In proof-of-stake blockchains, slashing is commonly talked about with a touch of worry. However for normal customers, the possibility of being slashed is sort of zero. Delegators solely face small dangers if their chosen validator misbehaves. For validators, nevertheless, slashing is a built-in safeguard that enforces the community’s guidelines and deters inefficient or dishonest habits.

So as to higher perceive your dangers when staking crypto, it is very important know what slashing is and the way it works.

What Is Slashing in Crypto?

Slashing refers to a penalty mechanism utilized in proof-of-stake (PoS) blockchains to discourage dishonest or negligent habits by validators. Validators are chargeable for confirming transactions and securing the community. In the event that they act in opposition to the principles, irrespective of if deliberately or by accident, the protocol can “slash” them by taking away a part of their staked tokens.

The principle objective of slashing is to align validator incentives with community safety. Since validators should lock up tokens as collateral, they danger dropping cash in the event that they fail to behave correctly. This ensures that solely these dedicated to trustworthy participation stay within the validator set.

Not each PoS blockchain makes use of the slashing mechanism, however for those who do, it performs a important position in retaining the community safe, truthful, and immune to assaults.

Learn extra: Proof-of-Stake vs. Proof-of-Work Blockchains.

Historical past of Slashing

The idea of slashing emerged alongside (and, in a manner, as a consequence of) the event of proof-of-stake blockchains. Early PoS designs within the 2010s centered on vitality effectivity and token-based safety however lacked sturdy deterrents for dishonest validators. With out significant penalties, malicious actors might disrupt consensus with little draw back.

Ethereum researchers popularized slashing through the shift to Ethereum 2.0, the place it grew to become a core a part of validator accountability. The community launched penalties not just for inactivity but additionally for dangerous behaviors like double-signing or colluding in consensus assaults.

Different ecosystems, equivalent to Cosmos and Polkadot, adopted related frameworks, every tailoring slashing guidelines to their consensus fashions. Over time, slashing has develop into an ordinary instrument in lots of PoS blockchains, reinforcing safety by making unhealthy habits pricey.

Objective of Slashing

Slashing serves a number of functions in proof-of-stake blockchains. It isn’t solely a punishment but additionally a deterrent and an incentive mechanism that ensures validators act in the very best curiosity of the community.

Stops Malicious Conduct

Slashing makes assaults pricey. Validators who try double-signing, collusion, or consensus manipulation danger dropping their stake. This excessive monetary penalty discourages malicious actors from attempting to undermine the system.

Retains Validators Accountable

Validators should function dependable nodes and observe protocol guidelines. In the event that they fail, whether or not by means of negligence, downtime, or mismanagement, they face penalties. This creates accountability and filters out validators who can not preserve correct operations.

Protects the Community

By punishing dangerous or careless actions, slashing strengthens community safety. It reduces the possibility of forks, chain instability, or coordinated assaults, preserving belief within the blockchain’s consensus.

Promotes Honest Participation

Slashing ensures that each one validators play by the identical guidelines. Trustworthy validators are rewarded, whereas dishonest or careless ones are penalized. This ranges the taking part in subject and fosters confidence amongst delegators who stake their tokens with validators.

Keep Protected within the Crypto World

Learn to spot scams and defend your crypto with our free guidelines.

How Slashing Works

Slashing depends on a set of roles, guidelines, and processes that collectively implement good habits in proof-of-stake networks. On the heart of this technique are validators, delegators, and, in some protocols, whistleblowers.

Learn extra: What Is Crypto Staking?

Validators stake their very own tokens and infrequently settle for delegated stake from others. They’re chargeable for producing blocks and signing transactions. If a validator breaks the principles (by signing conflicting blocks, going offline, or manipulating consensus) the protocol can slash their stake.

Delegators are token holders who don’t need to run validator nodes themselves. As an alternative, they delegate their stake to a validator and share within the rewards. However delegation additionally carries danger: if the chosen validator is slashed, delegators lose a portion of their stake too. This risk-reward stability makes validator choice important.

Slashers or whistleblowers are members incentivized to report misbehavior. After they present proof {that a} validator violated the principles, the protocol triggers slashing and awards a part of the penalty to the reporter.

