Wanting on the crypto market as we speak, there’s an actual pleasure across the FOMC fee lower, the 25 foundation factors that turns into information headlines in all places in a largely optimistic means as BTC is dancing round 117K USD, ETH is simply above 4.5K USD, creeping up about 0.7% within the final day, whereas XRP is buying and selling shut to three.07, having fun with a 1.6% acquire towards. If historical past is any information, comparable fee cuts normally spark 20–30% beneficial properties for high-risk property over the following few weeks. So sure, there’s trigger to be mildly excited.

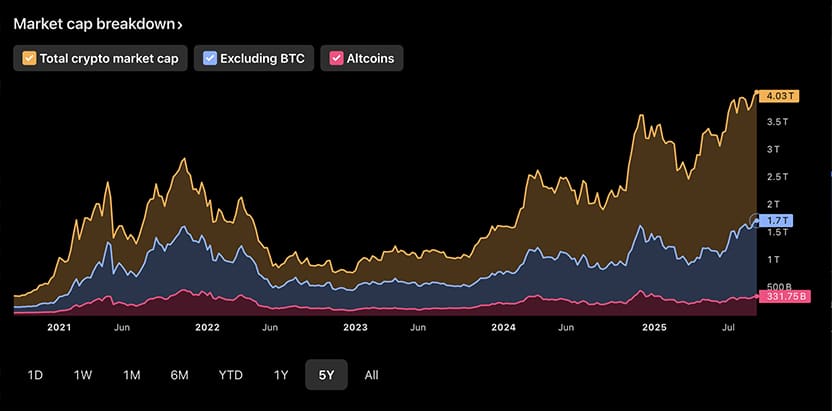

Altcoins are getting consideration now that the easing has landed. Knowledge from TradingView reveals whole crypto market cap rising, suggesting some capital is rotating out of BTC ▲0.50% and into high-risk performs.

(supply – TradingView)

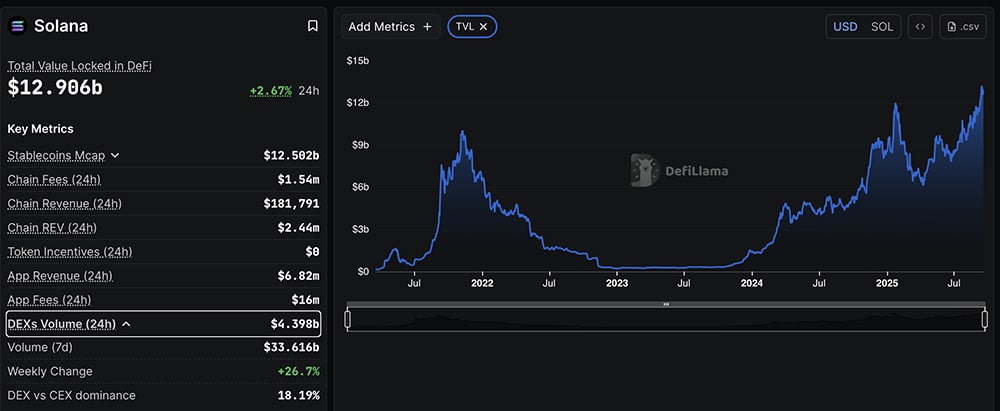

SOL ▲4.06% is as much as 244 USD, gaining 3.2% as we speak, helped by DEX volumes that climb to about $2.5B day by day per DeFiLlama, a 5% leap because the lower and about 26% this week.

(supply – DefiLlama)

BNB ▲5.04%, however, is with a pleasant spherical quantity, at 1,000 USD, simply as this text is being written. Its BSC TVL is at $7.8B, up by almost10% this week. These are the foundations of stronger sentiment throughout crypto.

DISCOVER: Prime 20 Crypto to Purchase in 2025

At this time Crypto Market Information Roundup: BTC, ETH, XRP Prepared for Moon as Fee Reduce Brings Stronger USD

Right here’s the place issues are headed. In response to CoinGlass, open curiosity for BTC USD is about $85B, and lengthy positions dominate in liquidations because the lower, a sample we’ve seen in previous ramps.

(supply – CoinGlass)

ETH USD is supported by Layer‑2 TVLs (by way of DeFiLlama https://defillama.com/chain/ethereum) exceeding $40B, and ETF inflows pushing over $1.2B weekly. XRP could acquire institutional credibility as its CME choices choose up steam with doubled quantity, now round USD 15B.

May BTC USD slip underneath $115,000 briefly? Positive. However with alerts from the Fed hinting at maybe two extra cuts this 12 months, bullish strain stays. The general DeFi whole market cap is $4.2B, an enormous quantity contemplating it towards the normal market.

(supply – CoinGecko)

If issues break effectively, XRP would possibly take a look at 3.20 USD, with BTC, ETH, and SOL main. Optimistically, September will finish on a robust observe, even when there are just a few dips alongside the way in which.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Memecore and EIGEN Worth Blasts 20%: Is BTC Layer 2 Subsequent 100X Crypto?

The hunt for the following 100x crypto intensified as we speak as merchants digested Federal Reserve Chair Jerome Powell’s 25bps fee lower, a transfer that has fueled bullish sentiment throughout threat markets. Crypto reacted nearly immediately, with Memecore and EigenLayer each surging greater than 20% larger previously 24 hours, sparking a contemporary wave of hypothesis about the place sensible cash will subsequent rotate.

Whereas Bitcoin reclaimed $117K, historical past reveals the most important returns don’t come from BTC itself however from smaller-cap tokens constructing modern ecosystems round it. With financial coverage easing and liquidity returning, merchants at the moment are asking: may a Bitcoin Layer 2 undertaking ship the following crypto to 100x as new capital floods into the market?

Learn the total story right here.

The submit Newest Crypto Market Information At this time, September 18: FOMC Fee Reduce Aftermath, BTC, ETH, XRP, and Solana Steady as BNB Near 1K USD appeared first on 99Bitcoins.