Ethereum is displaying indicators of renewed energy after a risky week, gaining over 13% since final Sunday’s native low across the $3,350 stage. After dealing with promoting strain and fears of a deeper correction, bulls have stepped again in, pushing the worth increased and regaining management of short-term market momentum. The uptick in volatility has introduced contemporary consideration to ETH, with analysts watching intently because the asset makes an attempt to reclaim key resistance zones.

The broader image stays essentially sturdy. Institutional curiosity in Ethereum continues to develop, with giant purchases reported in latest days. On-chain exercise can also be climbing, suggesting rising demand and consumer engagement throughout DeFi, NFTs, and Layer-2 ecosystems. Moreover, Ethereum’s function in real-world asset tokenization and good contract infrastructure reinforces its long-term worth proposition.

As ETH navigates its method by means of resistance ranges, the subsequent few classes shall be essential. A profitable consolidation above $3,700 may affirm bullish continuation, whereas a rejection could open the door for one more pullback. Both method, Ethereum’s latest efficiency and underlying fundamentals recommend that investor confidence is returning—doubtlessly setting the stage for a sustained transfer increased within the coming weeks.

Ethereum Whale Accumulation Indicators Lengthy-Time period Confidence

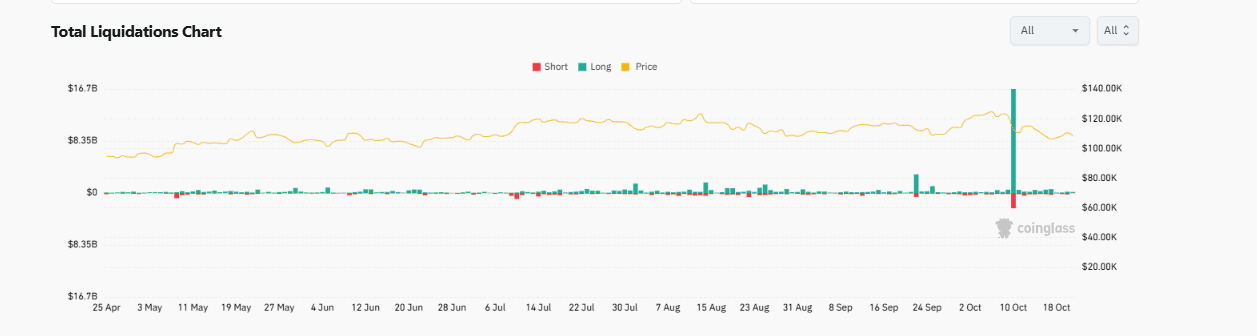

Based on prime analyst Ted Pillows, a mysterious whale or institutional participant has bought $122,955,634 value of ETH over the previous two days. This huge accumulation comes as Ethereum rebounds from latest lows and makes an attempt to reclaim the important $3,800 stage. The transfer is being interpreted by many analysts as a robust sign that good cash is quietly making the most of the latest dip to construct long-term positions.

The dimensions and timing of this purchase recommend strategic intent—seemingly a mirrored image of confidence in Ethereum’s underlying fundamentals and its broader function within the evolving digital economic system. As TradFi (conventional finance) cash continues to circulate into crypto, Ethereum is rising as a core asset for institutional portfolios due to its programmability, strong developer ecosystem, and rising use circumstances in tokenization and DeFi.

Regardless of Bitcoin displaying indicators of overheating and plenty of altcoins nonetheless buying and selling beneath key ranges, Ethereum’s relative energy stands out. Whereas the broader market stays cautious, this accumulation pattern highlights how knowledgeable traders are trying previous short-term volatility and positioning for multi-year highs.

Value Motion Particulars: ETH Retests Key Resistance

Ethereum (ETH) has surged over 13% since final Sunday and is now testing the important resistance stage at $3,860, as proven on the 4-hour chart. After forming an area backside close to $3,350, ETH has steadily climbed with rising quantity, signaling renewed purchaser curiosity and bullish momentum.

The latest breakout above the $3,700 mark got here with sturdy inexperienced candles, supported by rising quantity and a reclaim of the 50, 100, and 200 easy shifting averages (SMAs). This alignment of SMAs beneath the present value strengthens the bullish outlook, as ETH establishes assist zones between $3,630 and $3,685.

Nonetheless, the $3,860 resistance stage stays a key impediment. It marked earlier rejection zones in late July and has but to be flipped into assist. A confirmed breakout above this vary, adopted by sustained quantity and consolidation, may open the door for ETH to problem the $4,000–$4,200 area within the quick time period.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.