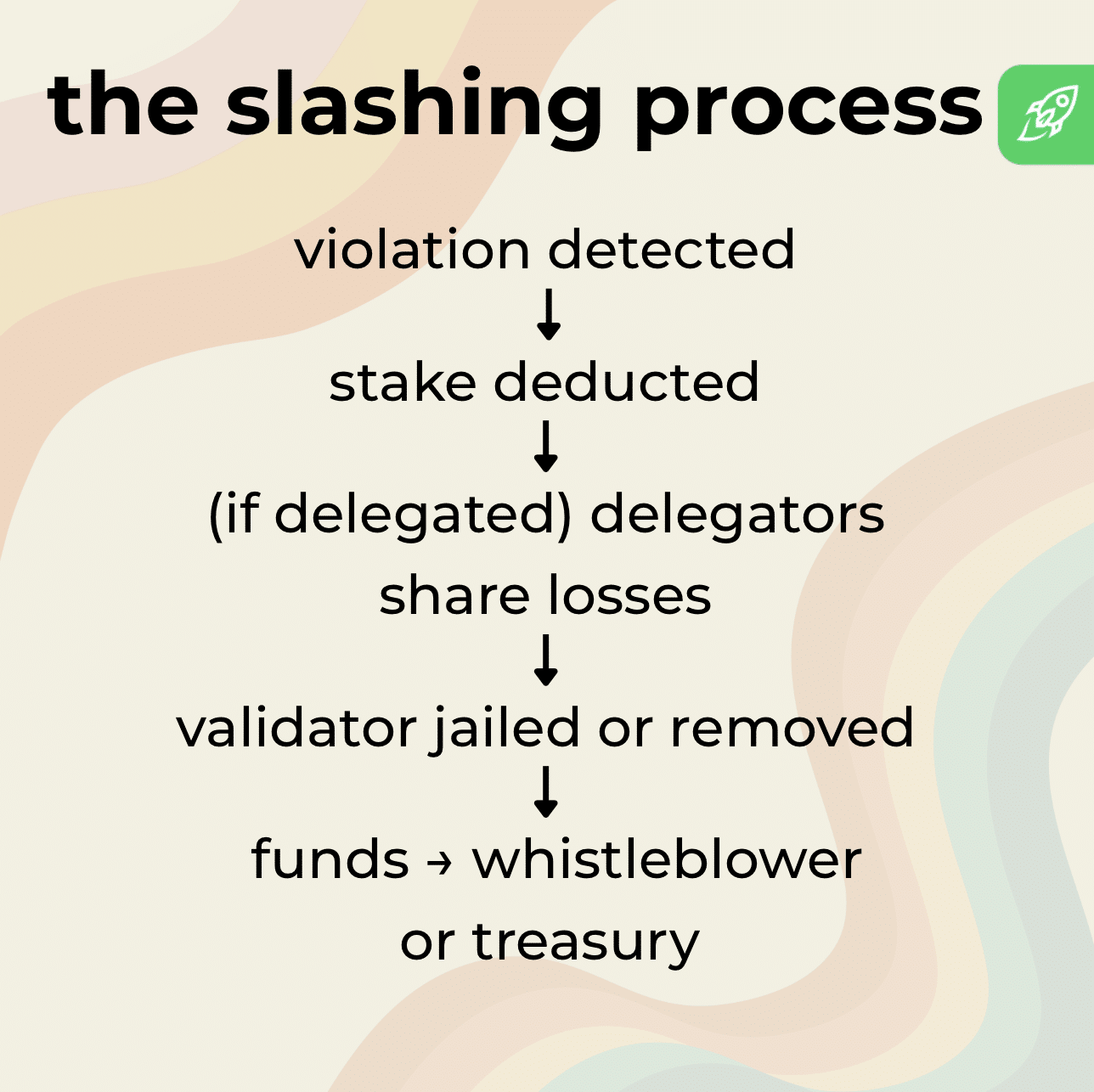

As soon as a violation is confirmed, the slashing course of begins. Relying on the blockchain, penalties can vary from small stake deductions for downtime to extreme measures equivalent to everlasting validator removing, token burns, or redistribution of slashed funds to the treasury. Some programs additionally impose “jail time,” the place a validator is barred from taking part for a interval earlier than they’ll return.

How Are Slashing Penalties Decided?

Financial parameters decide the impression of slashing. These embrace the slashing fraction (how a lot stake is reduce per offense) and correlated slashing, the place penalties improve if many validators misbehave on the similar time, deterring coordinated assaults. Protocol guidelines additionally tie in governance: communities can regulate slashing situations by means of on-chain voting, and funds collected might movement into the community’s treasury.

To keep away from pointless penalties, validators depend on technical safeguards like slash safety databases, distant signers that maintain keys remoted from machines, and safe setups equivalent to sentry node structure. Greatest practices in monitoring, alerting, and key administration additional scale back dangers.

Why Do Validators Get Slashed?

Validators might be penalized for a number of varieties of misbehavior in proof-of-stake (PoS) networks. These actions, amongst different issues, can threaten the community’s consensus course of or disrupt the chain’s transaction historical past. The precise guidelines range throughout PoS protocols and delegated proof-of-stake programs, however the principle classes of slashing occasions are constant.

Double Signing

Double signing occurs when a validator indicators two completely different blocks for a similar slot or top. This creates conflicting variations of the community’s transaction historical past. In PoS networks, such habits is handled as a severe violation as a result of it might result in forks and lack of belief within the chain. Validators caught double signing are normally slashed closely.

Encompass Voting

Encompass voting happens when a validator submits one vote that overlaps or “surrounds” one other vote they beforehand signed. This undermines the consensus course of by introducing contradictory attestations. Proof-of-stake protocols like Ethereum explicitly penalize this habits, since it may be used to govern finality.

