as a result of I felt like we would have liked to have a broader and extra various group of company treasuries to compete with Saylor, to attempt to decelerate how a lot he can proceed accumulating.”

Bitcoin was constructed to face up to centralized assaults, however the query isn’t whether or not one firm can break Bitcoin. It’s about how market notion modifications when one participant turns into the story. Wes Kaplan, former Cointelegraph CEO and present CEO of G-Knot, feedback:

“In contrast to particular person holders who promote progressively, these entities function with fiduciary obligations to shareholders and collectors. When market stress hits, these firms can face margin calls and creditor calls for no matter their Bitcoin conviction. A number of leveraged gamers promoting concurrently might create cascading liquidations.”

This isn’t nearly market drama. It’s about dilution, fragility, and interconnected danger.

Matt Mudano, CEO of Arch Community, sees the larger image, questioning how the centralization of the Bitcoin provide impacts miners. He notes:

“As extra buying and selling migrates to ETFs, centralized venues, and OTC desks, fewer cash truly settle on-chain. That siphons liquidity from the on-chain market that funds miners through charges. With block subsidies shrinking, a sturdy payment market is what retains miners worthwhile, and a broad mining base is essential to Bitcoin’s decentralization.”

The institutional period: good friend or foe?

Macro analyst and Bitcoin advocate Lyn Alden holds a special view. She’s not involved in regards to the centralization of the Bitcoin provide, declaring that the dynamics have all the time been this fashion: Mt. Gox had over 800,000 cash, a much bigger share than BlackRock or Technique has now.

Alden appears to leverage as the principle offender for techniques to unravel, telling Slate Sundays:

“MicroStrategy has fairly low leverage relative to their Bitcoin. Metaplanet has comparatively low leverage relative to their Bitcoin. We’ll see how the others come as they go. I actually suppose that we’ll see a washout. We’ll see a whole lot of altcoin treasury firms get washed out, and a few Bitcoin ones which are poorly managed are going to be in danger within the subsequent downturn.”

Alden’s ideas are echoed by OG Bitcoiner, CEO, and cofounder of BitcoinOS, Edan Yago. He says:

“I don’t see Technique’s transfer of shopping for BTC as an issue. In truth, it displays a long-term alignment with Bitcoin’s rules. In contrast to speculative holders, this places a whole lot of BTC within the palms of a long-term holder. Technique is exhibiting the world that Bitcoin is an institutional-grade treasury asset. This supplies a stability that creates stronger demand dynamics and truly makes Bitcoin’s provide extra resilient.”

Mudano’s take is considerably extra cautious, reminding Bitcoiners to see the larger image fairly than get blinded by NGU.

“Cheer conviction patrons like Saylor, however watch the plumbing: how encumbered these holdings are, who the custodians are, and whether or not miners’ payment share of income is rising. Deep on‑chain exercise, not simply large holders, is what in the end secures the community.”

Institutional shopping for on overdrive

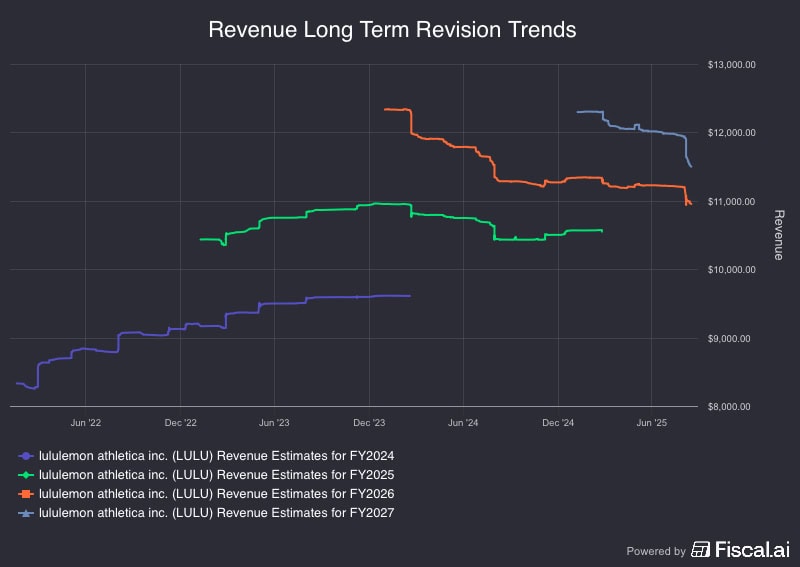

2025 is a actually a yr of inflection for Bitcoin. Technique stays the most important non-sovereign treasury by a rustic mile. Metaplanet in Japan is stacking BTC as “Asia’s MicroStrategy.” And Nakamoto is grabbing headlines with the annihilation of its shares, down a horrifying 96% from their Might highs.

In the meantime, governments, ETFs, and exchanges now command near a 3rd of all circulating Bitcoin provide, and knowledge from Glassnode exhibits that solely 14-15% of Bitcoin is really liquid, including gravity to each transfer by the most important gamers. The danger? Systemic fragility if one or two whales face margin calls or liquidity constraints.

Are we constructing the very vulnerabilities that Bitcoin was designed to remove? Counterparty danger, custody buildings, and treasury methods will all face their second of fact.

Decentralization versus adoption

So, is Technique’s place good or dangerous? The reply, as ever, is nuanced. For some, it’s the clearest signal but that Bitcoin is maturing; a reserve-grade asset match for institutional stability sheets. For others, it’s a warning to remain vigilant about focus, transparency, and systemic danger. As Yago factors out:

“Bitcoin thrives as a result of it’s held by those that perceive its shortage and worth… Bitcoin can’t be ‘managed’ by one entity… It’s designed to be utterly decentralized, and possession focus doesn’t change that.”

What issues most? Not whether or not one firm should purchase its approach to dominance, however whether or not possession (and stewardship) stays various.

The ethos that began this revolution was decentralization. If company and sovereign funds dominate the ledger, Bitcoin’s subsequent chapter will depend upon how they wield their energy and what occurs when the tides inevitably flip.

Alex Gladstein, Chief Technique Officer on the Human Rights Basis, succinctly sums up the temper:

“Let’s bear in mind why we’re right here

Cypherpunks write code

Thank an open-source developer as we speak

Wall Avenue didn’t create and maintain NGU, Satoshi and the cypherpunks did and can”

Ultimately, Bitcoin’s resilience received’t be measured by how a lot Technique owns, however by how nicely the ecosystem adapts, increasing provide throughout corporates, establishments, and people. That’s what retains Bitcoin true to type, and what is going to outline whether or not it stays the folks’s cash… or the plaything of the company elite.

Talked about on this article