Jackson Gap is within the highlight, and Powell’s phrases on charges may steer markets for months. Buyers are betting peak charges are behind us, with cuts on the horizon. That’s excellent news for rate-sensitive corners like REITs, the place earnings are stabilizing and selective alternatives are rising. Add in resilient investor conduct and a still-intact Bitcoin uptrend, and the week is shaping up with extra causes for optimism than concern.

Sector Focus: REITs – Past the ‘Workplace Apocalypse’

The Setup: Charges Are Peaking, Cuts Looming

The actual property sector, notably REITs, has been battered over the past two years by rising rates of interest. Greater low cost charges compressed valuations, whereas refinancing danger loomed massive for levered stability sheets.

Now, with price cuts on the horizon and markets starting to cost in a 2026 restoration, sentiment is slowly shifting. Regardless of uneven Q2 earnings outcomes, most subsectors are guiding to stabilization or restoration.

The place’s the Worth?

The strongest outlooks got here from datacenters, healthcare, industrial, manufactured housing, internet lease, single-family rental, and towers. Extra challenged teams included chilly storage, lodging, multifamily, and self-storage.

The market assumes price cuts into 2026 will reflate the house. That will assist, however counting on macro alone is harmful. The higher technique is to concentrate on an energetic choice course of, gauge resilient tenants, stability sheets, and money flows and to purchase solely the place costs already mirror extreme pessimism.

Workplace: Extra Noise Than Weight

The “workplace apocalypse” nonetheless dominates headlines, however listed REIT publicity tells a unique story. Workplace now makes up simply ~1% of the sector’s weighting after large NYC names like Vornado and SL Inexperienced have been dropped. The actual property index is ~80% concentrated in residential, industrial, healthcare, and specialised REITs, which don’t face the identical structural challenges.

That stated, selective alternatives exist. Douglas Emmett and Hudson Pacific delivered strong outcomes, however coastal workplaces stay fragile. Cousins Properties (Sunbelt) and COPT Protection (authorities/IT tenants) supply extra defensible niches the place tenant demand is stickier.

Datacenters: Secular Development, However Thoughts the Worth

Datacenters stay one of many sector’s strongest tales. Earnings outlooks are intact, supported by secular drivers equivalent to cloud adoption, AI workloads, and rising demand for digital infrastructure. Operators like Equinix and Digital Realty proceed to learn from pricing energy in interconnection and long-term contracts.

However, enthusiasm is excessive, and valuations already mirror an excellent portion of the expansion. The group has change into a consensus “protected harbor” for buyers rotating into REITs. For disciplined capital, which means alternative solely emerges when market sentiment swings too far, both by generalist profit-taking or broader sell-offs that drag the sector down. The higher entry factors will are available in moments of volatility, when sturdy fundamentals briefly get marked down with the remainder of the sector.

Healthcare: Sturdy Demographics

Healthcare REITs quietly constructed momentum. CareTrust is increasing its senior housing pipeline, and execution within the second half of the yr may beat longer-term expectations. NHI lastly noticed its SHOP portfolio ship margin growth. With an getting older inhabitants underpinning regular demand, healthcare stays one of many few areas the place defensive money flows and demographics create a margin of security.

Lodging: Brief Length, Excessive Beta

Accommodations face softer Q3 comps and stronger This autumn expectations. Share repurchases funded by asset gross sales are a theme, however money flows stay extremely cyclical. With out true misery pricing, lodging lacks the draw back safety required for long-term capital.

Macro Watch: What’s Driving REITs Past Earnings

Cap charges vs Treasuries: Cap charges have recovered from pandemic lows, however Treasury yields have too. Spreads stay under historic averages, leaving REIT valuations much less compelling relative to bonds.

Debt maturities: About 8% of REIT debt comes due within the subsequent 12 months. Rising refinancing prices are biting, although nonetheless manageable. Credit score charge-offs are climbing however stay far under recessionary peaks.