Prolonged Downtime

Validators should keep on-line to provide blocks and validate transactions. If a validator stays offline for too lengthy—whether or not as a consequence of poor infrastructure, community points, or negligence—they might be slashed. In delegated proof-of-stake programs, downtime penalties additionally have an effect on delegators who staked with that validator. Whereas downtime is much less extreme than double signing, it nonetheless harms the community’s liveness.

Consensus Manipulation

Some slashing situations goal broader makes an attempt to govern consensus, equivalent to colluding with different validators to alter transaction ordering or stall block manufacturing. These assaults threaten each security and equity in PoS protocols. Slashing ensures such coordinated efforts are extraordinarily pricey, discouraging validators from undermining the community’s integrity.

What Occurs When You Get Slashed?

When a validator is slashed, the penalty is utilized routinely by the community’s protocol. The impression is determined by the severity of the violation, however the course of normally follows the identical sequence.

This creates instant monetary penalties and, in lots of circumstances, reputational harm: delegators are much less prone to belief a validator with a historical past of penalties.

How Slashing Works on Totally different Blockchains

Slashing guidelines range throughout PoS networks, however the objective is identical: to safe consensus and deter validator misbehavior. Right here’s how some main blockchains deal with it:

Ethereum 2.0

Ethereum penalizes validators for double signing, encompass voting, and prolonged downtime. Extreme offenses can result in validator ejection. Penalties scale with what number of validators misbehave directly (correlated slashing).

Polkadot

In Polkadot, slashing applies to validators and nominators. Offenses embrace equivocation (double signing) and unresponsiveness. Penalties vary from small deductions to removing from the energetic set, with slashed funds going partly to the treasury.

Cosmos

Cosmos slashes validators for double signing and downtime. Delegators additionally share within the penalties, reinforcing the necessity to decide on validators rigorously. Extreme circumstances result in “tombstoning,” which completely removes the validator.

Tezos

Tezos slashing is targeted on double baking (proposing two blocks on the similar top) and double endorsing (signing conflicting blocks). Misbehaving validators lose a part of their bond, and delegators are not directly impacted by means of lowered rewards.

Slashing vs. Different Consensus Mechanism Penalties

Not all blockchains use slashing. Totally different consensus mechanisms implement validator or miner self-discipline in numerous methods. In proof-of-stake (PoS) networks, penalties normally contain stake discount, whereas in proof-of-work (PoW) programs, the fee comes from wasted vitality and sources.

Methods to Keep away from Slashing

Slashing targets malicious or negligent habits, however each validators and delegators can take steps to attenuate dangers.

For Validators

Keep away from double-signing. Run just one blockchain community node per validator key and use slash safety instruments.

Keep on-line. Use dependable {hardware}, monitoring, and backup infrastructure to stop downtime through the validation course of.

Comply with the principles. Sustain with protocol updates and governance modifications to make sure compliance.

For Delegators

Select dependable validators. Test efficiency historical past, uptime, and status earlier than staking.

Diversify if potential. Unfold stake throughout a number of validators to scale back publicity.

Keep knowledgeable. Monitor validator efficiency and change if their habits raises dangers.

Is Slashing a Good or a Dangerous Factor?

Slashing generally is a quite controversial matter within the crypto neighborhood. On one hand, penalizing validators can really feel harsh, particularly when downtime or errors trigger trustworthy operators to lose funds. Critics argue that it may well discourage smaller members who lack the sources to run extremely redundant programs.

Then again, details present that slashing is an efficient safeguard. By implementing strict community guidelines, it deters malicious or negligent habits and prevents validators from undermining consensus. With out it, PoS networks could be extra weak to forks, collusion, and inefficient habits that weakens safety.

In follow, most main proof-of-stake protocols depend on slashing as a result of the advantages outweigh the dangers. It retains validators accountable and reassures delegators that the community has sturdy defenses in place.

Ultimate Ideas

Slashing is greater than only a punishment: it’s a design selection that balances incentives, strengthens safety, and ensures equity in proof-of-stake programs. By penalizing validators for malicious or inefficient habits, networks defend each their consensus and their customers.

For on a regular basis token holders, the principle takeaway is straightforward: choose validators rigorously, keep knowledgeable concerning the guidelines of the chain you’re taking part in, and slashing will doubtless by no means have an effect on you immediately. For validators, the message is stricter: observe protocol guidelines, function dependable nodes, and deal with safety as a precedence.

As proof-of-stake continues to broaden, slashing will stay a cornerstone of how blockchains implement belief with out central authorities.

FAQ

Does each PoS blockchain use slashing?

No. Some networks select softer penalties or rely solely on reward discount, however many undertake slashing to implement their very own guidelines and discourage unhealthy habits.

How usually does slashing really occur?

Slashing is comparatively uncommon. Most validators observe the principles, and trendy setups embrace protections that decrease slashing dangers.

How do I do know if a validator is secure to delegate to?

Test validator efficiency, uptime, and historical past. Delegating to operators with a confirmed monitor report reduces the possibility of losses if slashing happens.

Disclaimer: Please observe that the contents of this text aren’t monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.