Ethereum is clearing a key space on the charts because it tops $4,000 and hits a multi-year excessive. The Each day Breakdown digs into the transfer.

Earlier than we dive in, let’s be sure you’re set to obtain The Each day Breakdown every morning. To maintain getting our each day insights, all you’ll want to do is log in to your eToro account.

What’s Occurring?

The Nasdaq 100 briefly hit a document excessive on Monday, however retreated and closed decrease alongside the opposite main US inventory indices forward of at present’s key CPI inflation report. Traders additionally noticed Bitcoin and different key cryptocurrencies retreat from yesterday’s highs too, after it regarded like BTC might make a run at its all-time highs.

Recall that final month’s CPI print confirmed an uptick in inflation, as did the PCE report a number of weeks in the past. One other scorching report at present may make buyers apprehensive that inflation is making a comeback — one thing that would influence expectations for decrease rates of interest.

For now, the market is pricing in a price reduce on the Fed’s subsequent assembly in September. We’ll see if at present’s information influences these odds within the coming days.

On the earnings entrance, Sea Ltd and On Holding (maker of On Cloud footwear) are making some noise this morning, whereas CoreWeave, Cava, and Rigetti Computing report tonight.

On the crypto entrance, Tezos, Balancer, and Bitcoin Money are pushing larger.

If you wish to improve your investing information this summer season, be sure to affix our eToro Academy Be taught & Earn Problem, the place you may take programs, go quizzes, and earn as much as $20 in rewards. Phrases and situations apply.

Need to obtain these insights straight to your inbox?

Enroll right here

The Setup — Ethereum

On Monday, Ethereum hit a multi-year excessive because it briefly topped $4,300. Notably, that additionally despatched it over a key resistance space, because the $3,900 to $4,000 zone has stifled the rallies since 2024. Now above this space, bulls are hoping that this prior space of resistance turns into present assist transferring ahead. Bear in mind, the all-time excessive is up close to $4,867.

Chart as of 8:00 a.m. ET on 8/12/2025. Supply: eToro ProCharts, courtesy of TradingView.

For buyers who can’t commerce or aren’t snug buying and selling cryptocurrencies outright, they’ll take into account ETFs for BTC and ETH. On the ETH entrance, ETHA stays the biggest ETF by belongings, whereas additionally supporting choices buying and selling.

Bulls can make the most of calls or name spreads to invest on upside, whereas bears can use places or places unfold to invest on draw back. In both case, buyers might think about using sufficient time till expiration.

For these trying to be taught extra about choices, take into account visiting the eToro Academy.

What Wall Road’s Watching

CRCL

Shares of Circle are buying and selling larger this morning, up nearly 10% in pre-market buying and selling after the agency reported its quarter outcomes. Income jumped greater than 50% 12 months over 12 months as robust stablecoin development within the quarter helped propel gross sales. Whereas effectively off the post-IPO highs, Circle continues to be up greater than 400% from its IPO value. Prime analysts have a consensus value goal of roughly $200 a share for CRCL.

NVDA

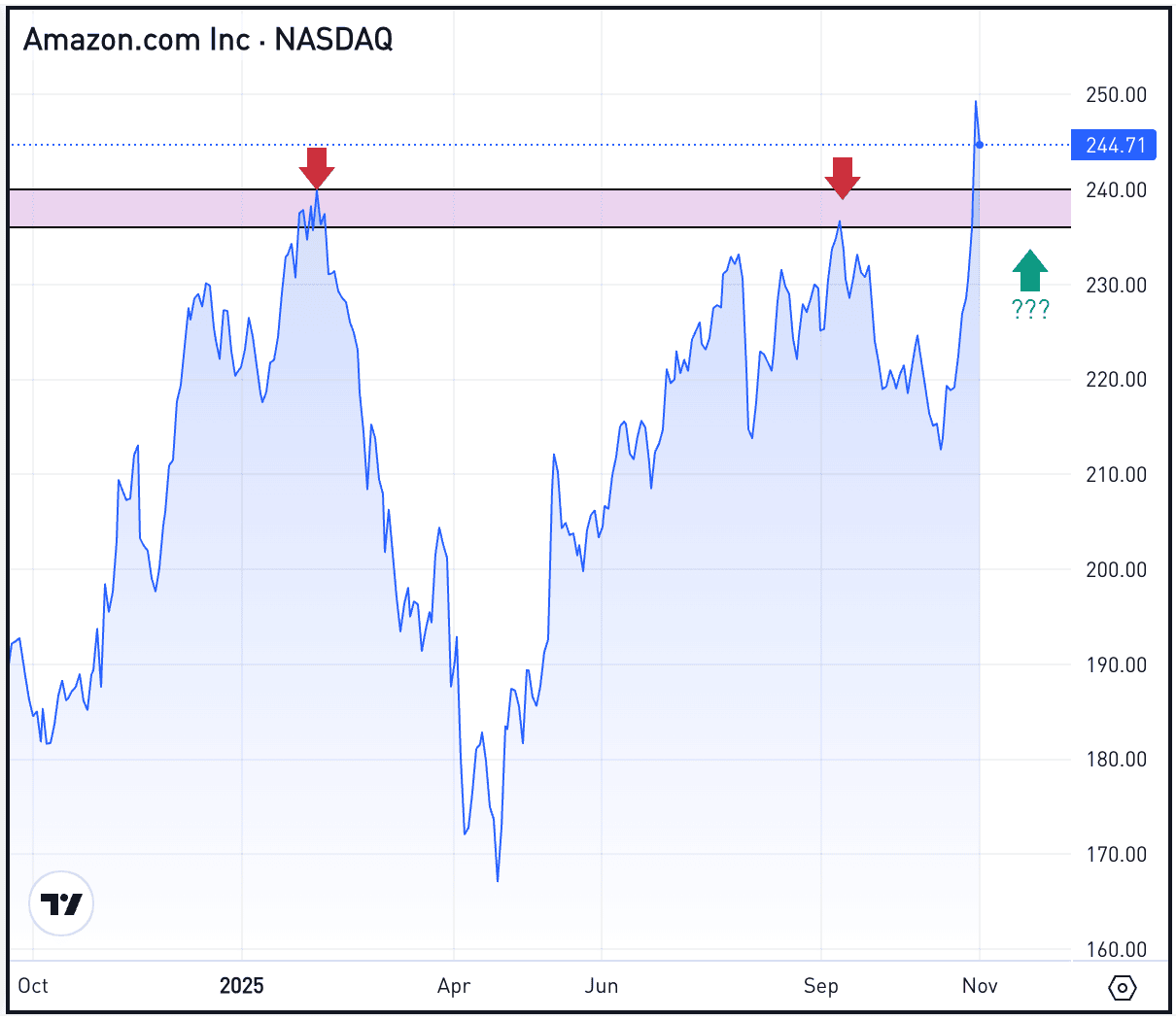

Nvidia and Superior Micro Units failed to shut larger yesterday regardless of reviews suggesting that they’ll be capable of resume chip gross sales to China — after agreeing to present 15% of the income from these chip gross sales to the US authorities. Try the chart for NVDA.

SPX500

The tariff drama is seeing extra can-kicking down the street, this time with negotiations between the US and China receiving a 90-day delay. Whereas it’s an excellent factor for markets, it’s one other instance of why buyers have stopped taking the tariffs threats as critically as they had been in March and April. The FXI ETF is one approach to achieve publicity to Chinese language equities.

Disclaimer:

Please word that as a result of market volatility, a number of the costs might have already been reached and eventualities performed out.