A Bitcoin whale from the early 2010s, holding cash mined or acquired in Bitcoin’s infancy, just lately woke up and bought 80,000 BTC. The sale was dealt with by Galaxy Digital, which executed the switch of over 80,000 BTC (value $9 billion) on behalf of this consumer, who’s described as a “Satoshi-era” investor.

Regardless of this huge sale and the volatility that got here after, Bitcoin has managed to regular and the following worth motion exhibits that bulls have been greater than ready to soak up the promote shock.

Associated Studying

Bitcoin Dips To $115,000, Bulls Shortly Purchased The Dip

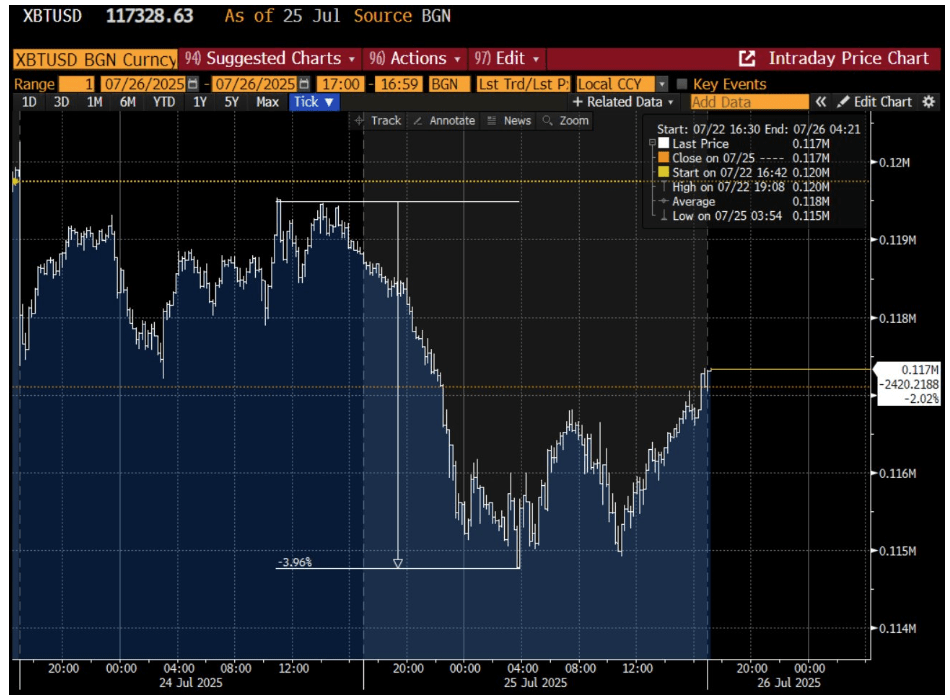

Information of the $9 billion Bitcoin sale initially prompted worth volatility. Bitcoin’s worth had just lately been buying and selling round $119,000, so the sudden inflow of promote orders prompted a short-lived pullback. On July 25, as studies of Galaxy’s whale sale unfold, BTC/USD swiftly fell to round $114,000 to $115,000.

The sheer dimension of 80,000 BTC (over 0.4% of whole provide) hitting the market had the potential to set off panic. Certainly, there have been indicators of profit-taking and better trade inflows within the days surrounding the sale. This, in flip, led to a 3.5% drop, which is one in every of Bitcoin’s steepest intraday dips in weeks, quickly breaking under the $115,000 assist stage.

Nevertheless, it quickly turned clear that Bitcoin’s bulls have been greater than ready to soak up the shock. The worth decline bottomed out in mere hours. By the tip of that very same day, Bitcoin had rebounded above $117,000, and it was buying and selling again within the mid-$117,000.

This fast restoration demonstrated outstanding liquidity and depth within the Bitcoin market. “80,000 BTC, over $9 billion, was bought into open market order books, and Bitcoin barely moved,” noticed crypto analyst Joe Consorti, displaying how shortly consumers stepped in to counter the promoting strain.

Picture From X: Joe Consorti

Again in earlier years, a promote order of this magnitude may have triggered a double-digit share worth crash. In contrast, the ecosystem in 2025 dealt with it with shocking ease. “The whole sale has been totally absorbed by the market,” famous Bitcoin analyst Jason Williams.

What’s Subsequent For Bitcoin Value?

With the whale’s 80,000 BTC sale now largely within the rearview mirror, the subsequent step is waiting for the place Bitcoin would possibly go from right here. The truth that the market digested a $9 billion sell-off with solely minor turbulence has many observers feeling much more bullish about Bitcoin’s trajectory. “We’re going a lot greater,” Jason Williams famous.

It’s a sentiment shared by a number of crypto analysts on X, who see the fast restoration as proof of robust upward momentum. The consensus amongst bulls is that new all-time highs could possibly be on the horizon within the coming months. Bitcoin already notched a file round $123,000 on July 14, however analysts are nonetheless calling for brand spanking new highs above $130,000, $150,000, and even greater.

Associated Studying

On the time of writing, Bitcoin is buying and selling at $118,063, up by 0.5% prior to now 24 hours.

Featured picture from Unsplash, chart from TradingView