Brits are exhibiting a rising curiosity in placing crypto inside retirement plans, however many nonetheless don’t absolutely grasp the dangers. In keeping with a brand new survey by Aviva, 27% of UK adults mentioned they might be open to together with digital foreign money of their retirement portfolios, whereas 23% mentioned they could withdraw half or all of their present pensions to purchase crypto instantly.

Rising Urge for food Regardless of Worries

Based mostly on studies from Censuswide, which polled 2,000 UK adults between June 4 and June 6, greater than 4 in 5 folks maintain pensions that add as much as about £3.8 trillion ($5.10 trillion).

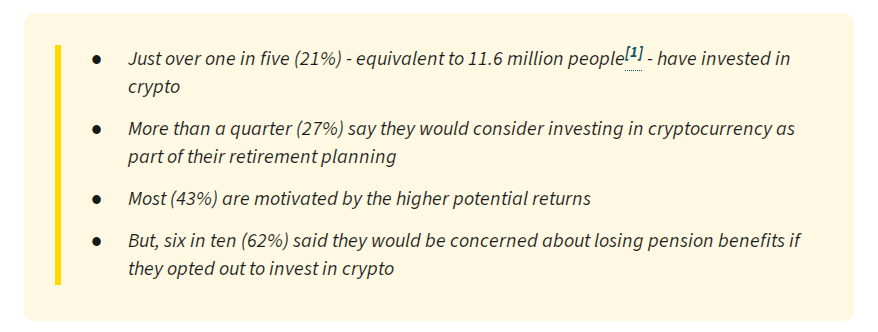

If even a small slice of that moved into crypto, it could possibly be significant for markets. Of the respondents who mentioned they have been open to digital foreign money in pensions, simply over 40% pointed to the possibility of upper returns as the principle draw.

UK retirement savers heat to crypto. A brand new Aviva survey finds 27% of UK adults would come with crypto in retirement, hinting at future flows from a multi-trillion pound pension market.

‣ 27% open to crypto in pensions, per @Censuswide polling for Aviva‣ 23% would even shift… pic.twitter.com/9xejvGEIGh

— TrinityPad (@Trinity_Pad) August 27, 2025

Youthful Savers Lead The Shift

Youthful adults look like probably the most energetic. Experiences present almost 20% of individuals aged 25 to 34 admitted to withdrawing pension cash to purchase crypto sooner or later.

Aviva’s analysis additionally discovered that about one in 5 UK adults — roughly 11.5 million folks — have held crypto at a while, and two-thirds of that group nonetheless maintain some type of digital asset.

Supply: Aviva

That blend of possession and age-skewed habits helps clarify why digital foreign money is now a part of conversations about retirement planning.

Survey contributors flagged clear issues. Hacking and phishing topped the listing at 40%, whereas 37% cited an absence of regulation and shopper safety, and 30% named volatility.

Virtually one-third admitted they didn’t fully grasp the trade-offs concerned in changing pensions with bitcoin, and 27% mentioned they have been unaware of any dangers in any respect. These numbers counsel curiosity outpaces understanding for a notable share of the general public.

Whole crypto market cap at $3.82 trillion on the day by day chart: TradingView

What Regulators And Corporations Are Doing

Regulation will doubtless play a big position in how briskly any shift occurs. Experiences observe that HM Income and Customs would require crypto platforms to gather full names, dwelling addresses, and tax identification numbers for each commerce and switch beginning January 1, 2026. That transfer is geared toward strengthening tax compliance and oversight and will change how some shoppers view bitcoin’s privateness and comfort.

US Coverage Additionally Strikes The Needle

The controversy over retirement funds and crypto isn’t confined to the UK. US President Donald Trump signed an govt order permitting 401(ok) plans to incorporate Bitcoin and different cryptocurrencies, opening potential entry to greater than $9 trillion in retirement belongings.

Featured picture from Getty Photographs, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.