The Each day Breakdown takes a more in-depth take a look at Lululemon, which has falling gross sales however a traditionally low valuation. What’s subsequent for LULU?

Earlier than we dive in, let’s ensure you’re set to obtain The Each day Breakdown every morning. To maintain getting our every day insights, all it is advisable to do is log in to your eToro account.

Deep Dive

Lululemon Athletica shares have been decimated this 12 months, down 58% in 2025. Worse, it’s down nearly 69% from its all-time excessive made in December 2023. What’s happening with this as soon as darling attire maker?

The corporate’s merchandise should not interesting to its core prospects the best way they as soon as did. Elevated competitors from firms like Vuori and Alo have damage, whereas tariffs are impacting the agency’s margins. These issues have led to a serious headache for traders, as US gross sales proceed to stall.

On the identical time, traders are wanting on the inventory and questioning when sufficient is sufficient.

Will Gross sales Rebound?

We’re midway by Lulu’s fiscal 12 months. When the corporate reported on Sept. 4th, administration lower its full-year gross sales outlook to $10.85 billion to $11 billion. The outlook for 2026 and 2027 have develop into extra pessimistic as properly, as famous on the graphic above.

On the plus aspect, analysts truly anticipate development — it’s simply not spectacular development.

Consensus estimates name for income development of three.5% this 12 months, 4.8% subsequent 12 months, and 5.8% within the following 12 months. That’s at the moment mid-single-digit development and hardly warrants a premium valuation.

Worse, earnings development estimates are much less constant. Analysts anticipate an earnings decline of roughly 11% this 12 months — which is probably going already priced into the inventory at this level, given its tumultuous fall — adopted by estimates for simply 1% development in fiscal 2026 and about 8% development in 2027.

The Backside Line: Lululemon’s enterprise might be close to a trough, however the lack of readability and pleasure for development within the out-years has traders feeling defeated.

Wish to obtain these insights straight to your inbox?

Join right here

Diving Deeper

With a near-70% decline from the highs — down from ~$516 to ~$160 in lower than two years — it’s apparent that one thing isn’t working and the inventory is out of favor with Wall Road. For traders although, the query turns into: At what level is the valuation too low to disregard?

Notice: Wall Road’s consensus worth goal on LULU inventory is ~$203, implying roughly 27% upside from present ranges.

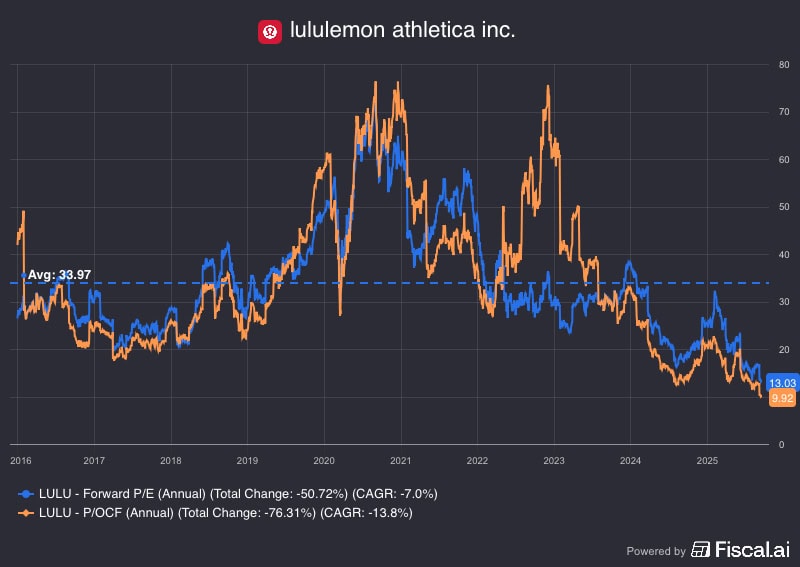

The chart above highlights the corporate’s ahead P/E a number of, with shares buying and selling at simply 13 occasions anticipated earnings. Valuation is usually a tough factor although.

Whereas that is by far LULU’s lowest valuation within the final decade, there’s no assure that will probably be supportive for the inventory. If earnings estimates become too excessive, the valuation is definitely not as little as it seems proper now. Additional, traders might not assign a premium valuation to this firm anymore given its operational points. As an alternative, a discounted valuation often is the new norm.

These are dangers that traders have to simply accept in the event that they take a place in LULU inventory.

Too Stretched?

Regardless of meager income development, this firm stays worthwhile and free-cash stream constructive. Exterior of lease obligations, Lululemon runs a fairly tight steadiness sheet with little or no debt. From these views, it’s cheap for traders to surprise if the inventory is oversold.

On the identical time, there’s nothing that claims the inventory’s freefall is unwarranted or that shares will rebound meaningfully from present ranges.

If Lululemon can discover a trough in its enterprise and return to development, shares may rebound. But when administration is compelled to revise its outlook even decrease, then the inventory may have extra draw back forward — and that is among the key dangers for traders to evaluate.

Disclaimer:

Please be aware that as a result of market volatility, among the costs might have already been reached and eventualities performed out.