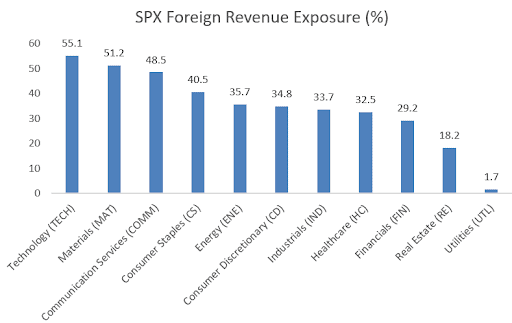

Tariffs: Actual property is among the least uncovered sectors to tariffs (solely ~18% of revenues from overseas). Nonetheless, tariffs may push up development prices and not directly strain yields.

Valuations: REITs commerce at ~17x ahead FFO, in step with post-GFC averages, not stretched, however not screamingly low cost both.

Sentiment Shift

Investor tone is transferring from “Ought to we reset expectations?” to “The place will we purchase the dip?” Generalist cash is beginning to sniff round, which might assist near-term efficiency. However true worth often emerges the place capital has already left, in underfollowed niches and misunderstood stability sheets.

Investor Takeaway: The rubble in REITs presents selective alternative. The actual story is much less about an workplace collapse and extra about discovering resilient tenants, steady stability sheets, and money flows that may face up to increased charges. These are the locations the place capital is almost certainly to compound, with or with out the Fed’s assist.

Volatility Is Not a Flaw, It’s A part of the Recreation

Right this moment’s market construction is considerably extra resilient than it was just a few many years in the past. Right this moment’s buyers are extra knowledgeable, long-term oriented, and disciplined. This shift is supported by automated ETF financial savings plans, common portfolio rebalancing, and a typically increased degree of monetary literacy. In response to the Q2 Retail Investor Beat, 35% of German buyers make their purchases usually or by automation, no matter market situations. Volatility stays part of on a regular basis market exercise, however it’s now not seen as one thing to concern. It’s more and more accepted as a pure function of functioning capital markets.

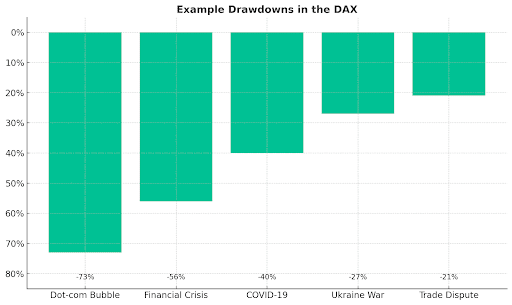

Many buyers now view durations of weak spot not as a menace however as an entry alternative. One in 5 German buyers buys throughout a market pullback of 11% to twenty% (Retail Investor Beat). Dips of three% to five% in indices just like the DAX or S&P 500 are widespread and happen a number of occasions a yr. Corrections, outlined as declines of 10% or extra, usually occur about annually. Even bear markets with losses exceeding 20% haven’t disappeared over the previous 25 years, however they usually unfold extra reasonably than they as soon as did (see chart). This displays a rising diploma of market resilience.

Buyers who keep calm throughout such phases and purchase in persistently are inclined to outperform over the long run. Traditionally, persistence mixed with disciplined shopping for throughout downturns has usually delivered higher outcomes than making an attempt to completely time the market. Even somebody who invested within the DAX on the peak of the dot-com bubble would have almost tripled their capital by now, rather more with common contributions.

Bitcoin: Failed Breakout, however Uptrend Intact

Final week, bitcoin shaped a candlestick with an extended higher wick. At one level, BTC climbed to a brand new all-time excessive above $124,500. The breakout lacked follow-through, resulting in a spherical of short-term profit-taking. The Honest Worth Hole between $109,500 and $115,900 now acts as a key assist zone. So long as this space holds, the potential for one more upward breakout try stays intact. Primarily based on the Fibonacci extension, attainable upside targets are positioned at $128,000, $132,000, and $138,000. If assist fails to carry, the correction may lengthen in the direction of the low of $97,000.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.