The UAE’s actual property market continues to set new data in 2025. In April alone, AED 62.1 billion in actual property transactions have been recorded, highlighting sturdy demand throughout the residential, industrial, and luxurious segments. One space gaining explicit consideration is the branded residences market, which is quickly changing into a standout within the UAE’s luxurious property sector.

In response to current information, Abu Dhabi’s branded residences phase has quadrupled over the previous 12 months, with luxurious gross sales reaching AED 6.3 billion in 2024. This progress displays rising demand from prosperous traders and high-net-worth people searching for exclusivity and status. The surge will not be solely remodeling the skyline, but in addition creating compelling alternatives for publicly listed actual property builders.

Emaar is arguably the largest beneficiary of the UAE’s property upswing. Its presence dominates Dubai’s skyline, and it’s a main pressure in branded residence growth, with flagship tasks resembling Armani Residences, The Tackle, and Palace Residences. By partnering with international luxurious manufacturers, Emaar has created premium way of life choices that enchantment strongly to worldwide traders.

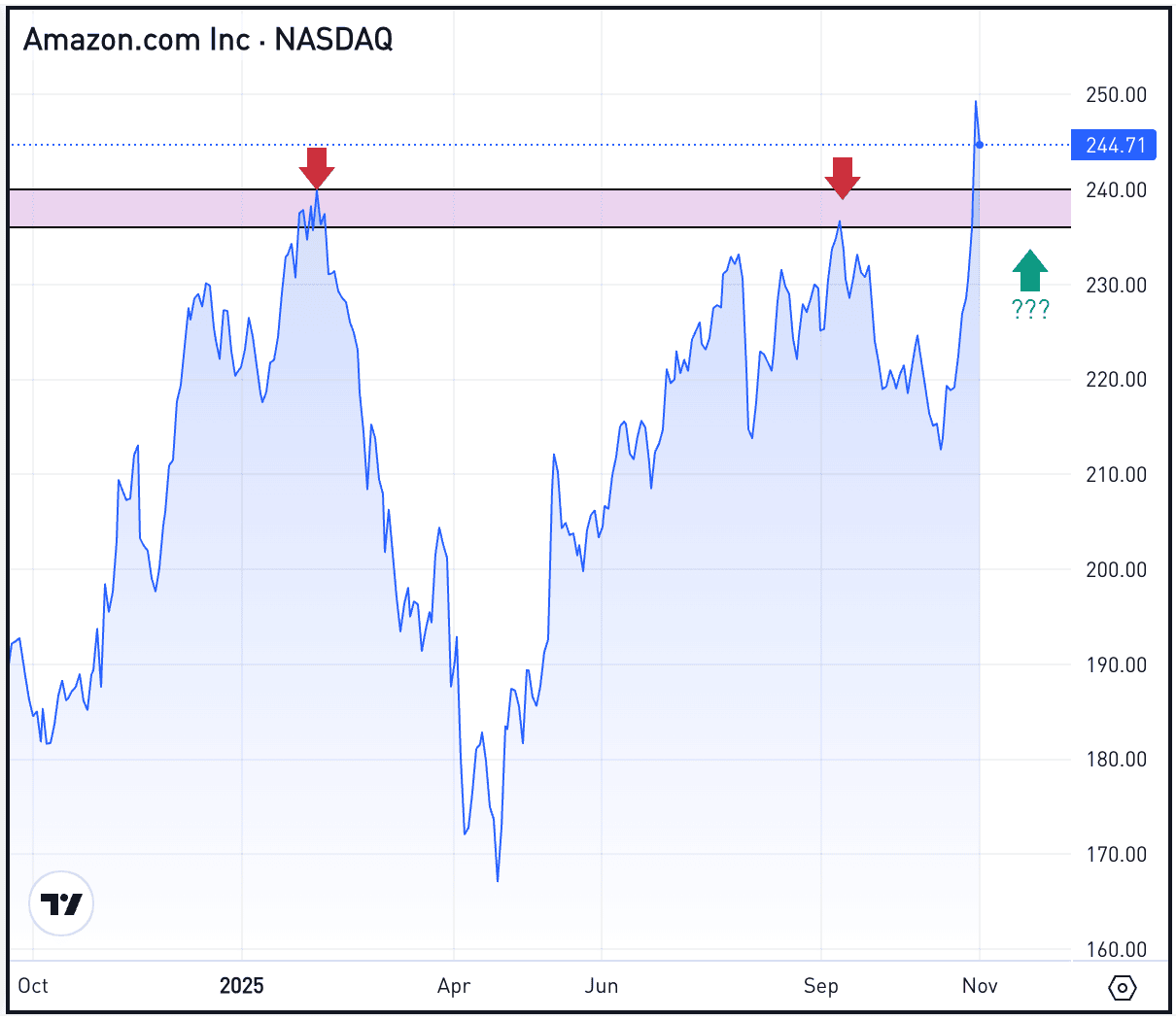

The corporate continues to construct on its momentum, with ongoing expansions in Downtown Dubai, Dubai Hills, and Dubai Marina. With record-breaking transaction volumes and a gentle inflow of rich consumers, Emaar’s diversified portfolio and model power – place it effectively for continued progress. That is mirrored in its share value, which has risen over 60% prior to now 12 months.

Aldar, based mostly in Abu Dhabi, is more and more following Dubai’s lead by embracing the branded residences mannequin. Its lately introduced Nobu Residences on Saadiyat Island provides to a rising luxurious pipeline. As Saadiyat emerges as a brand new luxurious hub, Aldar is well-positioned to capitalise on this development.

However, it’s not simply Saadiyat. Aldar is increasing its footprint throughout the UAE’s high-end market, aligning with international luxurious manufacturers to fulfill rising demand for ultra-premium properties. The expansion of branded residences in Abu Dhabi alerts that the capital is catching as much as Dubai’s tempo, providing Aldar the potential to unlock vital worth for traders.

The power of the UAE’s actual property market displays sturdy underlying fundamentals, together with speedy inhabitants progress, surging tourism, financial diversification efforts, and the draw of worldwide luxurious manufacturers – exemplified by the rise of branded residences.

For traders, this opens new avenues for progress, particularly by way of builders with publicity to high-end and branded tasks. Emaar, Aldar, and Deyaar are every well-positioned to probably profit from this demand in several methods, making them key gamers to look at as Dubai and Abu Dhabi proceed to draw international capital into their actual property sectors.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding goals or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.